- Introduction to Successful Digital Payment Solutions

- Overview of Notable Digital Payment Solutions

- Success Stories from Different African Countries on Digital Payment Solutions

- Key Features Contributing to Their Success on Digital Payment Solutions

- Lessons Learned and Best Practices of Digital Payments Solutions

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction to Successful Digital Payment Solutions

Across Africa today, the way people pay for things is changing fast. You no longer need to carry cash everywhere. Now, with just a mobile phone and the right app, you can send or receive money quickly and safely. These tools are called digital payments, and they are making life easier for millions of people.

Whether it’s paying for food at a market, buying schoolbooks, or shopping online, digital payments are becoming part of everyday life. In this article, we’ll look into case studies of successful digital payment solutions and how they are helping more people get access to money services.

Rise of Digital Payments in Africa

In the past decade, Africa has become a leader in using digital payment solutions. More people than ever now use mobile phones, and that has helped digital payments grow fast. Countries like Nigeria, Kenya, and South Africa are leading the way with tools like mobile money, digital wallets, and easy transfers.

This rise is not by chance. Many people in rural areas don’t have banks nearby. So, digital payment platforms help people send, save, or receive money without needing a bank account. All they need is a phone. Because of this, more people can now take part in the digital economy and join the fast-growing world of online business.

Also, many young people are now creating or using these payment tools to start businesses. This is helping African e-commerce grow and creating jobs too.

Importance of Case Studies in Understanding Success

It’s good to see how digital payments work, but it’s even better to look at real examples. Case studies show how people, companies, and even whole markets are using these tools in smart ways.

For example, a payment company might help traders in a busy market collect payments faster and more safely. This doesn’t just save time, it also helps the business grow. These real-life stories show us the role of digital payments in financial inclusion and how they help small businesses do more.

Case studies also teach us what works and what doesn’t. This helps banks, governments, and other companies learn how to choose the right digital payment solution and promote digital payments adoption better in different areas.

How Digital Payment Solutions Are Driving Financial Inclusion

One of the most powerful things about digital payment tools is that they help more people get access to financial services. Many people in Africa have never had a bank account. But with digital payments, they can now send money, pay bills, or even borrow money—all from their fingertips.

In some places, mobile money and agency banking are now the only ways people can use financial services. This is helping people in rural communities and small towns become part of the larger economy.

When more people understand how these tools work and have good mobile networks, they are more likely to use them. That’s why financial education and a strong internet are both very important.

Also, digital payments are giving more women, young people, and small business owners a chance to grow. The systems support job creation, reduce poverty, and allow people to save or borrow money more easily. Because of this, many banks and tech companies are working together to integrate digital payments with African banking systems and make things even better.

Overview of Notable Digital Payment Solutions

Digital payment solutions are changing the way people and businesses across Africa send and receive money. These platforms make it easier, faster and safer to do transactions. Let’s take a look at some of the most popular digital payment services making a big difference across the continent.

M-Pesa (Kenya)

M-Pesa is one of the first mobile money platforms in Africa. It started in Kenya in 2007 and is now used in many other countries. With just a basic mobile phone, users can send money, pay bills and buy airtime.

One reason why M-Pesa is so powerful is that it has agents everywhere. This means people can easily deposit or withdraw cash. Even those in villages and rural places can now access digital money.

Thanks to M-Pesa, more people can save, spend and grow their businesses without needing a bank account. It also helps connect mobile money with traditional banks. This has made M-Pesa a big part of the movement to improve financial inclusion and grow Africa’s digital economy.

Flutterwave (Nigeria)

Flutterwave is a Nigerian company that helps businesses accept payments from people all over the world. It works in over 30 countries and supports over 150 currencies. That means businesses can receive payments through cards, bank transfers and mobile money easily.

Flutterwave offers tools that help keep payments safe. One of them is called Rave, which makes sure transactions are secure and fast. It also connects businesses to both African and international payment systems.

