Introduction

Have you ever wondered how investors find those small-cap stocks that can potentially be the next big thing – the hidden value in small-cap stocks? You are not alone. Many investors struggle to know which small-cap stock valuation techniques to employ and how to do so efficiently. Do not worry; we will take you on a journey to understand small-cap stock pricing. So, get ready to explore the complex world of stock investing, where market capitalization is just the tip of the iceberg. Together, we’ll explore the fascinating methods that transform speculation into informed investment decisions, ensuring no hidden value remains undiscovered.

What are Small-Cap Stocks?

Small-cap stocks are highly prospective growth stocks that are shares of firms with market capitalizations ranging from $300 million to $2 billion. These firms are similar to start-up ventures with the potential to grow into larger enterprises. You can think of them as up-and-coming businesses with lots of growth potential. Investing in them can be risky and profitable if the company grows successfully.

Traditional Valuation Metrics for Small-Cap Stocks

Small-cap stock valuation can be a bit like figuring out a complex riddle. Traditional valuation metrics function as the foundational components, offering crucial insights into an organization’s financial health and expansion prospects. These metrics, widely used by analysts and investors, provide a systematic approach to assessing the value of smaller businesses that more established participants in the market frequently overlook. In this section, we will explore key traditional valuation metrics, such as the Price-to-Earnings (P/E) Ratio, Price-to-Book (P/B) Ratio, Enterprise Value (EV) Metrics, and Discounted Cash Flow (DCF) Analysis. These tools will help to understand the complex picture of a small-cap stock’s genuine value.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) Ratio is among the most popular measurements for valuing small-cap stocks. The P/E measures a company’s current share price to its earnings per share (EPS). The P/E ratio gives an idea of the company’s market price, influencing the investors’ perception of its growth prospects and profitability. A high P/E ratio could indicate the firm’s significant future growth, while a low P/E could be a significant undervalued stock or potential challenge.

To know whether the P/E ratio is high or low, it is best to compare with other companies in the same range. A comparison would help to get a more accurate assessment, as small-cap firms can vary in performance and potential.

Price-to-Book (P/B) Ratio

The Price-to-Book (P/B) Ratio compares a company’s market value or market capitalization to its book value (total assets minus intangible assets and liabilities). Investors can determine whether a small-cap firm is selling at a premium or a discount to its book value by using the P/B ratio. To get this ratio, the company’s current stock price per share is divided by its book value per share (BVPS). A P/B ratio less than 1 indicates the stock is trading below its book value, suggesting it is undervalued. On the other hand, a ratio greater than 1 could indicate the stock is overvalued.

Investors use the P/B ratio to identify undervalued (or cheap) stocks. By investing in undervalued stocks, investors expect rewards when the market acknowledges its undervaluation and drives the stock back to the price the investor analyses it should be. This valuation method is useful for assessing firms with substantial tangible assets, like manufacturing or real estate enterprises. However, this metric does not work with intangible assets like intellectual property.

Enterprise Value (EV) Metrics EV/EBITDA Ratio

The Enterprise Value (EV) metrics, such as the EV/EBITDA ratio, give a thorough understanding of a company’s worth, considering its debts and equity. A corporation’s enterprise value (EV) is compared to its earnings before interest, taxes, depreciation, and amortization (EBITDA). The EV/EBITDA ratio measures valuable small-cap stocks because it allows investors to gauge the company’s operational performance and financial health without tax differences and capital structure distortions. A lower EV/EBITDA ratio suggests the stock is undervalued to its profit potential, while a higher ratio implies it is overvalued. This metric is helpful in industries like manufacturing and telecommunications, where depreciation and capital expenditures play important roles.

Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) Analysis is a valuation technique used to calculate the value of an investment based on its expected cash flows. DCF analysis is essential as it offers a more profound knowledge of their intrinsic worth, even more than basic measures like P/E or P/B ratios.

This is how it works: A discount rate representing the investment’s risk is used in the DCF analysis to anticipate future cash flows the company is expected to generate and discount them back to their present value. In simpler terms, DCF Analysis helps determine how much a company is worth based on the money it will make. To do this, the cash the company will generate is estimated, and then those amounts are adjusted to today’s value, considering the risk involved.

