- Introduction

- What is Dividend Reinvestment?

- Benefits of Dividend Reinvestment

- Understanding Dividend Reinvestment Plans (DRIPs)

- How Do DRIPs Work

- Evaluating Companies for Dividend Reinvestment

- Criteria for Selecting Companies

- Implementing a Dividend Reinvestment Strategy

- Tips for Optimizing Your Strategy

- Tax Considerations with Dividend Reinvestment

- Monitoring and Managing a Dividend Reinvestment Portfolio

- Tracking Dividends and Reinvestments

- Case Studies and Success Stories

- Risks and Considerations of Dividend Reinvestment

- Mitigation Strategies

- Implementing Diversification Strategies to Mitigate Risk

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

In stock investing, one strategy known as dividend reinvestment stands out for its potential to create long-term wealth. This powerful wealth-building secret allows you to harness the magic of compound growth, steadily increasing your assets over time. Understanding and implementing dividend reinvestment strategies can be a game-changer for stock investors. In this guide, we’ll break down the critical aspects of dividend reinvestment in simple terms, empowering you to make informed investment decisions.

What is Dividend Reinvestment?

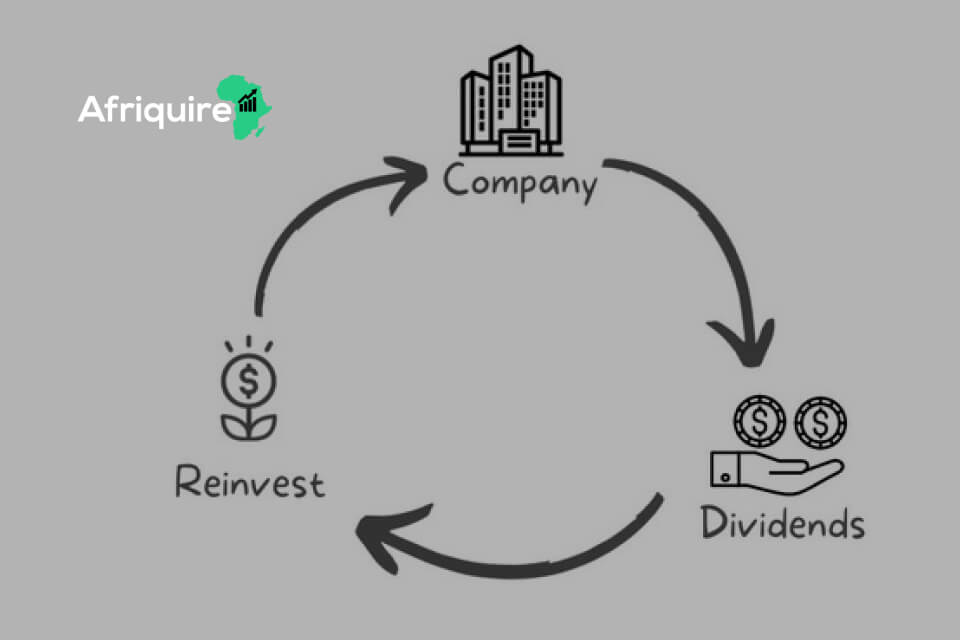

Dividend reinvestment, or DRIPs, is a smart and simple strategy. Instead of taking dividends in cash, you use them to buy more shares of the same stock.

As a result, your investment grows on its own. Over time, this can lead to much larger gains. Also, you won’t need to put in more money from your pocket.

Even better, reinvesting works well in strong markets. If the stock performs, your returns compound. Then, each dividend cycle adds more value.

So, while it’s low effort, it’s highly effective. Again and again, it proves to be a steady way to build long-term wealth..

Benefits of Dividend Reinvestment

Let’s delve into the enticing benefits of this strategy that have caught the attention of seasoned investors worldwide.

Passive Income Generation

Imagine your investments growing—day and night. That’s the strength of passive income. One key driver of this? Dividend reinvestment.

Instead of taking dividends in cash, you use them to buy more shares. Then, your portfolio grows—automatically.

Again and again, this builds momentum. Over time, small gains turn into something bigger. And you don’t need to add extra money.

So, it’s simple. It’s steady. And it works.

Long-Term Wealth Accumulation

Dividend reinvestment won’t make you rich overnight. But it’s a smart move for investors who think long term.

The true strength comes from compounding. Each time you reinvest, you buy more shares. Later on, those shares pay dividends too.

At first, the gains are small. But over time, they grow. Again and again, the process builds on itself.

So, be patient. Stay consistent. Let compounding do the hard work for you.