By helping businesses grow and reach new customers, Flutterwave is playing a big role in the growth of African e-commerce. It also shows how digital platforms can link with banking systems to improve the way people pay.

MTN MoMo (Ghana and beyond)

MTN MoMo, short for Mobile Money, is another popular digital payment service. It started in Ghana but has spread to many other countries in Africa. With MoMo, users can send money, pay bills, and even shop online.

One thing that makes MoMo easy to use is its large network of agents. These agents help people change their cash into digital money and back again. So, even if you live far from a bank, you can still use MoMo.

MoMo also lets people send money to other countries. This makes it great for cross-border payments. It is helping to solve common challenges in digital payments, like high fees and lack of access to banks.

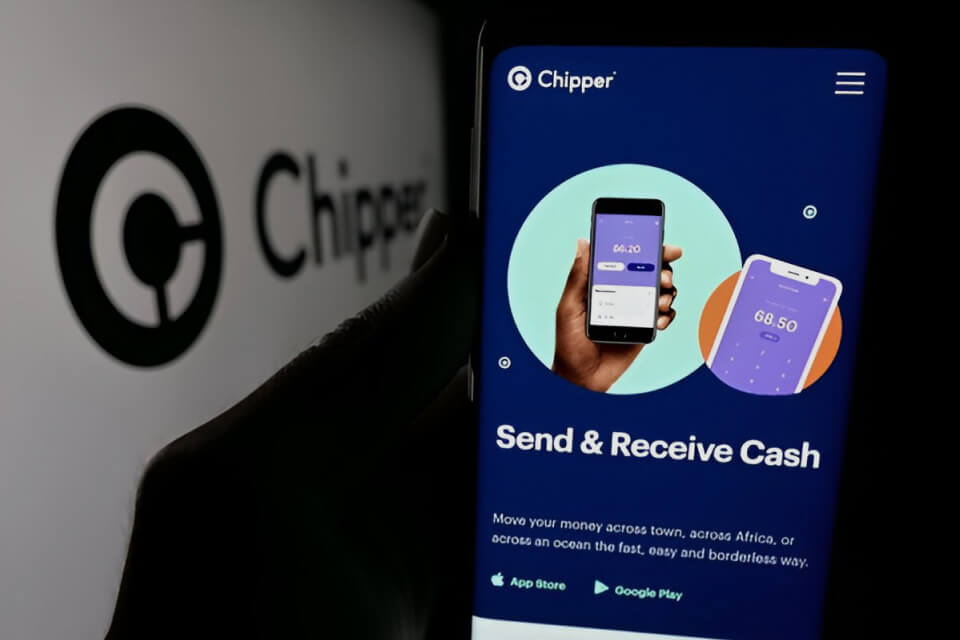

Chipper Cash (Pan-African)

Chipper Cash is a fast-growing app that helps people send money across African countries and even to the diaspora. It allows instant transfers in many local currencies. People can also use it to hold money in wallets and use a debit card.

Chipper Cash is simple to use and has low fees. It is great for anyone who wants to send or receive money quickly, whether for business or personal reasons.

By making payments affordable and easy, Chipper Cash is helping more people and businesses go digital. It’s also connecting different African banking systems and encouraging more people to trust and use digital payments.

Digital payment solutions are transforming how people manage money in Africa. From sending money to growing online businesses, these platforms make life easier. They are keys to opening up new opportunities and creating a stronger, more connected Africa.

Success Stories from Different African Countries on Digital Payment Solutions

Digital payment solutions are changing the way people across Africa send, receive, and spend money. Thanks to mobile phones and strong internet connections, many families and businesses now enjoy the benefits of fast and reliable payment platforms. Let’s look at how different countries in Africa have used these digital tools to improve lives and grow their economies.

How M-Pesa Revolutionized Mobile Money in Kenya

M-Pesa is one of the most successful digital payment platforms in Africa. It started in 2007 in Kenya and quickly became popular. Many people in Kenya didn’t have bank accounts, but almost everyone had a mobile phone. So, M-Pesa allowed them to send and receive money using their phones.

