- Introduction

- The Basics of Financial Statements

- The Balance Sheet: Understanding a Company's Financial Position

- The Income Statement: Assessing a Company's Profitability

- The Cash Flow Statement: Understanding a Company's Cash Flows

- Decoding Financial Statements Analysis Techniques

- Limitations and Challenges of Financial Statement Analysis

- Tools and Resources for Financial Statement Analysis: Your Competitive Edge

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

In the fast-moving world of stock investing, one skill clearly sets experienced investors apart from beginners: the ability to read and understand financial statements. For investors, this isn’t just a useful tool—it’s the key to uncovering the real story behind a company’s financial health.

In this article, we’ll guide you step by step through the world of financial statement analysis. Along the way, you’ll learn practical strategies for breaking down complex reports, spotting red flags, and using financial data to make smarter investment choices. By building this core skill, you’ll be better prepared to navigate the market with clarity and confidence.

The Basics of Financial Statements

Financial statements give investors a clear and organized view of a company’s financial health. These reports are essential. Why? Because they show key details about how a business is doing. In fact, many investors rely on them when deciding whether to buy, hold, or sell a company’s stock.

So, it’s no surprise that financial statements are a big part of fundamental analysis. You can think of them as report cards for a business. They help answer important questions. For example, is the company making money? Is it managing debt well? And is there enough cash coming in to keep the business running?

At the center of this analysis are three main financial statements. First, there’s the Balance Sheet. It shows what the company owns and what it owes at a certain point in time. Next, we have the Income Statement. This one shows how much money the company brings in and how much it spends over a period of time. Lastly, there’s the Cash Flow Statement. This report shows how money moves in and out of the company.

Each statement tells a different part of the story. But when you look at all three together, you get the full picture. You’ll see how the company is performing. You’ll understand its financial health. And you’ll be able to judge its long-term potential. So, if you’re thinking about investing, start here. These financial statements offer real, useful insights into how the business is run—and whether it’s built for long-term growth.

Now, let’s take a closer look at the three main types of financial statements.

The Balance Sheet: Understanding a Company’s Financial Position

We’ll begin our journey with the Balance Sheet—one of the most essential financial statements you’ll come across. It shows a company’s financial position at a specific point in time. Think of it like a snapshot, capturing exactly where the business stands financially, just as checking your bank balance gives you a quick view of your own finances.

The balance sheet gets its name because it always has to balance. In fact, it compares what the company owns to what it owes. To make this easier to understand, it’s divided into three main parts:

Assets

First, assets are everything the company owns. These include things like property, tools, inventory, equipment, and cash in the bank. Simply put, assets are the resources the business uses to operate and grow.

Liabilities

Next, liabilities are what the company owes. This can include loans, unpaid bills, or other debts. Just like you might have a mortgage or credit card balance, companies carry financial obligations that must be paid over time.

Equity

Finally, equity is what remains for the owners after all liabilities are paid off. In other words, it’s the company’s net worth. You find equity by subtracting total liabilities from total assets.

Why Does This Matter?

Reading a balance sheet is like lifting the hood on a car—you get a clear look at what’s really happening inside. So, if the company has more assets than liabilities, that’s usually a good sign. It means the business is on solid financial ground. On the other hand, if liabilities exceed assets, that could point to financial trouble or weak management.

Therefore, understanding the balance sheet is a vital first step in evaluating any company. It shows whether a business is building value over time—or potentially heading in the wrong direction.

