- Introduction

- Assessing Risk in Large-Cap Stocks

- Return Potential in Large-Cap Stocks

- Factors Influencing Risk and Returns in Large-Cap Stocks

- Investment Strategies for Managing Risk and Maximizing Returns in Stocks

- Analyzing Risk-Reward Profiles of Large-Cap Stocks

- Long-Term Perspective on Risk and Returns in Large-Cap Stocks

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

In the dynamic world of stock investing, understanding the intricate balance between risk and returns in large-cap stocks is paramount for investors seeking to optimize their portfolios. In this comprehensive guide, we will delve into the heart of this relationship, breaking it down into manageable components that even novice investors can grasp.

Definition of Large-Cap Stocks

Large-cap stocks represent companies with a substantial market capitalization. These are the giants of the stock market, often well-established corporations with market values in excess of billions. When we think of examples of large-cap stocks, we mostly think of household names like Apple, Amazon, or Microsoft.

Importance of Understanding Risk and Returns

Why is it important to understand the risk-return dynamics in large-cap stocks? The simple answer is that making informed investment decisions is key to your financial success. Large-cap stocks are generally considered safer investments, but they are not without risks. By understanding these risks and the potential rewards, you can make smarter choices, whether you’re a seasoned investor or just starting.

Assessing Risk in Large-Cap Stocks

Our voyage begins with a roadmap that guides you through each twist and turn of large-cap stocks. Before we embark on our exploration of risk and returns in large-cap stocks, it’s essential to understand the multifaceted nature of risk. Here’s a brief glimpse of the path we’re about to tread:

Types of Risks in Large-Cap Stocks

Market Risk: Also known as systematic risk, market risk pertains to factors inherent to the entire stock market. Factors like economic conditions, political events, and interest rates are just a few examples of what can sway the entire market, affecting large-cap stocks as a whole.

Industry Risk: Specific to the sector a company operates in, industry risk can significantly impact large-cap stocks. For example, tech stocks face different industry risks and opportunities than healthcare stocks.

Company-Specific Risk: As the name suggests, this risk is unique to individual companies. It can include factors like management decisions, financial health, and competitive pressures.

Metrics for Risk Assessment

Beta – Understanding How a Stock Moves with the Market

Beta is a way to measure how much a stock’s price tends to move compared to the overall market. A beta of 1 means the stock usually moves in step with the market. If the beta is higher than 1, the stock is more volatile. In other words, it moves more—both up and down. On the other hand, a beta lower than 1 means the stock is less volatile and moves less than the market.

For example, if a stock has a beta of 1.2, it’s expected to move 20% more than the market. So, if the market goes up by 10%, the stock might go up by 12%. But if the market drops by 10%, the stock could fall by 12%.

Standard Deviation – Measuring the Ups and Downs

Standard deviation shows how much a stock’s returns go up or down from the average over time. Simply put, it tells you how “spread out” the returns are. A high standard deviation means the stock’s price jumps around a lot. A low standard deviation means the price stays more stable.

The more a stock’s price moves, the higher the risk. That’s why standard deviation is such a useful tool when you want to understand how risky an investment might be.

Sharpe Ratio – Weighing Returns Against Risk

The Sharpe Ratio helps you figure out whether the return you’re getting is worth the risk you’re taking. It looks at your investment’s return compared to a risk-free rate (like a government bond) and adjusts for how much the investment fluctuates.

In simple terms, a higher Sharpe Ratio means you’re getting more return for the amount of risk you’re taking. That’s a good thing. Investors often look for investments with a strong Sharpe Ratio when trying to build a balanced, risk-aware portfolio.