Today, M-Pesa helps people in cities and villages. It is safer than carrying cash, and it makes daily life easier. Many small business owners and farmers, especially women, now earn more money because they can buy and sell through mobile payments.

This shows the important role digital payments play in financial inclusion. It also shows how mobile payments support the growth of online shopping and services in Africa.

Nigeria’s Growth in FinTech Through Flutterwave and Paystack

Nigeria is leading in digital finance, thanks to powerful companies like Flutterwave and Paystack. These two companies help businesses receive payments online. Flutterwave connects African businesses to global payment systems. Paystack (now part of Stripe) helps businesses in Nigeria and other countries accept online payments easily and securely.

Both companies are helping more people trust digital payments. Businesses can now sell their products and services online, and customers can pay without stress. Also, digital payments are now working closely with banks. This means money can move faster and safer between people and businesses.

Nigeria’s success is a clear example of how to integrate digital payments with African banking systems to support economic growth.

Mobile Money’s Role in Ghana’s Digital Economy

In Ghana, mobile money is now part of everyday life. MTN Mobile Money is one of the most used platforms. People use it to send money, pay bills, and buy goods. Even small businesses use it to collect payments and track their sales.

The growth of mobile money in Ghana shows how easy it can be to promote digital payments adoption. People no longer need to carry cash all the time. They feel safer and more in control of their money.

This success also supports the country’s digital economy. It reduces the use of cash and helps more people take part in the formal financial system.

Regional Expansion of Chipper Cash Across Africa

Chipper Cash is growing fast in Africa. It works in countries like Nigeria, Uganda, Ghana, and South Africa. The platform allows people to send money across countries for free or at a very low cost.

This makes it easier for families to support each other and for businesses to grow across borders. The company also keeps its services simple, so even people who are new to technology can use it.

However, cross-border payments also face some challenges. For example, each country has different rules and currencies. Still, Chipper Cash is finding ways to grow despite these issues.

This story shows both the opportunities and the challenges facing digital payments in Africa.

Key Features Contributing to Their Success on Digital Payment Solutions

Digital payment solutions are changing the way people and businesses in Africa send and receive money. These platforms are helping more people buy, sell and do business online. But what makes them so successful? Let’s look at the most important features that help digital payments grow and support things like e-commerce, financial inclusion, and cross-border trade in Africa.

User-Friendly Interfaces

First of all, digital payment solutions must be easy to use. Many people using them are new to online payments. So, the apps and platforms must be clear and simple.

When users can easily send money, pay bills or buy something, they feel more confident. This makes them more likely to keep using the service. For example, some platforms used in busy markets in West Africa are so easy that even first-time users can complete payments quickly.

In the end, user-friendly designs are one of the most important ways to promote digital payments adoption across the continent.

Low Transaction Fees

Next, let’s talk about money. Nobody likes paying extra fees, especially for small transactions. That’s why digital payment platforms with low transaction fees are winning.

When sending or receiving money is cheap, more people and small businesses will use the service. Low fees also help small businesses join the online economy.

So, if you’re trying to choose the right digital payment solution, always check how much it costs per transaction.

Cross-Border Capabilities

Africa is full of trade between countries. That’s why digital payment solutions that work across borders are very useful.

Some platforms let people send money in local currencies without needing to change to dollars or euros. This helps save time and money. Also, it supports trade between African countries.

Cross-border payments are important for growing African economies and connecting businesses beyond one country.

Partnerships with Local Banks and Telcos

Another reason digital payments are growing is because they work together with banks and mobile network providers. These partnerships are very important.

Banks provide safe places for money to go, and mobile networks help people in rural areas use these services. When payment platforms team up with both, they reach more people and build more trust.

This also helps to better integrate digital payments with African banking systems, so more people have access to financial services.

Strong Regulatory Compliance

Finally, trust matters a lot. People need to feel their money and personal data are safe. That’s why strong security and following government rules are very important.

