- Introduction

- Asset Allocation Techniques

- Sector and Industry Diversification: Expanding Horizons

- Global Reach: Geographic Diversification

- Diversification Beyond Traditional Assets

- Crafting Your Portfolio Diversification Strategy

- Case Studies in Maximizing Returns

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

In the fast-changing world of stock investing, one goal stays the same—maximizing returns. But, getting there takes more than just luck. It takes a smart plan. You need to manage risk. You need to make informed choices. And most of all, you need balance.

That’s where portfolio diversification comes in. It’s a time-tested method that helps you aim for strong returns while keeping risk under control. By spreading your investments across different assets, sectors, and regions, you reduce the impact of sudden market swings.

So, while the market may rise and fall, your portfolio stays steady—and ready for growth.

The Art of Maximizing Returns:

Investing in the stock market can feel like navigating uncharted waters, especially for beginners. Imagine it as a grand adventure, where the treasures you seek are higher returns on your investments. But, like any adventure, there’s an element of risk. Understanding this risk-return dynamic is crucial.

At its core, the potential for higher returns usually means facing higher risks. Imagine climbing a mountain for a breathtaking view; the higher you go, the more challenging the climb becomes. Similarly, aiming for those lofty returns might expose you to more significant market fluctuations. This is where the magic of diversification comes into play.

Diversification: Your Shield in the Storm:

Diversification might sound complex, but it’s like having a shield to protect you from unexpected rain on your adventure. It involves spreading your investments across different types of assets. You divide your investments among various options instead of placing all your resources in one company or industry. This way, if one investment faces challenges, others might thrive, helping to balance out potential losses and gains. This can come into play in bear and bull market conditions.

Think of it as having different types of boats for different weather conditions. One boat might struggle if the sea gets rough, but another designed for choppy waters could sail through. Diversification helps you avoid putting all your hopes in a single boat.

Asset Allocation Techniques

Let’s talk about something that sounds complex but really isn’t: asset allocation. Think of it like a map for your money. It helps you figure out where to put your money so you get the best possible results.

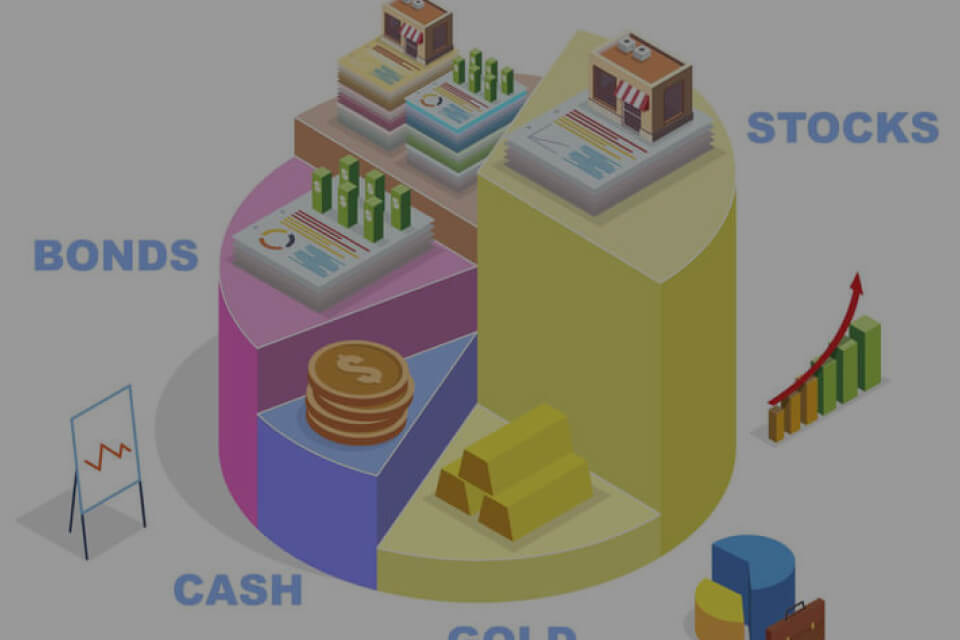

Now, your money can go into different types of assets. These are things like stocks, bonds, alternative investments, and cash. Each one plays a different role.

For example, stocks can offer big rewards. But at the same time, they can jump up and down a lot. That makes them a bit risky. On the other hand, bonds are usually steadier. They don’t earn as much, but they can help keep your portfolio balanced.

Then, there are alternative investments. These can be things like real estate or commodities. They add variety, which can sometimes protect your money when markets get rough. And of course, there’s cash. It’s safe and easy to access, but it doesn’t grow much over time.

So, why mix these? Because just like a puzzle, each piece needs to fit. When you mix them the right way, they work better together.

This mix depends on your goals and how much risk you’re okay with. That’s why asset allocation matters so much.

It’s not about picking the “best” investment. Instead, it’s about finding the right balance.

Balancing the Scales:

Picture yourself walking on a rope. On one side, there’s the excitement of reaching your money goals. On the other, there’s the chance of losing some of your investment.

Asset allocation is what helps you stay balanced on that rope. It’s about choosing where to put your money. And how much to put into each type of investment. That way, you can move forward without tipping too far one way.

For example, if you’re okay with a little risk, you might put more into dividend-paying stocks. These can swing up and down, but they also offer higher returns. But if you prefer a steadier path, you might go for something like an ETF fund. It’s usually less risky and more stable.

So, what’s the secret? It’s all about balance.

You pick a mix that fits you. Then, over time, you check in. You adjust things. Just like a rope walker shifts their weight to stay steady, you rebalance your investments as the market changes.