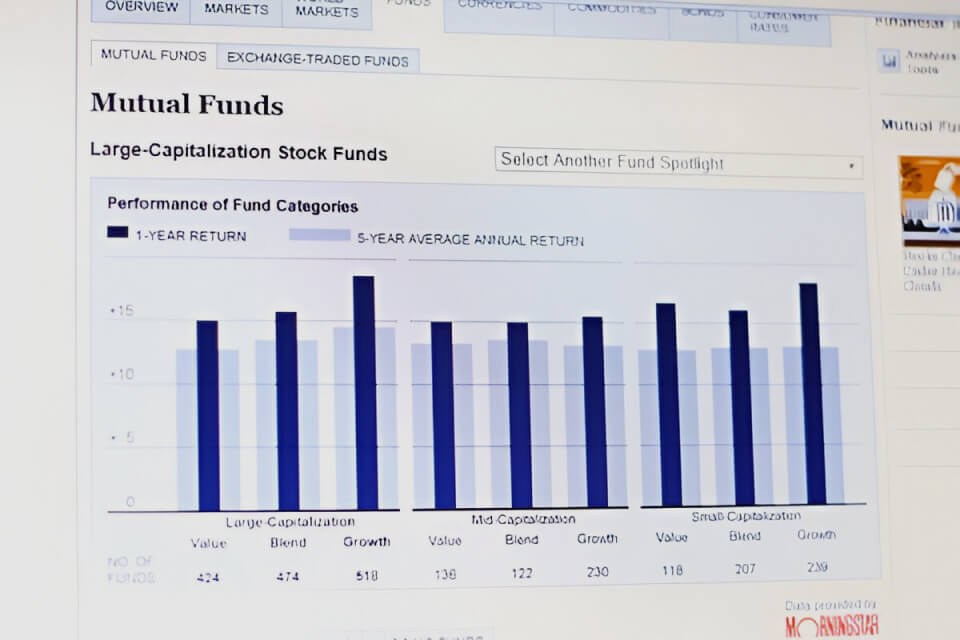

Risk-Reward Charts – Seeing the Big Picture

Risk-reward charts help you visualize what you could gain—and what you could lose—from an investment. They make it easier to compare different options by showing possible outcomes in a simple graph.

By using these charts, you can see how changing a few things—like the size of your investment or your expected return—might affect your overall portfolio. This can help you make smarter, more informed decisions.

Return Potential in Large-Cap Stocks

Investing in large-cap stocks is a lot like choosing a trail in the forest. You don’t just wander in—you need to know what lies ahead. Before you dive in, it’s important to understand what kinds of returns you might expect. This helps you spot both the opportunities and the risks.

Let’s start by looking at the two main ways you can earn money from large-cap stocks.

1. Capital Gains – Growing Your Investment Over Time

Capital gains are the profits you make when a stock’s price increases. It’s similar to planting a young tree and watching it grow. When you sell the stock for more than what you paid, the difference is your gain.

For example, if you buy a stock at $50 and later sell it for $70, your capital gain is $20 per share. These gains can take time, but with the right strategy and patience, they can become a major source of return.

We’ll also look at smart ways to help maximize these gains—whether through long-term holding, timing the market, or reinvesting profits.

2. Dividend Yields – Getting Paid While You Wait

In addition to price growth, many large-cap stocks offer dividends. These are regular payments made to shareholders, kind of like earning rent on a property you own. For investors, this is a steady stream of income that can be especially valuable during market downturns.

Dividend yields vary by company, so it’s important to know how to evaluate them. We’ll walk through how to assess dividend reliability, what a “healthy” yield looks like, and why dividends play a key role in building a strong, balanced portfolio.

Now, let’s shift focus. Understanding returns is just one piece of the puzzle. Next, we’ll explore the key factors that can influence both the risk and the reward of investing in large-cap stocks. This includes market trends, economic indicators, and company performance.

By knowing what to look for, you can make more informed choices—and stay confident in your investment journey.

Factors Influencing Risk and Returns in Large-Cap Stocks

Think About This Like Checking the Weather Before an Outdoor Event

What are the steps in planning an outdoor event? First, you check the weather. In the same way, you must understand what affects big-company stocks before you invest. Knowing the key factors can help you make smarter decisions. So, let’s break down the most important ones:

A. Market Conditions Matter a Lot

First of all, market conditions work just like weather patterns. Changes in the economy, interest rates, or world politics can push stocks up or down. These shifts set the mood of the entire stock market. So, always keep an eye on them.

B. Different Sectors Act Differently

Next, think about how we dress for different places. At the beach, you wear light clothes. In the snow, you wear a coat. In the same way, large-cap stocks in tech act differently than those in health care or energy. So, understand the sector before you invest.

C. Always Check the Company’s Health

Also, before you buy a car, you check the engine and tires. You need to know it runs well. So, do the same with stocks. Look into the company’s basics. Review its profits, debt, and leadership. Strong companies often lead to stronger returns.

D. Big Economic Trends Affect Everything

Now, picture the economy as the ocean tide. Stocks are like boats on that tide. When the tide rises or falls, it moves all the boats. But some float better than others. So, always consider the bigger economy when choosing your stocks.

E. Rules and Politics Can Shift the Road

Finally, think about politics and rules as signs on the road. Sometimes they speed you up. Sometimes they slow you down. Elections, new laws, or policy changes can shake the market. So, stay alert to these changes.

Next, we’ll look at smart strategies you can use to handle these factors and boost your returns over time.

Investment Strategies for Managing Risk and Maximizing Returns in Stocks

Investing in Big Stocks Is Like Taking a Long Road Trip

Investing in big-company stocks is a lot like planning a long road trip. You need a good plan to reach your goal and enjoy the ride along the way. So, here are the main strategies that can help you hit your targets:

A. Spread Out Your Investments (Diversification)

First, think of diversification like packing an umbrella. You might not need it, but if rain comes, you’re ready. When you spread your money across many big stocks, you lower the chance of losing everything. This smart move protects your investments from sudden market drops. So, every investor should make sure to build a mix of stocks to stay on track.

B. Choose a Path: Value or Growth Investing

Next, picking between value and growth investing is like choosing which road to take. Value investing means buying good stocks at lower prices. Growth investing means buying stocks that you think will grow fast in the future. Both paths offer chances to win. So, take time to learn about each one. Then pick the one that matches your style and goals.

