Afriquire Latest Articles

ETF Investing

Sector-focused ETFs: How to Diversify Smarter and Faster

Introduction Do you wish to diversify investments such that you also get increased exposure to a certain industry or sector? The sector-focused ETFs will provide ...

14 August 2024

IPO Investments

IPO vs Traditional Stocks: How to Pick the Right Strategy

Introduction In stock market investing, two leaders stand tall: IPO investing and traditional stock picking. While both offer promising returns, they differ significantly in their ...

12 August 2024

Dividend Stocks

International Dividend Investing: Build Wealth in Africa

Introduction In today’s interconnected markets, savvy investors are turning to International Dividend Investing to supercharge their portfolios and tap into a world of high-yielding opportunities. ...

10 August 2024

Stock Investing

Value Investing: How to Find Strong Undervalued Stocks

Introduction Two primary approaches stand out in value investing: deep value and quality value investing. Both strategies aim to uncover undervalued stocks, but their criteria ...

9 August 2024

ETF Investing

Investing in ETFs: Smart Ways to Leverage Big Gains

Introduction In pursuing financial success, investors increasingly turn to leveraged and inverse ETFs – a thrilling yet treacherous terrain where fortunes can be made or ...

8 August 2024

Investment Options

Large-Cap Stocks: Top Picks for Contrarian Investors Now

Introduction Have you ever wondered how some investors consistently find undervalued large-cap stocks that later deliver substantial returns? Imagine uncovering a hidden gem in the ...

7 August 2024

ETF Investing

Currency-Hedged ETFs: Master Global Risk Management Now

Introduction Concerned about how exposed your international investments are to currency fluctuations? Or do you wonder how to protect your portfolio from foreign exchange risk? ...

6 August 2024

Emerging Markets Stocks

Thematic Investing: Profit from Emerging Market Trends

Introduction As the global landscape continues to shift, emerging markets are on the verge of a revolution. African countries and other developing economies are transforming ...

5 August 2024

Dividend Stocks

Smart Investing: How to Pick Between Dividend Reinvestment and Manual Strategies

Introduction As an investor, have you ever wondered whether your approach to reinvesting dividends could significantly impact your portfolio’s growth? Dividend Reinvestment Plans (DRIPS) and ...

2 August 2024

Investment Options

Small-Cap Stock Crowdfunding: How to Invest in Promising Early-Stage Startups and Disruptors

Introduction Discover the game-changing world of small-cap stock crowdfunding, where individuals can invest in revolutionary startups and disruptors. This innovative approach empowers investors in emerging ...

