Introduction

Have you ever wondered why financial markets follow a predictable rhythm, almost like a natural cycle? The Elliott Wave Theory (EWT) might be the key to understanding this intriguing phenomenon. This revolutionary framework, developed by Ralph Nelson Elliott in the 1930s, exposes the underlying psychology and collective behavior driving market trends.

In identifying repetitive patterns, EWT provides traders and analysts a powerful tool to forecast market movements more accurately. In this article, we’ll break down the core principles of Elliott Wave Theory, demonstrate its application in real-world market analysis, and explore its continued relevance in today’s fast-paced trading environment. Get ready to elevate your market insights and stay ahead of the curve with EWT!

Introduction to Elliott Wave Theory

Overview of Elliott Wave Theory (EWT)

Elliott Wave Theory (EWT) is a sophisticated method of technical analysis that proposes market prices move in repetitive and predictable patterns, known as waves, which are intricately linked to the underlying psychology of investors. Ralph Nelson Elliott developed it; this theory suggests that these waves reflect collective behavior and sentiment within the market, oscillating between phases of optimism and pessimism. The wave patterns are categorized into two types: impulse waves, which move toward the prevailing trend, and corrective waves, which work against the trend.

By carefully analyzing these waves, traders and analysts can gain deeper insights and anticipate future market movements with greater precision, making EWT an invaluable tool for forecasting price trends and improving trading strategies.

The Significance of Market Psychology in Price Movements

The significance of market psychology in price movements cannot be overstated, as it forms the foundation for interpreting and predicting market trends. Market psychology refers to investors’ collective emotions, behaviors, and attitudes that drive buying and selling decisions. These psychological factors, such as fear, greed, optimism, and pessimism, create identifiable wave patterns within the market. By analyzing these patterns, traders can gain insights into the underlying sentiment and potential future movements. Recognizing the role of market psychology allows for a deeper understanding of why prices move the way they do, making it an essential component of practical market analysis.

Importance of Understanding Price Patterns in Technical Analysis

Understanding price patterns is paramount in technical analysis, as these patterns serve as a blueprint for predicting future market movements. By studying historical price patterns, traders can identify recurring trends and potential reversal points, allowing them to make informed trading decisions. These patterns provide valuable insights into market behavior, enabling traders to anticipate price changes and manage risks effectively. Mastering price patterns is essential for anyone looking to succeed in the financial markets.

Historical Context: Ralph Nelson Elliott and the Origins of the Theory

Ralph Nelson Elliott introduced the Elliott Wave Theory (EWT) in the 1930s after observing that financial markets move in repetitive patterns, which he believed were driven primarily by investors’ collective psychology and sentiment. Elliott proposed that these patterns, or “waves,” reflected the natural ebb and flow of market optimism and pessimism. His theory revolutionized technical analysis by suggesting that market prices are not random but instead follow a predictable rhythm.

Foundations of Elliott Wave Theory

Core Principles of EWT

EWT is based on several core principles:

- Wave Cycles: In the Elliott Wave Theory, market movements are understood to occur in repeating cycles. These cycles reflect the natural rhythm of investor behavior, driven by alternating waves of optimism and pessimism. According to the theory, one can anticipate future price movements and trends within the financial markets by analyzing these wave cycles.

- Fractal Nature of Markets: As explained in the Elliott Wave Theory, the fractal nature of markets reveals that waves exist within more giant waves. Each wave pattern is part of a broader trend, with smaller waves unfolding. These nested wave structures allow for analyzing market movements across different timeframes, from short-term fluctuations to long-term trends.

- 5-3 Wave Pattern Structure: The 5-3 wave pattern structure, central to Elliott Wave Theory, consists of five impulse waves followed by three corrective waves. The five impulse waves move toward the overall trend, while the three corrective waves counter it. This structure helps analysts identify the primary trend and anticipate potential market reversals, making it a vital tool for technical analysis.

