Introduction

In pursuing financial success, investors increasingly turn to leveraged and inverse ETFs – a thrilling yet treacherous terrain where fortunes can be made or lost in the blink of an eye. These powerful exchange-traded funds promise to supercharge your portfolio by amplifying gains or providing inverse returns but beware: their complexity and volatility can be a recipe for disaster. As you venture into this high-stakes arena, arm yourself with knowledge and caution, for the rewards are appealing, but the risks are very real. Explore the fascinating world of leveraged and inverse ETFs and discover how to harness their potential while avoiding the pitfalls that await the unprepared.

Fundamentals of Leveraged ETFs

Leveraged ETFs (Exchange-Traded Funds) use financial derivatives and debt to magnify the returns of an underlying index. For example, a 2x leveraged ETF seeks to deliver twice the daily return of its benchmark index. These ETFs utilize instruments like options, futures contracts, and swaps to achieve this. While they can significantly enhance gains, they also amplify losses, making them highly volatile. Due to the daily resetting of leverage, their performance can diverge considerably from the underlying index over extended periods, primarily because of the compounding effect. Consequently, leveraged ETFs are designed for short-term trading strategies rather than long-term investments, as the increased volatility and potential for substantial deviations from the index can pose significant risks for long-term holders.

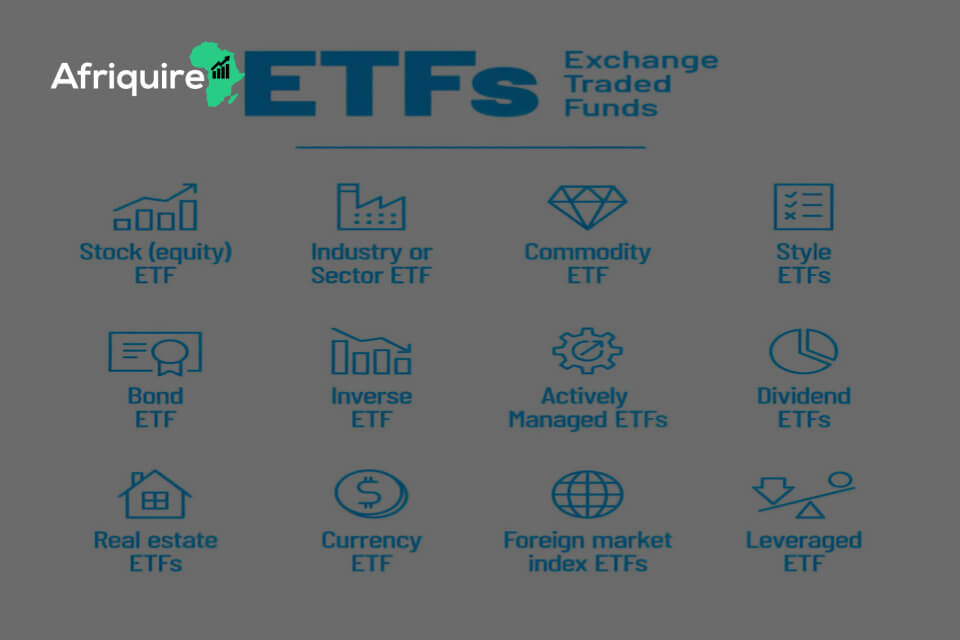

Types of Leveraged ETFs

- 2x Leverage: Provides twice the daily return of the underlying index. Leveraged and inversed ETFs, like 2x or 3x, utilize financial derivatives and debt to boost returns, offering traders a powerful tool for short-term gains. Unlike mutual funds, ETF investing in these instruments requires careful monitoring due to their amplified volatility and compounding effects.

- 3x Leverage: Aims to deliver three times the daily return of the underlying index. Leveraged and inversed ETFs offer aggressive traders a way to capitalize on market movements. These instruments, distinct from traditional mutual funds, use financial derivatives to amplify returns. ETF investing in such products demands vigilance due to heightened volatility and risk.

Examples of Popular Leveraged ETFs

- ProShares Ultra S&P 500 (SSO): Seeks to provide 2x the daily performance of the S&P 500. Leveraged and inversed ETFs like SSO use financial derivatives and debt to amplify returns, offering traders a powerful tool to capitalize on short-term market movements. For those into ETF investing, these products present an opportunity to supercharge gains. However, the amplified nature of these investments also brings increased volatility and risk, requiring active management and careful monitoring. Unlike traditional mutual funds, leveraged ETFs reset daily, meaning their performance over the long term can diverge significantly from the underlying index due to compounding effects.