Platforms that follow the rules help reduce fraud and protect users. In countries where there are clear rules for digital payments, adoption grows faster.

So, a secure and well-regulated platform helps people feel safe and builds long-term success.

Lessons Learned and Best Practices of Digital Payments Solutions

Digital payment solutions are changing the way people in Africa pay for goods and services. All over Africa, more people are now using their phones or cards to send and receive money. These tools are helping many join the formal economy and grow their businesses. But for these systems to work well, certain things must be done right. Let’s look at the lessons and best practices that help digital payments succeed across Africa.

Building Trust Through Security and Transparency

To start with, trust is very important. People must feel safe when using digital payment solutions. If users are afraid their money will disappear, they won’t use the system. That’s why strong security and clear records are key.

For example, trusted platforms keep every transaction visible so users can check their money at any time. Also, if anything goes wrong, there should be a quick and easy way to fix the problem. This kind of honesty and support helps more people feel comfortable using digital payments.

In fact, it plays a big part in the role of digital payments in financial inclusion by giving more people safe ways to manage their money.

Adapting to Local Market Needs

Next, what works in one place may not work in another. Every market is different. This is why the best digital payment solutions take time to understand local needs.

For example, some cities have fast-moving markets, while rural areas may have fewer banks and internet connections. In busy trading places, speed is important. In villages, using simple phones might be the only way to make payments. So, it’s important to create systems that match how people live and work in each location.

Also, when providers integrate digital payments with African banking systems and mobile networks, they make it easier for people to send, receive, and store money.

Importance of Strategic Partnerships

Now let’s talk about teamwork. One payment company cannot do everything on its own. That’s why strong partnerships matter. These include working with banks, mobile operators, small shops, and even government offices.

Together, they can reach more people, fix technical problems, and make payments faster. Working with trusted partners also builds confidence among users. Partnerships are one of the best ways to overcome the challenges facing digital payments in Africa such as poor internet and hard-to-follow rules. By joining forces, they help promote the use of digital payments across the continent.

Continuous Innovation and Scalability

Of course, technology is always changing. So, digital payment solutions must keep improving too. This means adding new features, updating software, and finding better ways to serve both small and large businesses.

For example, new tools like QR codes and contactless cards make it easier for people to pay quickly and safely. Some platforms even help big companies manage payments in many countries at once. When these systems can grow to serve more people without slowing down, they help support the role of digital payments in African e-commerce growth.

Also, by listening to users and testing new ideas, providers can make sure their services stay useful as things change.

Frequently Asked Questions (FAQs)

1. What makes digital payment solutions successful in Africa?

Successful digital payment solutions are easy to use, secure, and accessible even in areas with limited internet. They often integrate well with local banking systems and mobile money platforms.

2. How do digital payments support financial inclusion?

They provide access to financial services for people without traditional bank accounts, helping more Africans participate in the economy.

3. How do digital payments boost African e-commerce?

By enabling quick, secure online transactions, digital payments increase trust and convenience for buyers and sellers.

4. What challenges do digital payment solutions face in Africa?

Challenges include network reliability, fraud concerns, regulatory hurdles, and limited financial literacy.

5. How can digital payments adoption be promoted?

To encourage more people to use digital payments, businesses and governments must educate users. They should also improve the internet and offer rewards to both buyers and sellers. These steps are key in learning how to promote digital payments adoption.

Conclusion

Digital payment solutions are changing how people across Africa send and receive money. They bring more people into the financial system and help online shopping grow faster. That is why the role of digital payments in financial inclusion and African e-commerce growth matters so much today.

Even though there are some challenges facing digital payments in Africa, the future still looks bright. As more businesses understand how to choose the right digital payment solution and how to integrate digital payments with African banking systems, things will get better.

To speed things up, we must also focus on how to promote digital payments adoption across cities, towns, and rural areas. This will create more jobs, grow businesses, and build stronger economies. Africa is ready, and digital payments can lead the way.