The Concept of Wave Cycles in Market Movements

Wave cycles in market movements are crucial for understanding how stock investments behave over time. Markets naturally move in cycles of optimism and pessimism, forming distinct wave patterns that can be analyzed to predict future price movements. These cycles, as outlined in the Elliott Wave Theory, reflect the collective psychology of investors. Recognizing these wave patterns allows investors to make more informed decisions about their stock investments, potentially improving their returns.

Fractal Nature of Markets: Waves Within Waves

The fractal nature of markets highlights that market waves are not just isolated events but are part of a repeating pattern at various scales. In the Elliott Wave Theory, this means that within any given wave, smaller waves are present, and these, in turn, contain even smaller waves. This “waves within waves” structure allows for detailed analysis across different timeframes, revealing market movements’ complex and interconnected nature and providing valuable insights for traders and investors.

The 5-3 Wave Pattern Structure

- Impulse Waves (5-Wave Structure): Impulse waves are potent movements that follow the overall trend, consisting of a five-wave structure. These waves are essential in identifying the direction and strength of market trends.

- Corrective Waves (3-Wave Structure): Corrective waves are movements that go against the prevailing trend, usually unfolding in a three-wave structure. These waves are essential in adjusting or correcting the market’s previous impulse waves.

- Detailed Explanation of Wave Labelling (1-2-3-4-5, A-B-C): In wave labeling, each wave is systematically marked as 1-2-3-4-5 for impulse waves and A-B-C for corrective waves. This method is crucial for traders and analysts, as it helps identify and track each wave’s position within the overall market cycle, making it easier to predict future market movements.

The Role of Fibonacci Ratios in EWT

- Fibonacci Sequence and Its Relevance to Wave Theory

The Fibonacci sequence plays a significant role in Elliott Wave Theory by helping identify potential support and resistance levels within wave patterns. Fibonacci ratios, such as 23.6%, 38.2%, and 61.8%, are used to forecast price retracements and extensions, providing valuable insights for stock investments. Applying these ratios, traders can better predict market reversals and establish more informed strategies for buying and selling stocks.

- Applying Fibonacci Retracement and Extension Levels to Identify Wave Targets

Traders use Fibonacci retracement and extension levels to project wave targets and reversals, offering crucial insights into potential market movements. Analyzing these levels, traders can identify key support and resistance areas within wave patterns. Fibonacci retracement helps pinpoint where a market might reverse after a trend, while extension levels forecast potential price targets beyond the current wave. Applying these tools enhances decision-making and improves the accuracy of trading strategies.

The Psychological Basis of Elliott Wave Theory

- Market Sentiment and Behavioral Patterns

Investor sentiment drives wave formations, with optimism and pessimism influencing market movements significantly. When investor sentiment is optimistic, markets typically experience upward trends, leading to the formation of impulse waves. Conversely, corrective waves often emerge when pessimism dominates as markets move downward. These behavioral patterns reflect the collective psychology of market participants, shaping the waves observed in Elliott Wave Theory and offering valuable insights into future price movements.

- How Collective Investor Psychology Drives Wave Formations

Market psychology is reflected in the wave patterns seen in Elliott Wave Theory (EWT). These patterns are shaped by the collective emotions of investors, where optimism leads to upward waves, and pessimism results in downward waves. Understanding this psychological influence helps traders predict market movements and identify potential opportunities and risks.