The Income Statement: Assessing a Company’s Profitability

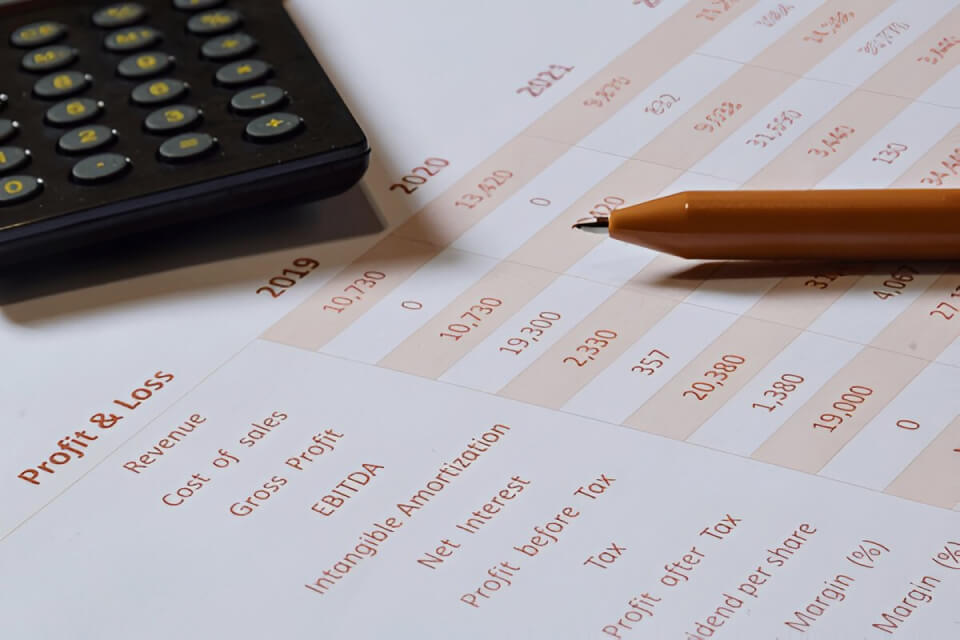

Next, let’s take a closer look at the Income Statement, also known as the Profit and Loss Statement. This report acts like a financial report card for a business. It shows how much money the company earned, how much it spent, and whether it ended the period with a profit or a loss. Most often, this covers a quarter or a full year.

Simply put, the income statement tells the story of a company’s ability to generate earnings over time. It’s structured to reveal performance step by step:

- Revenue

This is the total amount of money the company earns from selling its products or services. You may also hear it referred to as “sales” or “top-line revenue.” It’s always the first line because everything starts with income. - Expenses

Next are the costs. These represent the everyday expenses required to run the business. They include wages, rent, utilities, raw materials, and marketing. The goal is to manage these costs wisely—so revenue outpaces expenses. - Net Income

Finally, we reach the bottom line. Net income is what’s left after subtracting all expenses from revenue. If the number is positive, the company made a profit. If it’s negative, the company reported a loss.

So, why does this matter to investors?

Because steady profits are often a sign of a well-managed, financially healthy business. It shows the company not only knows how to earn revenue but also how to control its costs. On the flip side, if a company reports frequent losses—especially growing ones—that may signal deeper problems.

By studying the income statement, you can see whether the company is financially moving forward or falling behind. And when you combine it with the balance sheet, you gain a much deeper understanding of how the business is really performing.

The Cash Flow Statement: Understanding a Company’s Cash Flows

The Cash Flow Statement is one of the most important financial reports a company creates. In many ways, it works like a company’s bank statement. It shows where the cash comes from, where it goes, and how well it’s being managed. This is key because, even if a business looks profitable on paper, poor cash management can still cause big financial problems.

So, let’s break down the three key parts of the cash flow statement:

- Operating Activities

First, this section shows the cash the company earns—or spends—from its main business. This includes selling products or providing services. It helps you see if the business brings in enough money to cover its daily costs. In short, it shows if the company’s core operations are self-sustaining. If this number is regularly positive, that’s usually a good sign.

- Investing Activities

Next, we move on to investing activities. This part shows how the company is using its money to grow. For example, it might include buying new equipment, purchasing property, or making other long-term investments. While this can lower cash in the short term, these moves are often made to build future strength.

- Financing Activities

Finally, we get to financing activities. This section shows how the company raises money and how it uses that money. It includes borrowing, paying off debt, issuing stock, or buying back shares. It gives you a look at how the business funds its growth—and how it gives value back to its investors.

Why It Matters

When you look at a cash flow statement, you’re really checking the company’s liquidity. In other words, can it meet short-term bills and keep things running? Strong cash flow usually means the company can handle tough times and still invest in growth. So, for investors and analysts, this report gives powerful insight—far beyond what profits alone can show.

Decoding Financial Statements Analysis Techniques

With the basics in your arsenal, it’s time to dive into the heart of financial statement analysis. The true magic happens when you start applying various analysis techniques.

Ratio Analysis: The Investor’s Power Tool

Ratio analysis works like a magnifying glass for investors. In fact, it helps you take a closer look at a company’s financial health by turning large sets of data into clear, easy-to-understand numbers. By using different financial ratios, you can better understand how a business is really doing—beyond just what the income statement or balance sheet shows.

Moreover, instead of simply looking at financial reports as a whole, ratio analysis lets you focus on specific areas—such as profitability, efficiency, or the amount of debt the company carries. As a result, it becomes much easier to spot trends, identify strengths, or catch warning signs early—before making any investment decisions.

So, now let’s break down the most important types of financial ratios every investor should know:

Liquidity Ratios

Think of liquidity ratios like checking how quickly you can turn a jar of coins into cash. In business, these ratios work the same way. They show how easily a company can access cash to pay its short-term bills. In other words, they help answer the question: Can the company pay its bills on time without scrambling for money?

Understanding liquidity is very important. After all, even profitable companies can get into trouble if they can’t cover daily expenses. That’s why investors and analysts focus on two key liquidity ratios: the current ratio and the quick ratio.

