Introduction

Investing in the stock market can be a lucrative venture, but it’s not without its risks. One of the most crucial factors that can influence your success as an African or international stock investor is asset allocation. In this comprehensive guide, we’ll break down the complexities of asset allocation in your investment portfolio into simple terms, empowering you to make informed investment decisions.

Asset Allocation Basics

What is Asset Allocation?

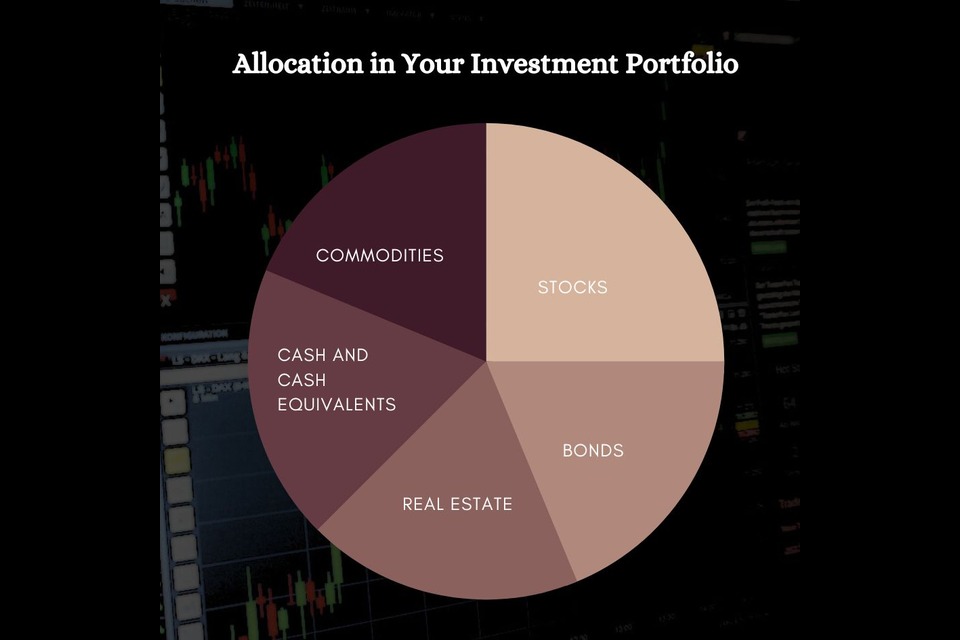

Asset allocation is the process of strategically distributing your investments across different asset classes, such as stocks, bonds, real estate, cash equivalents, and commodities. Think of it as diversifying your investment eggs into various baskets, each with its unique characteristics and potential.

Why is Asset Allocation Important?

Asset allocation is not just a fancy term; it’s a fundamental principle of prudent investing. Here’s why it’s crucial:

1. Risk Mitigation: Diversifying your investments across different asset classes helps minimize risk. While high-risk, high-reward investments like stocks can offer significant returns, they can also be volatile. On the other hand, low-risk options like bonds provide stability but might offer lower returns. Asset allocation in your investment portfolio enables you to strike a balance between these extremes, reducing the impact of market volatility on your portfolio.

2. Optimal Returns: Asset allocation isn’t solely about risk reduction. It’s also about optimizing your returns. By carefully allocating your assets, you aim to achieve the best possible returns within your risk tolerance. It’s like navigating the investment waters with a compass, adjusting your course to reach your financial goals.

3. Tailored Investment Strategy: Asset allocation is highly personalized. It considers factors like your financial goals, risk tolerance, and time horizon. This means that your asset allocation in your investment portfolio will be unique to you and aligned with what you want to achieve. It’s not a one-size-fits-all approach; it’s a strategy tailored to your needs.

Asset Classes Overview

Before we delve deeper into the complexity of asset allocation, let’s take a closer look at the key asset classes you’ll encounter in your investment journey:

Stocks

Stocks represent ownership in companies. They are the engines of growth in your portfolio, offering the potential for high returns. However, they come with a trade-off – higher volatility. Stock prices can fluctuate dramatically, making them a high-risk, high-reward asset.

Bonds

Bonds, on the other hand, are like the steady anchors in your portfolio. They are debt securities issued by governments or corporations, providing a predictable stream of steady income through interest payments. Bonds are generally considered safer than stocks and provide a fixed interest rate, making them an essential component of a well-balanced portfolio.