Imagine you want to invest in a company. You expect it to make $100 each year for the next five years. But the money you get in the future is worth less than the money you have today because of risks and opportunities. So, a discount rate is used to calculate how much those future earnings are worth in the present. It is a good investment if the company’s current price is less than the total present value you calculated. If it’s more, you might want to pass. Using this method, investors can assess if the stock’s current price is reasonable considering its projected earnings in the future.

When it comes to small-cap stocks, investors should consider the distinct risks and opportunities these companies bring by using DCF analysis since their potential for future growth can substantially impact valuation. For individuals looking for a comprehensive evaluation of investment options in smaller, possibly high-growth enterprises, it’s an essential tool.

Relative Valuation Methods

Relative valuation methods offer a practical approach to knowing the value of small-cap stocks by comparing them to similar companies, usually similar in size and sector. Instead of depending on the financial information of one firm, these methods consider the market value of other businesses. Comparison helps investors gauge whether a small-cap stock is overvalued or undervalued based on peer performance and industry standards. This section will address relative small-cap stock valuation techniques like comparative analysis with peers and discuss the importance of selecting comparable companies and adjusting for differences in growth prospects and risk profiles. By leveraging these methods, investors can find possible small-cap investing opportunities and make better-informed judgments.

Comparative Analysis with Peers

Comparative analysis with peers means evaluating the performance of a small-cap stock by comparing it to similar firms in the same sector. Using this strategy, investors can learn how a stock compares to its rivals in terms of performance and valuation. To conduct a comparative analysis, investors compare financial ratios and metrics, like the Price-to-Earnings Ratio, Price-to-Book Ratio, and Enterprise Value metrics. Comparing these ratios alongside industry standards can help investors understand whether a small-cap stock is overvalued, undervalued, or rightly priced.

Importance of Selecting Comparable Small-Cap Companies

Choosing the right companies for comparison is crucial for an accurate comparative analysis result. The companies to be compared should operate in the same sector and have similar business models. For example, comparing two start-up tech companies makes more sense than comparing a small tech company and a manufacturing business. This way, looking at two similar companies that face similar challenges and environments would give an objective view. This ensures that the comparison is relevant and meaningful.

In addition, the size and market capitalization of the comparable companies should be similar. Comparing a small-cap and a large-cap company can lead to inaccurate results because they are on different scales. Imagine comparing a 2-year-old tech company and a 15-year-old tech company. This would lead to unrealistic views of the smaller company. Small-cap companies usually have different growth potentials when compared to larger firms.

By choosing comparable companies, investors can better create a mental picture of the value of small-cap firms and make better and more informed investment decisions.

Adjusting Multiples for Differences in Growth Prospects and Risk Profiles

When comparing small-cap companies, it is imperative to account for variations in growth potential and risk profiles by adjusting multiples. Not every business grows at the same rate or faces the same dangers, even in the same industry. For instance, a small-cap business may grow quickly because of new items, but another may grow more slowly because of market saturation. Investors must modify valuation multiples such as the P/E or EV/EBITDA ratios to establish a fair comparison. This modification guarantees that businesses with more potential for growth are not unjustly contrasted with those with slower growth rates.

Similarly, varying risk profiles can affect a business’s valuation. Typically, a small-cap company with a consistent and steady revenue stream will be viewed as less hazardous than one with fluctuating profitability or a high debt load. The valuation multiples ought to be modified by investors to account for these risks. For example, a business with a higher financial risk may have a lower P/E ratio because investors believe that taking on more risk will result in a higher return. Investors can make more meaningful and accurate comparisons and make better investment selections by accounting for growth and risk.