Current Ratio

First, the current ratio compares a company’s current assets—like cash, accounts receivable, and short-term investments—to its current liabilities, such as unpaid bills and short-term loans. So, this ratio gives a broad view of whether the company can cover what it owes soon. As a result, it is often the first place people look when checking short-term financial health.

Quick Ratio

Next, the quick ratio, also called the acid-test ratio, goes a step further. While it also compares assets to liabilities, it leaves out inventory. That’s because inventory usually takes longer to turn into cash. Therefore, the quick ratio gives a sharper, more focused look at liquidity by only counting the most liquid assets.

By looking at both ratios together, you get a clearer picture of how well a company can handle sudden financial pressure. For investors, this insight is crucial—especially when markets are uncertain.

Profitability Ratios

Profitability ratios help answer one of the biggest questions in investing: Is the company actually making money? After all, investors want to know if a business is turning its operations into real profits. To figure that out, they rely on a few important profitability ratios.

Gross Profit Margin

First, the Gross Profit Margin shows how much money the company keeps after paying for the cost of goods sold. In other words, it reveals how efficiently the company makes or sells its products. A higher margin means there’s more room to cover other expenses—and still earn a profit. So, this ratio often gives an early sign of strong financial health.

Net Profit Margin

Next, the Net Profit Margin shows what’s left after all costs are taken out. This includes operating costs, interest payments, and taxes. Because it covers everything, it gives a complete picture of how profitable the company really is. As a result, it helps investors decide if the business can stay healthy over the long run.

Solvency Ratios

Solvency ratios help measure a company’s long-term financial health. Put simply, they show if the business can handle its long-term debt without running into trouble. These ratios are key for understanding how likely a company is to survive over time.

Debt to Equity Ratio

To start, the Debt to Equity Ratio compares how much money the company gets from debt versus equity. In other words, it shows how much the company depends on borrowed money. A higher ratio means the business relies more on debt. So, that could point to more risk—especially during tough economic times.

Interest Coverage Ratio

Next, the Interest Coverage Ratio checks if the company can pay interest on its debt. It looks at earnings and asks, “Are they high enough to cover interest payments?” The higher this number, the better. That’s because it means the company is in a stronger spot to meet its debt payments without stress.

Efficiency Ratios

Efficiency ratios work like a performance check-up for a company’s operations. They help you see if the business is using its assets in a smart way to generate revenue. Simply put, these ratios show how well a company turns resources into results.

Inventory Turnover Ratio

To begin with, the Inventory Turnover Ratio tells you how quickly a company sells its inventory. So, the faster the turnover, the better the inventory is managed. As a result, a high ratio usually means strong product demand and solid control over operations.

Accounts Receivable Turnover

Next, the Accounts Receivable Turnover shows how fast the company collects money from its customers. Since quicker collections boost cash flow, a higher turnover often points to strong financial discipline. It also suggests the company is managing its working capital well.

Limitations and Challenges of Financial Statement Analysis

While financial statement analysis is a powerful tool, it’s not a crystal ball. It can give you valuable insights, but it won’t predict every twist or turn in a company’s future. That’s why it’s so important to understand its limits and be aware of a few key challenges.

Assumptions and Estimates

To begin with, financial statements often rely on management’s assumptions and estimates. Sometimes these are fair and realistic. But other times, they can be too optimistic—or simply wrong.

External Factors

Next, it’s important to consider outside influences. A company’s performance can shift due to changes in the economy, the industry, or even new laws and regulations. These outside factors often affect results in ways that the numbers alone may not show.

Limited Historical Data

In some cases, the company is new or hasn’t been around long. That means there may not be enough past data to spot trends or judge long-term strength. So, analysis becomes more difficult.

Qualitative Data

Also, keep in mind that financial analysis is based on numbers. But success doesn’t always come down to just figures. Things like strong leadership, company culture, and brand image can play a big role—even if they don’t show up on a balance sheet.

Comparative Analysis

Lastly, ratio analysis only works well when you have good comparisons. If there are no clear industry benchmarks, it’s harder to judge if a company’s numbers are strong or weak. Without context, the data loses meaning.

In short, ratio analysis is helpful, but it’s just one part of the picture. The financial world is full of moving parts. So, to make smart investment decisions, you need to look beyond the numbers and consider the bigger picture.

Tools and Resources for Financial Statement Analysis: Your Competitive Edge

Financial statement analysis can be a complex task, but it becomes significantly more manageable with the right tools and resources. These are like the instruments and guides that help you navigate the intricate world of finance. They make your analysis more efficient and accurate, giving you a competitive edge in the world of investing.

Software Tools

Imagine building a house—you wouldn’t want to do it all with your bare hands. Likewise, financial analysis becomes much easier when you use specialized software. These tools help you process and analyze large amounts of financial data efficiently, so you don’t get lost in endless spreadsheets.