- Direxion Daily Financial Bull 3X Shares (FAS): Targets 3x the daily performance of the Financial Select Sector Index. Leveraged and inversed ETFs like FAS use financial derivatives to amplify returns, making them attractive for aggressive traders. These ETFs differ from traditional mutual funds and mid-cap stocks, offering a way to leverage market movements. However, ETF investing in such products involves significant risk due to heightened volatility. The compounding effect can lead to substantial deviations from the expected performance over time. Active management is essential to navigate these dynamic market instruments’ risks and potential rewards. Market Capitalization Comparison often highlights the unique benefits of these leveraged tools.

Fundamentals of Inverse ETFs

Explanation of Inverse ETFs and How They Work

Inverse ETFs are designed to provide returns opposite to their benchmark index’s performance. A -1x inverse ETF seeks to deliver the negative of the daily return of its underlying index. These ETFs are commonly used for short-selling or hedging against declines in the market. By inversely mirroring an index, investors can profit from or protect against market downturns without directly shorting stocks, which can be riskier and more complex. Inverse ETFs achieve this through derivatives such as futures contracts, swaps, and options. They are typically short-term investment tools, as their daily reset mechanism can lead to compounding effects that may cause the ETF’s performance to deviate from its intended inverse return over more extended periods.

Types of Inverse ETFs

- -1x Inverse: -1x Inverse provides a distinctive investment opportunity by delivering the inverse of the index’s daily return. Ideal for traders looking to profit from falling markets, it pairs seamlessly with mutual funds to create a robust risk management strategy. This tool is particularly beneficial for those aiming to hedge their investments or bet against underperforming sectors. By incorporating -1x Inverse into their portfolio, investors can achieve better diversification and potentially offset losses. For experienced market participants and those exploring advanced financial strategies, -1x Inverse represents a valuable component for dynamic risk management and portfolio optimization.

- -2x Inverse: -2x Inverse is a powerful investment vehicle designed to deliver twice the inverse of the daily return of an index. This leveraged tool is ideal for traders who seek to amplify their gains from declining markets, offering double the exposure to inverse movements. It operates as a high-risk, high-reward option, making it suitable for those confident in their market predictions and willing to take on greater volatility. By integrating -2x Inverse with other investment strategies, such as mutual funds or traditional equities, investors can potentially enhance their risk management and capitalize on market downturns with increased intensity.

Examples of Popular Inverse ETFs

- ProShares Short S&P 500 (SH) is a strategic investment vehicle designed to deliver the inverse of the daily performance of the S&P 500 index. This exchange-traded fund (ETF) is ideal for investors seeking to hedge against market declines or profit from bearish market trends. By providing a return that moves opposite to the S&P 500’s daily fluctuations, SH allows traders to potentially benefit from falling stock prices without shorting individual stocks. Its straightforward approach to inverse performance makes it a valuable tool for those aiming to manage risk or capitalize on downturns in the broader market.

- Direxion Daily S&P 500 Bear 3X Shares (SPXS): The Direxion Daily S&P 500 Bear 3X Shares (SPXS) is an aggressive investment product aimed at delivering three times the inverse of the daily performance of the S&P 500. This leveraged ETF is designed for traders who wish to capitalize on significant declines in the S&P 500 index with amplified returns. SPXS seeks to provide the negative return of the index three times each day, making it a potent tool for those anticipating sharp market downturns. Ideal for experienced investors, SPXS offers a high-risk, high-reward strategy, allowing them to leverage their bets against the broader market while managing volatility with precision.

Benefits of Leveraged and Inverse ETFs

Potential for Higher Returns in Short-term Trading

Higher returns in short-term trading are a significant appeal of leveraged and inverse ETFs. When market conditions favor the strategy, these ETFs can substantially amplify profits within a short time frame. Traders can capture impressive gains by targeting an index’s inverse or leveraged performance multiple times. This approach is particularly potent in volatile markets where swift movements yield substantial returns. Comparing market capitalization and incorporating mid-cap stocks can further enhance trading strategies. Leveraged and inverse ETFs provide dynamic opportunities for investors looking to capitalize on rapid market shifts with strategic precision.