Potential for Exponential Growth

Investing takes trust. It also takes patience. But dividend reinvestment gives you a clear reason to stick with it.

Here’s how it works. As your portfolio grows, so do your dividends. Then, as you reinvest those dividends, you buy more shares.

And with more shares, you earn more dividends. So, it becomes a cycle. One that builds on itself.

Over time, this leads to steady growth. But only if you stay consistent. And, most importantly, give it time to compound.

Understanding Dividend Reinvestment Plans (DRIPs)

To get the most from dividend reinvestment, you need to know how Dividend Reinvestment Plans—also called DRIPs—work.

Many companies offer DRIPs to help shareholders grow their holdings over time.

With a DRIP, your dividends are used to buy more shares—automatically. Even better, this often happens with no extra fees.

So, it’s an easy way to keep growing your portfolio. And once it’s set up, you barely have to do a thing.

How Do DRIPs Work

DRIPs make dividend reinvestment simple and automatic—just like a smooth-running machine.

Here’s how it works: when you own stock in a company that offers a DRIP, your dividends are used to buy more shares right away.

Best of all, this usually happens with little to no fees. So, you avoid paying extra brokerage costs.

Over time, you end up owning more of the company—without having to place new buy orders yourself. It’s an easy way to grow your investment steadily.

Advantages and Disadvantages of DRIPs

Like any strategy, DRIPs come with pros and cons. So, it’s key to look at both before getting started.

Advantages:

Low Cost: DRIPs often skip brokerage fees. So, they offer a cheaper way to grow your investment.

Steady Investing: Since it runs automatically, you invest on a regular basis. No need to time the market.

Strong Compounding: Reinvesting boosts your gains over time. As a result, your wealth can grow steadily.

Disadvantages:

Less Control: You don’t pick when to buy shares. Instead, purchases follow the company’s dividend schedule.

Limited Access: Not all companies offer DRIPs. So, this approach may not work with every stock you hold.

Even so, DRIPs remain a smart, hands-off tool for building wealth—especially if you’re in it for the long haul.

Evaluating Companies for Dividend Reinvestment

As an African stock investor looking to benefit from dividend reinvestment, one key step is choosing the right companies.

Not all dividend-paying stocks are the same. Some offer better long-term value than others.

So, take time to review each company carefully. Make sure their dividend history, payout strength, and overall growth match your goals.

The right pick can make a big difference—especially when you’re reinvesting over the long haul.

Identifying Dividend-Paying Stocks

The first step in evaluating dividend stocks is to find companies that consistently pay dividends.

These are typically well-established businesses with a strong financial track record. They’ve proven they can generate enough profit to share with shareholders regularly.

Look for companies with a history of reliable payouts, as this shows stability and a commitment to rewarding investors.

Look for Consistent Dividend Payers

When building a dividend reinvestment portfolio, start with reliable companies.

Look for those with a strong history of paying dividends every year. This steady track record often signals solid financial health.

Even more, it shows the company values its shareholders. And chances are, they plan to keep rewarding them over time.

Criteria for Selecting Companies

Once you’ve identified dividend-paying stocks, the next step is to narrow down your choices by considering specific criteria. Here are the key factors to weigh:

1. Dividend Yield

Dividend yield is a crucial metric to watch. It shows how much a company pays in dividends each year, compared to its current stock price.

A higher yield can mean more income from your investment—especially if you’re reinvesting those dividends.

However, always check if the yield is sustainable. A high number is great, but only if the company can keep it going.

2. Dividend Growth History

A company that regularly increases its dividends is often a strong pick.

This steady growth in payouts shows not only financial strength but also a clear commitment to its shareholders.

So, when choosing where to invest, look for businesses that raise their dividends year after year. It’s a good sign they’re in it for the long haul.

3. Financial Health

Always take time to do a fundamental analysis before investing.

Start by reviewing the company’s financial statements. Look closely at its debt levels, cash flow, and overall earnings.

A strong balance sheet often means the company can keep paying dividends—even when the economy slows down.

You can easily find this information on platforms like Yahoo Finance or Google Finance.

In short, the more financially stable the company, the more reliable its dividend payouts are likely to be.

4. Assessing Dividend Stability

Dividend stability is just as important as the dividend itself. It’s not enough for a company to pay dividends now—it should keep paying them even when times get tough.

So, look for companies with a solid history of steady payouts. This shows they can handle economic conditions without cutting back on shareholder rewards.

5. Look at Historical Dividend Payments

Take a good look at the company’s dividend history. Did it keep paying during past recessions or tough markets? If yes, that’s a strong sign of stability.

After all, a company that held steady in hard times is more likely to do it again.