Example 1: Microsoft Excel

First, Microsoft Excel is one of the most widely used tools for financial analysis. Thanks to its powerful built-in functions, you can quickly calculate ratios and build detailed financial models. In this way, it acts like your reliable toolbox, ready to support all your numerical analysis needs.

Example 2: Bloomberg Terminal

On the other hand, for deeper, more sophisticated analysis, many professional investors turn to Bloomberg Terminal. It delivers real-time financial data, news, and advanced analytics—all in one place. Essentially, it’s like having a dedicated financial research assistant working alongside you, providing up-to-the-minute insights whenever you need them.

Databases

Databases are like treasure chests packed with valuable financial information. They store years of data on thousands of companies, which makes it much easier to track performance, compare results, and spot trends over time.

Example 1: Morningstar

To begin with, Morningstar is a trusted and widely used resource. It offers a deep pool of financial data, including stock quotes, investment research, and mutual fund analysis. Not only that, but it also provides helpful tools for comparing companies and analyzing performance. In many ways, it acts like your own financial library—filled with insights across a wide range of investments.

Example 2: SEC EDGAR Database

Next, there’s the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) database. This platform is a must for serious investors. It gives you direct access to official financial filings from all publicly traded companies. So, if you’re looking for reports like 10-Ks, 10-Qs, or annual statements, this is the place to go. Think of it as a digital filing cabinet—organized, official, and always available.

Example 3: Yahoo Finance and Google Finance

Finally, platforms like Yahoo Finance and Google Finance are great for quick access to financial data. These tools offer snapshots of company performance, real-time stock quotes, and historical data all in one spot. As a result, they’re ideal for staying up to date with the market while also reviewing long-term trends. Plus, their easy-to-use interfaces make them perfect for both beginners and experienced investors alike.

Educational Materials

Learning how to analyze financial statements can feel overwhelming at first. However, the right educational materials work like a guidebook. They break down complex ideas step by step. They also give you clear explanations, real-world examples, and proven strategies to help you learn more easily.

Example 1: The Intelligent Investor by Benjamin Graham

To start, The Intelligent Investor is often called a must-read in the world of value investing. This classic book explains the basics of financial analysis in a simple way. It also shows you how to find undervalued stocks with confidence. In many ways, it’s like having a trusted mentor guide you through the fundamentals.

So, by using the right tools and resources, you can make learning financial analysis much easier. Just like a builder needs strong tools to build a sturdy home, investors need trusted resources to build a strong portfolio. That’s why smart tools, quality databases, and well-written learning materials matter so much. With the right support, you’ll be ready to handle the complex world of finance—and make smarter investment choices as you go.

Frequently Asked Questions (FAQs)

1. What are some key liquidity ratios to consider in financial statement analysis?

Key liquidity ratios include the current ratio and the quick ratio, which assess a company’s short-term financial health.

2. How can financial statement analysis tools make my investment process more efficient?

Financial statement analysis tools like Microsoft Excel and Bloomberg Terminal can streamline data processing and provide real-time analytics, saving time and improving accuracy.

3. Are there any red flags in financial statements that signal potential financial trouble for a company?

Some red flags might include inconsistent or declining revenue, excessive debt, frequent changes in accounting methods, or aggressive earnings management.

4. Can you provide examples of solvency ratios used in financial statement analysis?

Solvency ratios include the debt-to-equity ratio and the interest coverage ratio, which assess a company’s long-term financial stability.

5. What is the DuPont Analysis and how does it differ from other financial analysis methods?

The DuPont Analysis is a financial ratio-based method that dissects return on equity (ROE) into three components: profitability, efficiency, and leverage. It provides a more detailed understanding of what drives a company’s ROE compared to traditional methods.

Conclusion

In conclusion, decoding financial statements is a key skill in fundamental analysis. Not only does it help investors understand a company’s numbers, but it also gives them the confidence to navigate the stock market with greater clarity. Throughout this guide, we’ve walked step by step through the basics. First, we looked at the structure of financial statements. Then, we dug deeper into the balance sheet, income statement, and cash flow statement. Along the way, we also explored key analysis methods, discussed the limits of financial data, and introduced valuable tools to support your progress.

As you move forward on your investing journey, it’s important to remember that mastering financial statements takes time. After all, this isn’t a skill you pick up in a day. Instead, it builds slowly—through practice, experience, and real-world application. The more often you read and interpret financial data, the sharper your analysis will become.

So, continue to use what you’ve learned. And, just as important, keep applying it to your investment decisions. Stay curious. Keep reading actual financial reports. Compare companies. Test your insights. Over time, you’ll start noticing patterns. You’ll spot red flags faster. And you’ll feel more confident in your decisions. In the end, financial statements hold valuable insights—and now, you’re well on your way to making the most of them.