Tools for Hedging and Managing Portfolio Risk

The Tools for hedging and managing portfolio risk, inverse ETFs offer a practical solution against market downturns. These financial instruments are specifically designed to deliver returns that move in the opposite direction of the underlying index, counterbalancing losses in other investments. By incorporating inverse ETFs into a diversified portfolio, investors can effectively mitigate the impact of adverse market conditions. They act as a safety net during market volatility or economic uncertainty, helping protect overall portfolio value. This strategic use of inverse ETFs enhances risk management, allowing investors to navigate fluctuating markets with greater confidence and stability.

Accessibility and Ease of Trading

The Accessibility and ease of trading make leveraged and inverse ETFs highly appealing to retail investors. These financial products can be traded like regular stocks through standard brokerage accounts, simplifying their integration into every day trading strategies. Their straightforward trading mechanics allow investors to buy and sell shares quickly, providing flexibility in managing short-term market positions. With no special accounts or advanced setups required, these ETFs offer a user-friendly way to engage with complex trading strategies. This accessibility democratizes advanced financial tools, enabling a broad range of investors to leverage market opportunities and manage their portfolios with enhanced control and efficiency.

Risks and Challenges

Some risks and challenges associated with this are:

1. Understanding Compounding and Its Impact on Returns: Understanding compounding and its impact on returns is crucial for leveraged ETFs. These funds reset daily, meaning their performance can diverge significantly from the expected multiple of an index’s return over extended periods. In volatile markets, compounding effects can erode returns, making long-term performance unpredictable and potentially less favorable than anticipated.

2. Market Volatility and Its Effect on Leveraged and Inverse ETFs: Market volatility can significantly impact leveraged and inverse ETFs, as these funds are susceptible to market swings. In periods of high volatility, the amplified effects of these ETFs can lead to significant losses. Their performance is closely tied to daily market fluctuations, making them vulnerable to rapid and unpredictable changes, which can magnify both gains and losses.

3. Daily Rebalancing and Tracking Error: Daily rebalancing in leveraged and inverse ETFs can lead to tracking errors, causing deviations from the expected performance over more extended periods. As these funds adjust their holdings daily to maintain their targeted leverage or inverse ratio, the compounding effects and market volatility can create discrepancies between the ETF’s performance and the index it aims to track.

4. Liquidity Risks: Liquidity risks in leveraged and inverse ETFs can result in higher trading costs and wider bid-ask spreads. Low liquidity means fewer buyers and sellers, making it more expensive to enter or exit positions. This lack of liquidity can also lead to less favorable trade execution and increased ETF price volatility.

Winning Strategies for Leveraged and Inverse ETFs

1. Identifying Market Trends and Timing Trades: Successful trading of leveraged and inverse ETFs necessitates accurately identifying market trends and timing trades to maximize returns. This strategy involves closely monitoring market movements and leveraging data analysis to make informed decisions, optimizing investment outcomes, and capitalizing on these ETFs’ amplified performance during volatile market conditions.

2. Short-term Trading Strategies: Leveraged and inverse ETFs are designed for short-term trading strategies rather than long-term holding. Their structure aims to amplify daily returns, making them ideal for capturing short-term market movements. However, holding these ETFs long-term can lead to significant performance deviations from the intended benchmark, increasing risk and potential losses.

3. Using Technical Analysis to Inform Decisions: Technical analysis can help traders make informed decisions about entry and exit points by analyzing historical price movements and market patterns. This method uses charts and indicators to predict future price actions, allowing traders to strategically time their trades and maximize potential returns in volatile markets.

4. Incorporating Leveraged and Inverse ETFs into Broader Trading Strategies: Leveraged and inverse ETFs can be integrated into a broader trading strategy, complementing diversification and risk management techniques. By strategically incorporating these ETFs, traders can enhance potential returns and hedge against market downturns. This approach allows for a more balanced portfolio, optimizing gains while mitigating overall investment risks.

Risk Management Techniques

Setting Stop-Loss Orders to Limit Potential Losses

Setting stop-loss orders is a crucial strategy for managing potential losses and protecting capital in trading. These orders automatically sell a security when its price reaches a predetermined level, helping to limit losses in volatile markets. With stop-loss orders, traders can establish clear exit points, preventing emotional decision-making and minimizing the impact of sudden market downturns. This risk management tool is essential when trading leveraged and inverse ETFs, where price movements can be rapid and unpredictable. Implementing stop-loss orders as part of a broader trading strategy ensures disciplined trading practices and helps safeguard investments against significant losses.