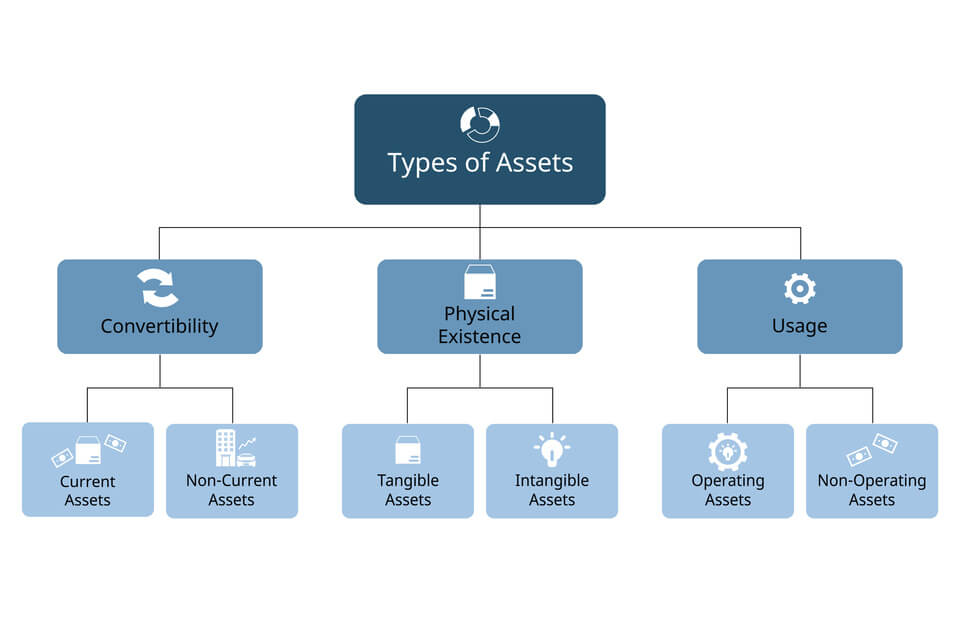

Asset-Based Valuation Techniques

Asset-based valuation techniques aim to determine the company’s value based on its assets rather than focusing on a company’s earnings or market comparisons. This approach evaluates a small-cap stock’s tangible and intangible assets, including cash, real estate, equipment, patents, and trademarks, to determine its value. Investors can better understand a company’s worth by examining its assets’ value, mainly if the enterprise is asset-heavy or operates in a stable industry. Asset-based valuation is beneficial when assessing organisations that may not have high earnings but have valuable assets that add to their overall worth.

Net Asset Value (NAV) Analysis

The Net Asset Value (NAV) is the value of an investment fund that is calculated by deducting its liabilities from its assets. Net asset value (NAV) analysis is a fundamental asset-based valuation that evaluates a company’s tangible and intangible assets to ascertain its total value.

Using this technique, investors determine the combined worth of intangible assets like patents and brand value and tangible assets like cash, real estate, and machinery. To reflect an asset’s genuine value, adjustments are made for the state of the market and its strategic importance. This approach is beneficial in small-cap equities where standard earnings-based valuations might not adequately reflect the company’s future.

Assessing Tangible and Intangible Assets in Small-cap valuation

You can assess tangible and intangible assets in small-cap valuation involves evaluating physical and non-physical assets contributing to a company’s overall worth. First, investors assess the company’s tangible assets, like cash, real estate, machinery, and inventory. These assets are physical items that have a clear market value. Next, intangible assets, like patents, trademarks, goodwill, and brand value, are valued. Intangible assets are challenging to place a value on. However, they are essential to a company’s overall worth, competitive advantage and potential future earnings. Intangible assets are very valuable in tech companies or service-based businesses. By carefully assessing both types of assets, investors can understand a small-cap stock’s actual value beyond its financial statements.

Adjustments for Market Conditions and Strategic Assets

After assessing a company’s assets in small-cap valuation, knowing how external factors can influence asset valuation is essential. Market conditions, like current industry and economic fluctuations, play an important role in determining the worth of assets. For example, market conditions can affect the value of properties in a small-cap company.

Furthermore, the value of strategic assets—like patented innovations, powerful brands, or exclusive contracts—often holds more value than their book value. Financial statements may not completely reflect the competitive advantages or potential future revenue streams these assets could generate. Assessing these assets’ potential for generating money and their strategic significance allows investors to adjust their valuation.

Investors can determine the intrinsic value of a small-cap stock more accurately and realistically by incorporating these factors into the Net Asset Value (NAV) analysis. This comprehensive methodology guarantees that the true worth of tangible and intangible assets is appropriately accounted for during the valuation process, giving investors a solid basis to making well-informed investment decisions.

Quality of Management and Growth Potential

Evaluating the quality of management is essential for determining small-cap stocks’ growth prospects. Management quality refers to the efficiency of a company’s leadership in executing strategies, navigating obstacles and promoting growth. This factor influences the ability of a business to create value for investors and ensure long-term growth. This section will explore how assessing management quality can provide insights into the small-cap stock’s prospects and overall investment appeal.