C. Try to Time the Market (Carefully)

Now, market timing is like driving a fast car to make quick stops. Some investors try to buy when prices drop and sell when they rise. They hope to make fast profits. This takes skill, practice, and sharp focus. You need to watch market trends, technical analysis, and real-time data, and stay alert. So, while this can work, it also carries more risk. Many investors prefer to avoid it.

D. Think Long-Term (For Long Journeys)

Finally, long-term investing is like driving a safe and steady car across the country. You move slowly but surely. In this strategy, you buy good stocks and hold them for many years. You focus on the company’s earnings, growth, and health—not daily price changes. Over time, your money can grow with the power of compounding and steady market gains. So, if you’re patient, this road often leads to success.

Analyzing Risk-Reward Profiles of Large-Cap Stocks

Looking at Risk and Return in Big Stocks

Studying risk and return in big-company stocks is very important. It matters even more if you plan to hold your stocks for a long time. So, think of a balance scale. On one side is risk. On the other side is return. Every big stock fits somewhere in the middle. So, it helps to know where each stock stands and why.

Big Stocks with High Risk and High Return

Now, think of climbing a steep mountain. That’s how it feels when you invest in a high-risk, high-return stock. Yes, the top can be amazing, but the path can shake you up.

Take Tesla, for example. Tesla is a well-known big stock with high risk and big returns. The company makes electric cars and works on clean energy. It has changed the game in many ways. At the same time, its stock price jumps up and down a lot. This gives investors a chance to earn big profits. But the road comes with bumps—like rules, changes in laws, and tough competition. Still, those who got in early have seen huge rewards. But the ride has not been smooth.

Big Stocks with Low Risk and Steady Return

Now, picture a nice walk through a quiet park. That’s what it’s like with low-risk, steady-return stocks. They won’t make you rich fast, but they give you peace of mind.

Procter & Gamble is a good example. It’s a big name in home and health products. It owns brands like Tide, Crest, and Pampers. It pays regular dividends and grows at a steady pace. So, many investors who hate big risks choose this stock. They like how safe and calm it feels. It may not grow fast, but it rarely surprises you in a bad way.

Long-Term Perspective on Risk and Returns in Large-Cap Stocks

Investing in Big Companies for the Long Run

Investing in big companies means thinking far ahead. It’s like planning a long road trip where you want to enjoy the ride and reach your goal safely. So, let’s look at how to think long-term about risk and returns.

Looking Back at How Big Stocks Performed Over Time

First, think of this step like checking a map before your road trip. You need to know where others have gone. So, we’ll look at past trends in big-company stocks. These trends help us see how they did over time.

How Compounding Grows Your Money

Next, think of compounding like putting a strong engine in your car. It helps your money grow faster the longer you keep it invested. The more time you give it, the more it can grow.

Smart Ways to Lower Risk Over Time

Also, like packing a first-aid kit for your trip, long-term investors need tools to manage risk. For example, one smart way is dollar-cost averaging. Another one is reinvesting dividends. These strategies can help lower risk and build wealth slowly.

The Art of Balancing Risk and Return

Navigating the risk-return profiles of large-cap stocks is an art. As an investor, you understand that finding the right balance is key to long-term success. It’s like selecting the right gear for your adventure – not too heavy to slow you down, but not too light to leave you unprepared.

Frequently Asked Questions (FAQs)

1. What are the key advantages of investing in large-cap stocks?

Large-cap stocks offer stability and a lower risk profile compared to small-cap stocks. They are often dividend-paying stocks and have a track record of weathering market fluctuations.

2. How can I assess the risk of a large-cap stock before investing?

You can assess risk by considering factors like market conditions, sector-specific influences, and a company’s financial health. Tools like beta and standard deviation help quantify risk.

3. What are some long-term investment strategies for large-cap stocks?

Long-term strategies include dollar-cost averaging, dividend reinvestment, and holding stocks through market cycles to benefit from compounding.

4. How can I analyze the risk-reward profile of a large-cap stock I’m interested in?

Evaluate factors like beta, standard deviation, and the Sharpe Ratio to gauge the risk-adjusted returns. Additionally, use risk-reward charts to visualize potential gains and losses.

5. Can you provide examples of large-cap stocks with high-risk, high-return profiles?

Examples include Tesla (TSLA) and Amazon (AMZN), which have demonstrated significant price volatility and the potential for substantial returns.

Conclusion

Always remember—risk and return in stock investing do not stay the same. In fact, they often shift as market conditions change. So, you need to stay alert and keep learning. Again and again, review your strategy. Keep reading, keep watching the market, and always look for new trends.

The more you study and stay informed, the better you’ll get at spotting risks and rewards. Over time, you’ll learn how to manage the ups and downs of large-cap stocks. And because of that, you’ll grow more confident and more skilled. Step by step, you’ll move closer to long-term success in your investing journey.