Diversifying Across Different Asset Classes and Sectors

Diversifying across different asset classes and sectors is essential for reducing the impact of adverse movements in leveraged and inverse ETFs. Investors can mitigate risks associated with any single market segment by spreading investments across various asset types, such as stocks, bonds, commodities, and different industry sectors. This approach helps balance the potential volatility of leveraged and inverse ETFs, as losses in one area can be offset by gains in another. Diversification enhances portfolio stability and provides opportunities for growth in varying market conditions, ensuring a more resilient investment strategy that can withstand economic fluctuations and unexpected market events.

Monitoring and Adjusting Positions Regularly

Regular monitoring and adjusting positions are crucial for effective risk management in trading. Markets are dynamic, and the performance of investments, including leveraged and inverse ETFs, can change rapidly. By consistently reviewing positions, traders can identify shifts in market conditions and adjust their strategies accordingly. This proactive approach allows for timely reactions to adverse movements, helping to protect capital and optimize returns. Regular adjustments also enable traders to realign their portfolios with evolving market trends and personal investment goals. Maintaining vigilance and flexibility ensures that trading strategies remain effective and that risks are managed efficiently in a constantly changing financial landscape.

Understanding and Managing Leverage Risk

Understanding and managing leverage risk is essential for investors using leveraged financial products like ETFs. Leverage amplifies potential returns and losses, making it crucial to fully grasp its implications. Investors should know that while leverage can enhance gains, it also increases exposure to significant losses, especially in volatile markets. Effective risk management involves setting clear limits on leverage use, regularly monitoring positions, and employing stop-loss orders to mitigate potential downsides. By thoroughly understanding how leverage affects their investments and managing exposure carefully, investors can navigate the complexities of leveraged trading and protect their capital.

Regulatory and Compliance Considerations

Overview of Regulatory Guidelines for Leveraged and Inverse ETFs

Regulatory bodies like the SEC provide comprehensive guidelines for leveraged and inverse ETFs to ensure transparency and protect investors. These guidelines mandate detailed disclosure of these complex financial products’ risks and performance characteristics. Regulations require ETF providers to maintain clear and accurate information about their investment strategies, fees, and potential market impacts. Regulatory bodies aim to enhance investor understanding and promote informed decision-making by enforcing these standards. Additionally, they implement rules to prevent market manipulation and ensure that leveraged and inverse ETFs operate within a framework that prioritizes investor protection and market integrity.

Understanding the Role of the SEC and Other Regulatory Bodies

The SEC and other regulatory entities are crucial in overseeing the trading and management of leveraged and inverse ETFs. These bodies establish and enforce regulations to ensure market integrity, protect investors, and promote fair trading practices. The SEC aims to mitigate systemic risks and prevent market manipulation by monitoring these complex financial instruments. Regulatory oversight includes setting transparency, disclosure, and risk management guidelines, ensuring that ETF providers adhere to high standards. Understanding the role of these regulatory bodies helps investors stay informed about compliance requirements, enhances market confidence, and supports the development of a stable and resilient financial system.

Importance of Compliance and Staying Informed About Changes in Regulations

Staying updated with regulatory changes is crucial for maintaining compliance and making informed trading decisions. Financial markets constantly evolve, and new regulations can significantly impact investment strategies and market dynamics. Awareness of these changes helps investors and traders adapt to new rules, avoid potential legal issues, and optimize their portfolios. Compliance ensures that all trading activities adhere to current laws, minimizing the risk of penalties and enhancing overall market integrity. Informed trading, backed by up-to-date knowledge of regulations, enables market participants to navigate complexities more effectively, seize opportunities, and mitigate risks, ultimately leading to better financial outcomes.

Case Study

The 2020 Oil Price Crash and the ProShares UltraPro 3x Crude Oil ETF (OILU)

In April 2020, the COVID-19 pandemic triggered a seismic shock in the global oil market, resulting in an unprecedented collapse in oil prices. On April 20, 2020, West Texas Intermediate (WTI) crude oil futures plummeted to $37.63 per barrel, marking a historic low. A massive demand shock drove this sharp decline as global economies grappled with lockdowns and reduced consumption.

Amid this chaos, the ProShares UltraPro 3x Crude Oil ETF (OILU) — a leveraged ETF designed to triple the daily returns of WTI crude oil — was hit hard. As oil prices nosedived, OILU’s value followed suit, plunging by an eye-watering 93.5% in just one day. Investors in OILU faced severe losses, with many watching their investments evaporate almost entirely.