Management Quality Assessment

Management quality assessment evaluates how competently and effectively a company’s leadership team steers the organisation towards its financial and strategic goals and enhances shareholder value. This assessment involves analysing their track record in decision-making, leadership experience, ability to innovate, adaptation to market fluctuations, transparency in communication with stakeholders, and ethical standards. Poor management decisions can lead to financial instability and missed growth opportunities. Evaluating management quality is essential for small-cap stocks, where operational and management decisions can affect growth and operational efficiency. This evaluation helps investors gain insights into a small-cap stock’s potential for sustained growth and profitability, which is crucial for making informed investment decisions.

Impact of Management Team on small-cap Stock Performance

A management team’s influence on small-cap stocks can not be overstated since it regularly determines the company’s capacity to overcome challenges and seize growth opportunities. Effective leadership stimulates investor confidence, operational efficiency, and strategic decision-making. This, in turn, shapes the company’s financial health, stability and market perception. A competent management team capitalizes on growth potential and fosters innovation, thereby increasing the company’s value.

On the other hand, poor management choices can limit organizational growth and erode investors’ trust and confidence. Due to their flexibility and fast growth potential, small-cap businesses are highly aware of the importance of competent and effective management to mitigate risks and leverage opportunities swiftly. Long-term shareholder value can be fostered by a competent and visionary management team that can successfully navigate the business through regulatory changes, competitive pressures, and market volatility. Investors, therefore, scrutinize management quality, track records, transparency and investor-company goal alignment. Ultimately, the competence and integrity of a management team play an essential role in seeing the potential for a successful small-cap investment.

Evaluating Growth Strategies and Execution Capabilities

In evaluating a company’s prospects as a small-cap stock investment, its growth strategy and execution capabilities must be assessed. Investors analyse the management‘s ability to expand market share, penetrate new markets, innovate new goods and services, and capitalize on industry trends. Effective growth strategies usually have a realistic view of growth prospects. These strategies are ambitious and always align with the company’s core competencies and market trends.

Execution capabilities evaluate how well the management team can implement these plans and produce quantifiable outcomes. This includes monitoring deadlines, distributing resources wisely, controlling risks, and adjusting to shifting market conditions. Agile and proactive management teams are critical to small-cap stocks’ ability to grasp growth possibilities and overcome obstacles quickly. Investors can more accurately assess the possibility of long-term value creation and sustainable growth when making investment selections by considering the management team’s execution skills and strategic vision.

Sector and Industry Analysis

Sector and Industry analysis examines the larger economic environment and specific industry dynamics and how they affect small-cap stocks. This analysis provides investors with crucial information on market trends, competitive landscapes, sector-specific risks and opportunities, helping the investor make wise and informed investment decisions in the small-cap market.

Sector-Specific Valuation Considerations

Sector-specific valuation for small-cap stocks means looking at the factors within an industry that influence a company’s value. Each sector has distinct dynamics – regulatory environments, technological advancements, consumer demands, and competition, which can significantly make or break a small-cap stock. Take tech firms as an example; their valuation usually depends on new ideas and intellectual property, while manufacturing companies are more about their physical assets, like machines, and supply chain efficiency. These differences help investors apply the relevant valuation metrics and benchmarks specific to the industry.

Additionally, sector-specific risks, such as commodity price volatility or regulatory changes, must be considered in the valuation process. Energy stocks might fluctuate due to volatility in oil prices, or the healthcare industry might be affected if regulatory laws change. When you factor all these in, you can quickly get a clearer picture of the value of a small-cap stock. This way, you are not guessing the wise investment choices; you are sure of the best option or choice.

Understanding Industry Dynamics and Competitive Landscape

Investors must understand industry patterns and the competitive landscape to price small-cap stocks accurately. Industry patterns show trends like technological advancements, economic shifts, consumer behaviour and regulatory changes. Analysing these factors helps investors spot future growth opportunities and potential obstacles a small-cap business might face. Take the technology sector as an example. Fast innovation and short product lifespan shape the company valuations. Investors must assess if a small-cap tech company can innovate and create unique products to maintain a competitive advantage.