1 August 2024

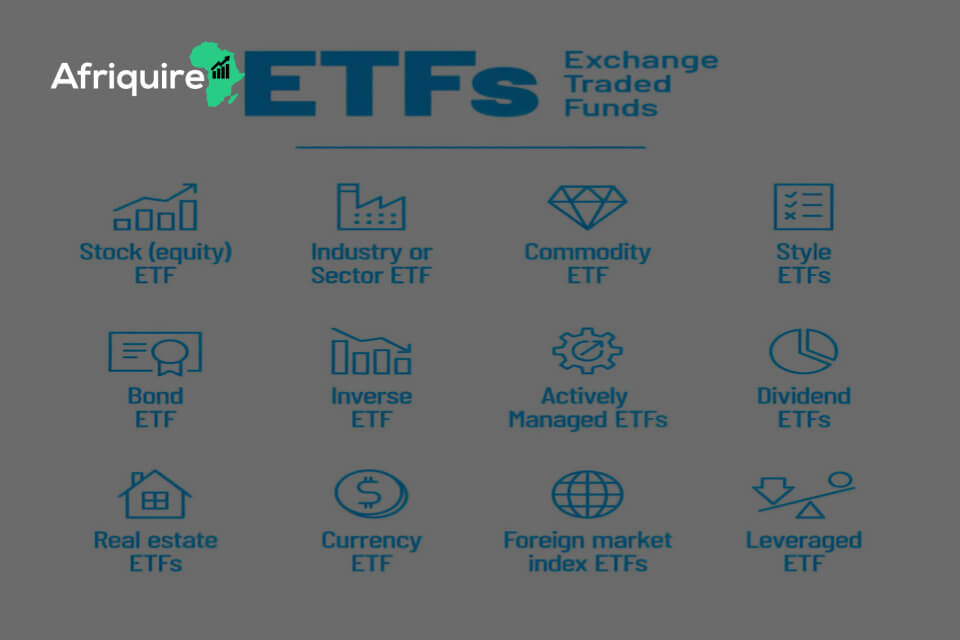

ETF Investing

Sector-focused ETFs: How to Diversify Smarter and Faster

Introduction Do you wish to diversify investments such that you also get increased exposure to a certain industry or sector? The sector-focused ETFs will provide the solution. You will be able to diversify your portfolio by focusing on a particular sector. This could be technology, health, or energy. How do ...

14 August 2024

IPO Investments

IPO vs Traditional Stocks: How to Pick the Right Strategy

Introduction In stock market investing, two leaders stand tall: IPO investing and traditional stock picking. While both offer promising returns, they differ significantly in their approach and potential outcomes. As a stock investor, you’re likely eager to navigate the enigma of these strategies and maximize your portfolio’s growth. Get ready ...

12 August 2024

Dividend Stocks

International Dividend Investing: Build Wealth in Africa

Introduction In today’s interconnected markets, savvy investors are turning to International Dividend Investing to supercharge their portfolios and tap into a world of high-yielding opportunities. By venturing beyond domestic borders, investors can harness the growth potential of global markets, diversify their income streams, and potentially earn higher returns. But what ...

10 August 2024

Stock Investing

Value Investing: How to Find Strong Undervalued Stocks

Introduction Two primary approaches stand out in value investing: deep value and quality value investing. Both strategies aim to uncover undervalued stocks, but their criteria and focus differ. This article explores the intricacies of these two investment philosophies, deep value vs quality value Investing, examining their definitions, characteristics, and performance ...

9 August 2024

ETF Investing

Investing in ETFs: Smart Ways to Leverage Big Gains

Introduction In pursuing financial success, investors increasingly turn to leveraged and inverse ETFs – a thrilling yet treacherous terrain where fortunes can be made or lost in the blink of an eye. These powerful exchange-traded funds promise to supercharge your portfolio by amplifying gains or providing inverse returns but beware: ...

8 August 2024

Investment Options

Large-Cap Stocks: Top Picks for Contrarian Investors Now

Introduction Have you ever wondered how some investors consistently find undervalued large-cap stocks that later deliver substantial returns? Imagine uncovering a hidden gem in the stock market—a large-cap company that everyone else has overlooked or undervalued. This is the essence of contrarian investing. These investors thrive on looking beyond the ...

7 August 2024

ETF Investing

Currency-Hedged ETFs: Master Global Risk Management Now

Introduction Concerned about how exposed your international investments are to currency fluctuations? Or do you wonder how to protect your portfolio from foreign exchange risk? International markets can be overwhelming, especially when currency swings noticeably reduce your returns. Currency-hedged ETFs provide a strategic solution: giving investors access to global markets ...

6 August 2024

Emerging Markets Stocks

Thematic Investing: Profit from Emerging Market Trends

Introduction As the global landscape continues to shift, emerging markets are on the verge of a revolution. African countries and other developing economies are transforming at an unprecedented pace, driven by dynamic forces that will reshape the world as we know it. Thematic investing is the key to unlocking the ...

5 August 2024

Dividend Stocks

Smart Investing: How to Pick Between Dividend Reinvestment and Manual Strategies

Introduction As an investor, have you ever wondered whether your approach to reinvesting dividends could significantly impact your portfolio’s growth? Dividend Reinvestment Plans (DRIPS) and manual reinvestment are two distinct ways of reinvestment that offer different advantages and possible disadvantages. The choice between these methods will affect the efficiency of ...

2 August 2024

Investment Options

Small-Cap Stock Crowdfunding: How to Invest in Promising Early-Stage Startups and Disruptors

Introduction Discover the game-changing world of small-cap stock crowdfunding, where individuals can invest in revolutionary startups and disruptors. This innovative approach empowers investors in emerging markets to tap into the global innovation ecosystem, backing groundbreaking businesses that will shape the future. Dive in to uncover the subtleties of small-cap stock ...

1 August 2024