Real Estate

Real estate investments encompass physical properties like homes, commercial spaces, and real estate investment trusts (REITs). They offer a blend of income and appreciation potential. Real estate can add diversification to your portfolio and provide a hedge against inflation.

Cash and Cash Equivalents

Cash and cash equivalents include assets like savings accounts and short-term investments. They offer liquidity and stability. While they may not yield significant returns, they play a crucial role in capital preservation and are handy for immediate financial needs.

Commodities

Commodities are tangible resources like gold, oil, and agricultural products. They can provide diversification and act as a hedge against economic uncertainties. Investors often include commodities in their portfolios to spread risk.

Each of these asset classes carries its own set of risk and return characteristics. To master asset allocation, you need to understand these traits and blend them strategically to meet your investment objectives.

The Role of Asset Allocation in Your Investment Portfolio

Asset allocation in your investment portfolio isn’t just a passive act of spreading your investments; it’s the captain of your investment ship. It determines the course of your portfolio, steering it towards your financial destination. The allocation you choose should be your well-thought-out plan, considering:

1. Goals: Your financial objectives, whether it’s long-term wealth accumulation, retirement investing, or funding your child’s education.

2. Risk Tolerance: Your comfort level with risk. Are you willing to tolerate market ups and downs for potentially higher returns, or do you prefer a more conservative approach?

3. Time Horizon: The length of time you plan to invest. Longer time horizons often allow for more aggressive asset allocation strategies, while shorter horizons may require a more conservative approach.

Understanding Risk and Return Allocation in Your Investment Portfolio

In the dynamic world of investments, risk and return are like two sides of a coin. They are completely linked, and as an investor, you must master the art of balancing these two critical factors.

Risk and Return Relationship: It’s essential to recognize that investments that offer the potential for higher returns also come with higher levels of risk. For instance, stocks are known for their potential to deliver substantial returns over time. However, they are equally notorious for their volatility. Stock prices can soar to dizzying heights but can also drop unexpectedly.

Balancing Act: To achieve your financial goals, you must strike a careful balance between risk and return. This is where asset allocation takes center stage. Asset allocation allows you to design a portfolio that aligns with your risk tolerance while maximizing your potential for returns.

Diversification: One of the key strategies in risk management is diversification. By spreading your investments across various asset classes, you can reduce the impact of a poor-performing asset on your overall portfolio. For instance, if stocks take a hit, the stability of bonds can help cushion the blow.

Correlation and Covariance

Understanding the complex dance between different assets in your portfolio is crucial for effective asset allocation. Two essential concepts in this regard are correlation and covariance.

Correlation: This metric quantifies how two assets move in relation to each other. A correlation of +1 implies a perfect positive correlation, meaning they move in the same direction. A correlation of -1 signifies a perfect negative correlation, indicating they move in opposite directions. A correlation close to 0 implies little to no relationship.

Covariance: Covariance measures how the returns of two assets vary together. A positive covariance indicates that the assets tend to move in the same direction, while a negative covariance suggests they move in opposite directions.

Diversification Effect: The beauty of understanding correlation and covariance lies in the diversification effect. When you combine assets with low correlation or negative covariance, you create a portfolio that’s less prone to wild swings. This diversification helps reduce overall risk.

Strategic Asset Allocation

Strategic asset allocation is your long-term game plan. It’s similar to setting the route on a lengthy ship cruise. This approach involves carefully planning and deciding on target allocations for different asset classes based on your unique financial goals and risk tolerance.

Long-Term Vision: With strategic allocation, you’re not concerned with short-term market fluctuations. Instead, you focus on your long-term financial objectives. For instance, if your goal is to build substantial wealth over several decades, you might allocate a significant portion of your portfolio to stocks for their growth potential.

Discipline is Key: Maintaining your chosen allocation over time requires discipline. Market trends and economic conditions may tempt you to deviate from your plan, but sticking to your strategic asset allocation can help you stay on course toward your financial destination.

Tactical Asset Allocation

Tactical asset allocation, on the other hand, involves making short-term adjustments to your portfolio based on changing market conditions and economic factors. Think of it as maneuvering your ship to navigate temporary storms.

Adaptability: Tactical allocation allows you to adapt to short-term market opportunities and threats. For example, if you anticipate an upcoming economic downturn, you might reduce your exposure to stocks and increase your bond holdings to protect your capital.