Additionally, the competitive industry involves understanding the strengths, weaknesses, opportunities and threats peculiar to other companies. You must also identify direct competitors and evaluate their market shares, strategies, products, and services. This competitive positioning is essential for small-cap stocks since these small companies compete with bigger and older companies. A small-cap firm can be successful by finding a niche in the market, making their products stand out or capitalising on ignored markets. These strategies can push a small-cap firm to a top market spot.

The competitive landscape also means examining strategies to protect small-cap companies from new competitors. By analysing industry dynamics, investors can predict a small-cap company’s potential growth, leading to more innovative tactical investing moves. Through thorough research and analysis, investors can make better bets on which small-caps might be profitable.

Sector-specific Metrics and Benchmarks for Small-cap Stocks

Sector-specific metrics and benchmarks are essential for valuing small-cap stocks because they offer a customised framework for appraising businesses in a particular industry. Different sectors have unique outcome measures that reflect their operational and financial health. For instance, key tech sector metrics could be revenue growth rate, the proportion of revenue spent on research and development, and user engagement metrics. In contrast, the healthcare industry might prioritise clinical trial success rates, regulatory approval timelines, and patient outcomes.

These benchmarks or industry standards allow investors to gauge how well a small-cap company performs relative to its peers. Such benchmarks may include average P/E ratios, EV/EBITDA multiples or profit margins within the sector. Understanding these sector-specific metrics and benchmarks enables investors to identify companies outperforming or underperforming their industry peers, thereby shedding light on potential investment opportunities or risks. By employing the most appropriate metrics and benchmarks, investors can make accurate decisions about small-cap stocks from different industries, and such decisions will be based on informed data analysis.

Financial Health and Sustainability

The Financial health and sustainability are essential indicators of a small-cap stock’s stability and growth potential. This involves looking at factors like debt levels, liquidity, cash flow stability and profitability metrics to ensure the firm can withstand any economic storms, deliver long-term shareholder value, and continue functioning maximally. Analyzing these factors allows investors to determine whether a small-cap stock will achieve long-term growth and maintain success.

Debt Levels and Liquidity

The Debt levels and liquidity are pivotal indicators of a small-cap stock’s financial health and resilience. Debt levels refer to the proportion of firms’ total capital financed by borrowings as opposed to equity or earnings, which affects their ability to pay obligations and finance expansion opportunities. This implies that huge debts can cause more financial risks, especially when the economy is experiencing a slowdown or interest rates are increasing.

Alternatively, liquidity relates to the company’s capability of fulfilling its immediate financial commitments through quickly convertible assets. It includes metrics such as the current ratio (current assets divided by current liabilities) and quick ratio (liquid assets divided by current liabilities). Adequate liquidity would ensure that a small-cap firm does not over-rely on external financing to cover operating expenses, servicing debt and other emergency outgoings.

Investors analyse debt levels and liquidity ratios to assess small-cap stocks’ financial stability and flexibility. Companies with manageable debt levels and strong liquidity positions are better positioned to overcome challenges and exploit growth opportunities, enhancing their long-term sustainability and attractiveness as investments.

Evaluating Debt-to-equity Ratio and Liquidity Ratios

The Evaluating of the debt-to-equity ratio and liquidity ratios is crucial for understanding small-cap stocks’ financial health and stability. The debt-to-equity ratio reveals the balance between a company’s debt and shareholders’ equity, showing how much of the company’s funding comes from debt versus equity. A higher ratio can indicate risk and reliance on borrowing.

On the other hand, liquidity ratios evaluate a company’s capability to meet its term financial obligations using current assets like cash and accounts receivable compared to current liabilities such as accounts payable and short-term debt. A higher liquidity ratio signifies term financial health and capacity to cover immediate expenses.

For small-cap stocks, these ratios offer insights into how a company handles its financial commitments and risks. Maintaining a balance between debt levels and equity and solid liquidity for immediate needs suggests financial stability. Investors rely on these indicators to gauge a company’s resilience during downturns, support growth endeavours, and deliver returns, shaping their investment strategies accordingly.

Impact of Financial Health on Small-cap Stock Valuation

The financial health of a small-cap stock influences investor perceptions of risk and potential profit. Metrics like debt levels, liquidity, profitability and efficiency ratios directly inform its valuation. Strong financial well-being, characterised by low debt levels, strong liquidity, and high and consistent profits, generally results in higher valuation. High small-cap stock valuation impacts investor confidence in the firm’s ability to have efficient operations, repay debts and fund future growth opportunities without reducing stock value.