That way, your plan stays on track.

Sector and Industry Diversification: Expanding Horizons

Imagine you’re on a treasure hunt. But instead of looking for one big prize, you’re collecting small gems hidden all over a wide landscape.

This is what sector diversification is all about. It’s like having a map that takes you to different parts of the stock market. These parts are called sectors—like technology, healthcare, finance, and more.

Each sector is different. You can think of them like plants in a garden. Each one grows best under different conditions. Some need sun. Others prefer shade. So, when you invest in several sectors, you’re not counting on just one to do well. If one has a rough patch, the others might still grow strong.

For example, if tech stocks drop, healthcare or energy might go up. That way, your overall portfolio stays healthier.

Think of it like planting different vegetables. If one crop fails, the others may still give you a good harvest.

So, sector diversification helps spread out risk. It’s one way to keep your investment garden growing, even when some parts face tough weather.

Global Reach: Geographic Diversification

Now, picture your investment journey taking you across the globe. Just like traveling opens your mind, investing globally can open up new financial opportunities. This is called geographic diversification.

It means spreading your investments beyond your home country. And yes, it’s a smart way to reduce risk.

Think of it like holding passports to different economies. If one place runs into trouble, another might still be doing well. That way, your money isn’t stuck in one spot.

For example, if your local market takes a dip, your investments in Europe, Asia, or other parts of the world might help balance things out.

It’s kind of like having shelters in different places. When one area has a storm, you still have safety elsewhere.

So, by looking beyond borders, you give your portfolio more chances to grow. And at the same time, you protect it from local ups and downs.

Diversification Beyond Traditional Assets

Adding variety beyond traditional assets is like bringing a little adventure to your investment journey.

Think of yourself as a collector. Maybe you already have coins and paintings. But now, you’re curious about rare gemstones. In the same way, alternative investments bring something new to your portfolio.

For example, cryptocurrencies can be exciting. They don’t follow the same rules as regular markets. So, they might bring unique returns—but also come with more risk.

Then there’s real estate and commodities. These are like new lands waiting to be explored. They often move differently than stocks and bonds. That means they can help balance your portfolio when markets shift.

However, just like you wouldn’t buy a rare gem without learning about it, the same goes for these kinds of assets. They require research. And they call for a good understanding.

So, if you’re open to learning and ready to explore, diversifying beyond traditional assets could bring exciting new growth to your investment mix.

Crafting Your Portfolio Diversification Strategy

Think of building your diversification strategy like planning a great expedition.

It’s also a bit like creating a piece of art. You choose the colors, patterns, and shapes that reflect your personal style. In the same way, your strategy brings together different investments that match your goals and comfort level.

Everyone has a different approach. Just like artists have their own styles, investors have their own needs.

Start with your risk tolerance. This is your comfort zone. Some people enjoy fast-paced adventures. Others prefer a slower, safer route.

Next, think about your investment timeline. Are you saving for something soon? Or are you in it for the long haul?

Then, look at your financial goals. These are your destinations. Knowing where you want to go helps you plan the right path.

Your strategy will use ideas from different areas. For example, asset allocation helps you choose the right mix of stocks, bonds, and other assets.

Sector diversification brings in different investment sectors as parts of the economy—like adding spices to a meal.

Geographic diversification adds flavor from around the world. It helps your portfolio stay strong, even if one area struggles.

Also, always take time to research each investment. Look closely at the company, the industry, and the sector.

You can use tools like Yahoo Finance or stock screeners to check history, trends, and other important data.

So, take your time. Mix wisely. And shape a strategy that fits you.

Case Studies in Maximizing Returns

Imagine you’re at a gathering of the top businessmen in your country. You meet with these wise men and listen to their success stories.

Case studies are just like these stories. They show real-life examples of how diversification can protect and grow your investments.

Now, picture this: an investor faces a sudden market crash. But they’re ready. Their portfolio includes different sectors and countries. So, while one area takes a hit, others stay strong.

Because of this smart mix, they lose less and recover faster once the market calms down.

Then there’s another story. A tech-savvy investor spreads their money between technology and healthcare. While other sectors struggle, these two keep moving forward. Thanks to smart sector choices, their investments stay steady even when the market shakes.

These aren’t just fun stories. They are evidences that diversification really works.

They’re like a compass in your investing journey—helping you make better choices as you go.

So, by learning from real examples, you gain the tools to handle your stock investment journey along with its ups and downs with more confidence.

Frequently Asked Questions (FAQs)

1. Why is portfolio diversification important for stock investors?

Portfolio diversification reduces risk by spreading investments across various assets, enhancing the potential for consistent returns.

2. How does geographic diversification impact my portfolio?

Geographic diversification minimizes exposure to localized market risks, offering a chance for higher returns through global exposure.

3. What role does asset allocation play in portfolio diversification?

Asset allocation involves distributing investments across different asset classes and optimizing returns while managing risk.

4. Can I diversify my portfolio beyond stocks and bonds?

Absolutely. Exploring assets like real estate and cryptocurrencies introduces diversification into unconventional areas.

5. Is there a ‘one-size-fits-all’ diversification strategy?

Diversification strategies should be personalized to align with individual risk tolerance and financial goals.

Conclusion

In the world of stock investing, diversification stands out as a steady guide. It’s more than just a tactic. It’s a proven approach that helps you grow your money while also protecting it from big surprises. For years, investors have used diversification to manage risk and increase returns. And it still works today.

As you start or continue your investing journey, keep this in mind—diversification is not just a method. It’s a mindset. It helps you stay steady when markets shift. And at the same time, it opens the door to real growth.