Active Management: This approach requires a more active management style. You need to keep a vigilant eye on market developments and be ready to reallocate your assets swiftly when necessary.

Considerations for Different Life Stages

Early Career

In the early stages of your career, you’re like a financial sprinter, racing toward your long-term goals. Here, your asset allocation should reflect your quest for growth and wealth accumulation.

Asset Allocation Strategy: Consider leaning towards growth assets like stocks. They have the potential for substantial returns over the long term, and you have time on your side to ride out market fluctuations.

Risk Tolerance: With a longer investment horizon, you can afford to take on more risk. Stocks may be volatile, but they offer the potential for significant rewards.

Diversification: While growth is essential, don’t put all your eggs in one basket. Diversify across various sectors and industries to spread risk.

Midlife

As responsibilities and financial commitments grow, your investment strategy should evolve to reflect these changes.

Asset Allocation Strategy: A balanced approach is often prudent. This means mixing stocks and bonds in your portfolio. Stocks can continue to drive growth, while bonds provide stability and a source of regular income.

Risk Tolerance: Your risk tolerance might start to shift. You may become more risk-averse as you have more to protect. A balanced allocation helps manage risk while pursuing growth.

Diversification: Diversification remains crucial. It helps ensure that your portfolio isn’t overly reliant on a single asset class.

Retirement

Retirement is the culmination of your financial journey. It’s time to transition from the accumulation phase to the preservation and distribution phase.

Asset Allocation Strategy: At this stage, you’re focused on capital preservation and generating retirement income. This often involves a more conservative approach with a higher allocation to bonds and income-producing assets.

Risk Tolerance: Your risk tolerance may continue to decrease. Preserving your nest egg becomes a top priority.

Diversification: Diversification is essential, even in retirement. It helps manage risk and provides a hedge against unexpected market downturns.

Impact of Market Conditions on Asset Allocation

Bull Markets

During bull markets, when stock prices are rising and optimism prevails, it’s tempting to let your allocation drift. However, staying disciplined is essential.

Rebalancing: Rebalancing your portfolio is crucial to maintain your desired allocation. Sell some of your overperforming assets and reallocate to those that have lagged behind. This helps lock in gains and ensures your portfolio doesn’t become too heavily skewed toward a single asset class.

Bear Markets

In contrast, during bear markets, when stocks are in decline and fear grips the market, your asset allocation might be tested.

Stay the Course: It’s crucial to stay disciplined and avoid making impulsive decisions. Don’t abandon your long-term strategy due to short-term market turbulence. Stick to your strategic asset allocation plan and view market downturns as opportunities to rebalance and buy assets at lower prices.

Monitoring and Reviewing Asset Allocation

Regularly reviewing your portfolio is similar to conducting routine maintenance on your financial ship. It ensures that you stay on course toward your financial goals.

Frequency: How often you review your portfolio may depend on your specific circumstances and preferences. Some investors opt for annual reviews, while others monitor more frequently.

Adjustments: When you review your portfolio, assess whether it’s still aligned with your goals and risk tolerance. If not, make adjustments. This may involve rebalancing or reallocating assets.

Professional Guidance: Consider consulting with a financial advisor during your reviews. They can provide expertise and insights to help you make informed decisions.

Frequently Asked Questions (FAQs)

1. What is the ideal asset allocation for a beginner investor?

For beginners, a balanced allocation with a mix of stocks and bonds is often recommended to manage risk while seeking growth.

2. Can asset allocation protect my investments during market crashes?

Yes, a well-structured asset allocation in your investment portfolio can help reduce the impact of market crashes by spreading risk across different assets.

3. How do I choose the right mix of asset classes for my goals?

Consider your investment goals, time horizon, and risk tolerance. Younger investors with longer horizons may lean toward more stocks, while those near retirement may favor bonds for stability.

4. What are some common mistakes to avoid in asset allocation?

Avoid over-concentration in a single asset class and regularly rebalance your portfolio to maintain your chosen allocation.

5. How often should I rebalance my portfolio?

Rebalancing should occur periodically, typically once a year or when your portfolio drifts significantly from your target allocation.

Conclusion

In conclusion, asset allocation in your investment portfolio is not a one-size-fits-all approach; it’s a dynamic strategy that evolves with your life stages and adapts to changing market conditions. As a stock trader, paying attention to these considerations and being disciplined in your approach is key to achieving your financial goals and navigating the ever-shifting landscape of the financial markets.