Leveraged and inversed ETFs like OILU are known for their amplified reactions to market movements. When oil prices crash, these ETFs can experience extreme volatility. Investors need to understand the risks of ETF investing, including the potential for rapid declines in value, especially in volatile markets. This dramatic event highlights the risks of investing in leveraged funds and the importance of analyzing the performance and costs associated with these ETFs.

Lessons Learned:

Here are 5 lessons learned from the case study:

1. OILU’s 93.5% single-day decline vividly illustrates the extreme risk of leveraged ETFs, particularly during sharp market downturns. This dramatic drop underscores how these funds, designed to amplify returns, can also magnify losses, exposing investors to substantial financial peril when underlying assets experience sudden and severe declines.

2. The triple-leverage factor in OILU significantly magnified the losses, causing the ETF’s decline to be far more drastic than the underlying oil price drop. This amplification effect highlights the inherent risk in leveraged ETFs, where the potential for amplified gains is matched by the potential for even more severe losses.

3. The unprecedented oil price collapse triggered by the COVID-19 pandemic underscores how unexpected market events can drastically impact investments. This crisis revealed the vulnerability of financial markets to sudden shocks, demonstrating how rapid and severe declines can disrupt even well-established investment vehicles, leading to significant financial losses.

4. Investors in OILU faced severe losses, underscoring the critical need to assess personal risk tolerance. Understanding the risks of leveraged ETFs is vital, as these funds can amplify gains and losses. This situation highlights the importance of careful consideration before investing in volatile financial instruments.

5. The case study stresses the importance of thoroughly analyzing the performance, costs, and risks associated with leveraged and inverse ETFs before investing. This due diligence can help investors avoid unexpected and severe losses, ensuring they are well-informed about these complex financial instruments’ potential volatility and financial dangers.

Frequently Asked Questions (FAQs)

1. What are leveraged ETFs, and how do they work?

Leveraged ETFs aim to amplify the daily returns of an underlying index by using financial derivatives and debt. These funds seek to provide multiples of the index’s daily performance, either positive or negative. By employing leverage, they offer the potential for higher gains but also come with increased risk.

2. What is the difference between leveraged and inverse ETFs?

Leveraged ETFs seek to multiply the daily performance of an index, offering amplified returns, whether positive or negative. In contrast, inverse ETFs aim to deliver returns that are the opposite of the index’s performance. Both types use financial strategies to achieve their objectives, catering to different investment goals and risk profiles.

3. Are leveraged and inverse ETFs suitable for long-term investing?

Generally, leveraged and inverse ETFs are designed for short-term trading because of their daily rebalancing and compounding effects. These characteristics can lead to significant deviations from expected long-term performance. Their structure is intended to capitalize on short-term market movements, making them less suitable for buy-and-hold strategies.

4. What are the main risks associated with leveraged and inverse ETFs?

Risks associated with leveraged and inverse ETFs include high volatility, which can lead to significant price swings. Compounding effects may distort long-term returns, while tracking errors can cause deviations from the expected performance. Additionally, liquidity issues can increase trading costs and wider bid-ask spreads, impacting overall efficiency.

5. How can investors use leveraged and inverse ETFs effectively in their portfolios?

Investors can utilize these ETFs for short-term trading and hedging and integrate them into broader trading strategies. However, effective use requires careful risk management due to their high volatility and daily rebalancing. Properly managing these factors can help achieve investment goals while mitigating potential downsides.

Conclusion

In conclusion, leveraged and inverse ETFs offer potent tools for traders and investors seeking to amplify returns or hedge against market movements. However, their complexity and potential for significant gains or losses demand a thorough understanding of their mechanics and associated risks. By grasping the fundamentals of these financial instruments and implementing effective risk management strategies, investors can harness their potential while minimizing exposure to adverse market conditions. The ProShares UltraPro 3x Crude Oil ETF (OILU) case study is a powerful reminder of the importance of caution and due diligence when navigating the intricacies of leveraged and inverse ETFs.

As the financial landscape evolves, staying informed and adaptable will be crucial for investors seeking to optimize their investment outcomes in this dynamic and often unpredictable market environment.

1 thought on “Investing in ETFs: Smart Ways to Leverage Big Gains”

Hello mates, nice article and fastidious urging commented here, I am actually enjoying by these.