So, the longer and more consistent the track record, the better your chances for steady income down the road.

Implementing a Dividend Reinvestment Strategy

Now that you’ve identified potential dividend-paying companies for dividend reinvestment, it’s time to craft a personalized strategy that aligns with your financial goals and risk tolerance.

The Different Approaches to Dividend Reinvestment

There are two primary approaches to consider:

1. Reinvest in the Same Stock

You can choose to reinvest dividends back into the same stock. This approach allows you to deepen your ownership in a specific company over time.

2. Diversify with Different Dividend-Paying Stocks

Alternatively, you can diversify your dividend reinvestment by allocating dividends to different dividend-paying stocks. Diversification can help spread risk across various industries and sectors.

Tips for Optimizing Your Strategy

To get the most from dividend reinvestment, keep a few simple tips in mind.

Check Your Portfolio Often: Review your holdings on a regular basis. Make sure they still match your goals. If not, make changes to stay balanced and diversified.

Watch for Deals: At the same time, look for strong companies trading at lower prices. Buying quality stocks on sale can boost your returns over time.

In the end, staying informed and active helps keep your strategy on course.

Tax Considerations with Dividend Reinvestment

Understanding how taxes affect dividend reinvestment is key to managing your wealth wisely.

With the right approach, you can boost your overall returns by keeping more of what you earn.

Use Tax-Efficient Strategies: Plan your investments to reduce tax burdens where possible. For example, holding dividend-paying stocks long term can lead to lower tax rates on qualified dividends.

Also, make the most of tax-advantaged accounts like ISAs or pension plans. These can help shield your earnings and support long-term growth.

In the end, smart tax planning makes a big difference—especially when reinvesting for the future.

Monitoring and Managing a Dividend Reinvestment Portfolio

Managing a dividend reinvestment portfolio isn’t a one-time job. Instead, it takes steady attention, clear goals, and smart updates over time.

Markets shift. Companies change. So, your portfolio should adjust as well. That’s why regular check-ins help you stay on track and make the right moves.

In the long run, staying alert and informed makes all the difference. So, keep learning, keep reviewing, and always invest with purpose.

Portfolio Management Techniques

Good portfolio management is key to making dividend reinvestment work. And one of the best tools you have is smart diversification.

Spread Risk Through Diversification

Don’t put all your eggs in one basket. Instead, spread your investments across sectors and industries. That way, one weak spot won’t drag down the rest.

Why It Matters

First, it cuts down risk. If one sector takes a hit, others may hold strong.

Second, it evens out income. Since dividends often pay at different times, this can smooth your cash flow.

Third, it gives you room to grow. When one area rises, it can help balance out losses elsewhere.

So, by diversifying, you protect your income—and set your portfolio up for long-term success.

Tracking Dividends and Reinvestments

There are plenty of tools and apps that make tracking your portfolio easier. Most give real-time updates on dividends, reinvestments, and overall performance. Even better, they’re easy to use.

While most brokerages offer built-in tracking, you can also try third-party apps designed just for this. So, whether you’re just starting out or have years of experience, these tools help you stay on top of your investments every step of the way.

The Importance of Tracking

Tracking your dividend income and reinvestments adds real value.

Stay Clear on Performance

First, it shows exactly how your investments are doing. You’ll see how much income you’re earning and where it’s coming from.

This kind of clarity helps you make better choices—and keeps your strategy on course.

Make Tax Time Easier

Next, it helps with tax reporting. With accurate records, you’re less likely to miss anything—and more likely to pay the correct taxes on your dividends.

Improve Your Decisions

Finally, tracking helps you decide when to reinvest dividends, rebalance your portfolio, or take profits. Simply put, it keeps you in control.

Case Studies and Success Stories

Case Study 1: The Coca-Cola Company

Coca-Cola has long been a top pick for dividend investors—and for good reason.

Picture this: an investor buys 100 shares in the early 1980s. Back then, Coca-Cola paid just $0.10 per share each year. But the company didn’t stop there. Over time, it kept raising its dividend.

By the early 2000s, the payout had climbed to over $1 per share. Today, that same investor earns more than $4 per share—every year.

Meanwhile, each dividend was reinvested. So, the number of shares kept growing. And with more shares, the total dividend income grew even faster.

That steady compounding added up—showing the real power of time, consistency, and reinvestment.

Case Study 2: Johnson & Johnson

Johnson & Johnson, a well-known name in healthcare, has a strong track record of rewarding investors.

Picture this: someone invests $10,000 in J&J stock in the late 1990s. At that time, the dividend was modest—but steady.

Even during tough markets, the company kept raising its payout. And with each dividend reinvested, the number of shares grew.