On the other hand, poor financial health, like high debt (reliance) or weak liquidity, can lead to lower valuation due to perceived risk and uncertainty. It could also lead to a loss of shareholders’ trust. Financial health also affects a small-cap stock’s access to capital markets and borrowing costs. Companies with robust financial profiles may secure favourable financing terms, supporting expansion plans and enhancing shareholder value. In contrast, those with weaker financial health may face challenges raising capital or incur higher financing expenses, limiting growth opportunities and potentially depressing stock prices.

Overall, assessing financial health is essential for investors evaluating small-cap stocks, as it provides insights into the company’s resilience, growth potential, and overall investment attractiveness in both stable and volatile market conditions.

Case Study and Example

Successful Examples of Small-Cap Stock Valuation Techniques

One notable example of a successful small-cap stock investment is Shopify Inc., a global e-commerce Canadian company. The ascent of Shopify from a small-cap stock to the forefront of the market exemplifies how well small-cap stock valuation techniques and strategic choices are applied. Shopify’s initial valuation was based on its cutting-edge online shop platform. However, it also showed quick revenue growth and profitability—two crucial metrics in its valuation.

Investors were able to effectively analyse Shopify’s market position and growth potential using valuation approaches such as ongoing evaluation of its revenue multiples and comparative study with rivals in the tech industry. The lessons learnt from Shopify’s success emphasise the significance of recognising disruptive innovations, evaluating scalability, and comprehending market dynamics in small-cap investments. Shopify’s experience shows how smart valuation choices and tactics may produce sizable gains in small-cap stocks. Shopify’s outstanding performance demonstrated the potential benefits of investing in creative, well-managed small-cap companies. Investors that applied rigorous analysis and early recognised Shopify’s growth opportunities benefited from its success.

Lessons Learned from Valuation Techniques Applied to Specific Cases

Real-life case studies provide valuable lessons on effective small-cap stock valuation techniques.

The case of Twilio Inc., a cloud communications platform, is an example. Initially undervalued by traditional metrics due to its high research and development costs, investors recognized Twilio’s potential by focusing on its disruptive technology and rapid revenue growth. This case emphasizes the importance of looking beyond conventional metrics to accurately assess innovation and market potential.

Zoom Video Communications is another instance that experienced exponential development amid the COVID-19 outbreak. With the rise in popularity of remote work, Zoom’s stock price skyrocketed due to its scalable video conferencing technology. Zoom’s quick rise was fuelled by investors who saw the importance of technology in facilitating remote communication, underscoring the need for current market trends and sector-specific analysis in valuation.

These examples show that finding start-ups with creative business plans, scalable technologies, and promising markets is frequently essential to making profitable small-cap investments. The necessity for adaptability in small-cap stock valuation techniques, keeping abreast of market developments, and realising the revolutionary influence of new technology on market dynamics are among the lessons that have been learned. By applying these insights, investors can better navigate the complexities of small-cap investing and uncover opportunities for long-term growth and value creation.

Frequently Asked Questions (FAQs)

1. What are small-cap stocks?

Small-cap stocks are shares of companies with a small market capitalization between $300 million and $2 billion.

2. Why is management quality important in small-cap valuation?

Management quality affects a company’s ability to execute growth strategies, navigate obstacles, and improve long-term shareholder value and trust

3. What is the Price-to-Earnings (P/E) Ratio?

The P/E ratio measures a company’s current share price relative to its earnings per share (EPS).

4. What are sector-specific valuation metrics?

These are customised performance indicators unique to each industry used to evaluate small-cap stocks.

5. How do debt levels and liquidity impact small-cap stock valuation?**

High debt levels can indicate financial risk, while strong liquidity suggests a company’s ability to meet immediate financial obligations, affecting its overall valuation.

Conclusion

In summary, traditional metrics like market capitalization are not the only measurement used to evaluate small-cap stocks. It is essential to employ strategies that include basic analysis, management quality evaluation, and analysis of industry prospects. Qualitative factors like market positioning and niche market growth potential should also be taken into account by investors. A thorough methodology that balances quantitative measures and qualitative insights is necessary to locate undervalued small-cap stocks. This process allows savvy investors to find hidden value in dynamic and frequently overlooked market niches.