Over time, what started as a few hundred dollars in income became a reliable stream of passive earnings.

Thanks to compounding, that original $10,000 turned into a much larger portfolio—proving how steady reinvestment can lead to real long-term growth.

Risks and Considerations of Dividend Reinvestment

No strategy is without risk—including dividend reinvestment. While it’s a smart way to grow wealth, you still need to understand the risks and protect your portfolio.

Market Risk

First, stock prices rise and fall with the market. So, when markets drop, your reinvested dividends can lose value too. This doesn’t mean you should panic. But it does mean you need to stay diversified and avoid overloading on one sector.

Company-Specific Risk

Next, there’s the risk tied to individual companies. A business may cut or stop its dividend if it runs into trouble. That’s why it’s smart to watch a company’s financial health—and not rely too heavily on just a few stocks.

Staying aware of these risks helps you invest with confidence and stay on track.

Inflation Risk

Lastly, don’t forget inflation. Over time, the same dividend payment may buy you less. To fight this, consider reinvesting in companies that regularly raise their dividends.

In Summary

Dividend reinvestment can be powerful—but only if you stay alert to these risks. Use smart diversification, monitor your holdings, and adjust as needed. This way, your strategy remains strong—even in changing conditions.

Mitigation Strategies

While risks come with any investment, you can take simple steps to manage them. These strategies can help protect your portfolio and keep it on track.

Spread Your Risk

Start by diversifying your investments. Put your money into different companies and industries. If one area struggles, others may hold steady or grow. While this won’t guarantee profits, it helps reduce the hit from losses.

Do Your Research

Next, always check the facts before buying a stock. Look at the company’s finances, profit trends, and history of dividend payouts. A solid record doesn’t remove all risk, but it helps lower the chance of a cut.

Check In Often

Even good plans need updates. So, review your portfolio often. Are your investments still meeting your goals? If not, it might be time to make some changes.

Stay Focused

In the end, a steady dividend strategy takes attention. With a bit of care upfront—and regular follow-up—you can better manage risk and stay on course.

Implementing Diversification Strategies to Mitigate Risk

Diversification is a key strategy for managing investment risk. By spreading your investments across different assets, you reduce the impact of any single investment’s poor performance. This approach helps balance potential losses with gains from other areas.

To diversify effectively, consider investing in various industries and sectors. For instance, you could spread your investments across technology, healthcare, finance, and consumer goods. Each of these sectors tends to respond differently to economic changes, so one sector’s poor performance may be offset by another’s growth.

Moreover, diversification isn’t just about having different stocks. It’s also about balancing risk. By including assets with varying risk levels, you can better protect your portfolio.

In the long run, a well-diversified portfolio increases your chances of achieving steady growth while reducing the overall risk. Remember, the goal is to build a resilient portfolio that can weather different economic conditions.

Frequently Asked Questions (FAQs)

1. How can I track the performance of my dividend reinvestment portfolio?

You can use portfolio tracking tools, brokerage platforms, or financial software to monitor the performance of your dividend reinvestment portfolio.

2. How do I enroll in a Dividend Reinvestment Plan (DRIP)?

To enroll in a DRIP, contact your brokerage or the company whose stock you own. They will provide you with the necessary forms and instructions.

3. Are there fees associated with participating in a DRIP?

DRIPs often have minimal or no fees for reinvesting dividends. However, checking with the company or brokerage for specific details is essential.

4. Is dividend reinvestment a guaranteed way to make money in the stock market?

While dividend reinvestment can be a reliable strategy, it’s not guaranteed. Stock prices can fluctuate, impacting the overall performance of your portfolio.

5. What is the difference between a DRIP and a Direct Stock Purchase Plan (DSPP)?

DRIPs typically involve reinvesting dividends in the same company’s stock, while DSPPs allow you to purchase shares directly from the company, often without going through a brokerage.

Conclusion

Dividend reinvestment is one of the most reliable ways to build long-term wealth. Instead of taking dividends as cash, you use them to buy more shares. As a result, your investment grows. Over time, these additional shares generate more dividends. Then, those dividends buy even more shares. So, the cycle continues and compounds.

Furthermore, staying focused on the long term is essential. While short-term gains may seem tempting, steady reinvestment usually pays off more. Even though it may take time, patience leads to greater growth.

In addition, you don’t need to add new money. Rather, your portfolio grows naturally. As your shares increase, your income potential rises, too.

Therefore, starting early matters. The sooner you begin, the more time compounding has to work. So, keep reinvesting. Stay consistent. Let time and discipline grow your wealth.

In conclusion, small steps today can lead to lasting financial strength.