Herding Behavior and Its Impact on Waves

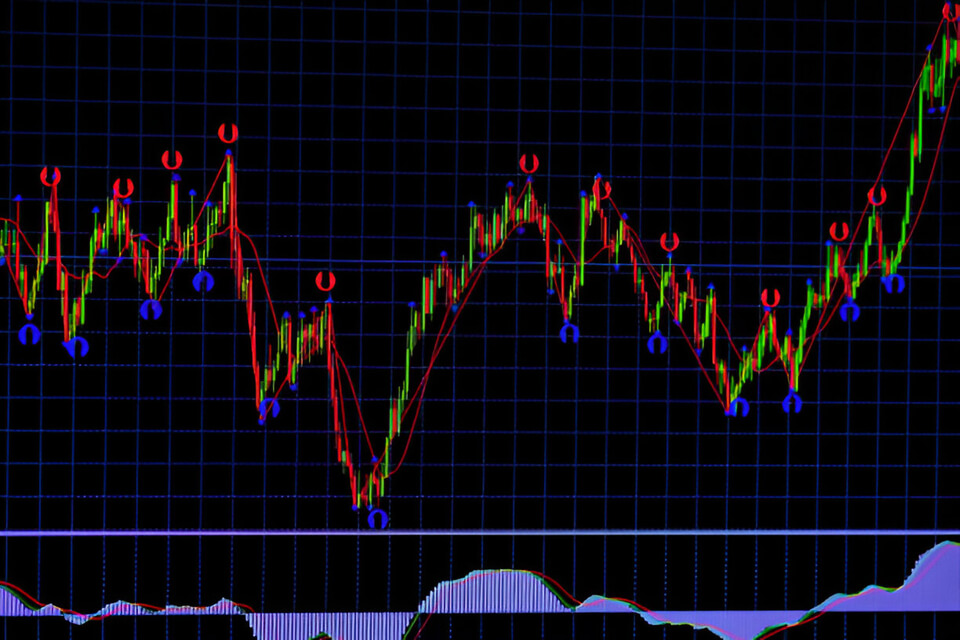

- Understanding Crowd Psychology in the Context of EWT: Crowd behavior significantly influences wave patterns in Elliott Wave Theory (EWT), often leading to predictable trends. As collective emotions shift between optimism and pessimism, these patterns help forecast market movements.

- The Self-Fulfilling Nature of Wave Patterns Due to Market Participants’ Actions: Market participants’ actions can reinforce wave patterns, creating self-fulfilling prophecies. As traders anticipate specific trends, their collective actions often drive the market, further solidifying these expected wave formations.

Emotions and Market Cycles

- Greed and Fear as Primary Drivers of Market Waves: Greed and fear are vital emotions driving the cycles of market waves. These powerful forces influence investor behavior, creating patterns of buying and selling that shape market trends, which can be analyzed using the Elliott Wave Theory to forecast future movements.

- How Psychological Phases Correspond to Different Wave Formations: Psychological phases align with specific wave formations in the Elliott Wave structure, where optimism drives impulse waves, and fear triggers corrective waves. This correlation helps traders understand market sentiment and predict potential reversals, making it a crucial aspect of technical analysis.

The Impulse Waves: Detailed Analysis

Characteristics of Impulse Waves

Impulse waves are characterized by solid and directional movements that follow a 5-wave structure.

- Identification of Motive Waves in a Trend: Motive waves are the driving force behind significant market trends, characterized by solid movements in the direction of the overall trend. Identifying these waves helps traders understand the market’s primary direction and make informed trading decisions.

- Key Features of Each Wave Within the 5-Wave Structure: Each wave within the 5-Wave structure has distinct characteristics and roles. Waves 1, 3, and 5 are impulse waves driving the trend, while waves 2 and 4 are corrective waves that adjust the previous movements, shaping the overall trend.

Rules and Guidelines for Impulse Waves

- Wave 2 Cannot Retrace Beyond the Start of Wave 1: Wave 2 should not retrace past the beginning of Wave 1, as this would invalidate the typical Elliott Wave structure. This rule ensures that the corrective phase of Wave 2 remains within acceptable limits, preserving the integrity of the impulse sequence.

- Wave 3 Is Never the Shortest: Wave 3 is typically the longest impulse wave and never the shortest among the five waves in an Elliott Wave sequence. This rule helps confirm the strength and direction of the trend, ensuring Wave 3 aligns with the overall market movement.

- Wave 4 Does Not Overlap the Price Territory of Wave 1: Wave 4 should not overlap the price range of Wave 1, as this would disrupt the Elliott Wave structure. This rule maintains the clarity of the impulse sequence and ensures Wave 4 remains distinct from Wave 1’s price territory.

Extensions and Truncations in Impulse Waves

- Understanding Extended Waves: When One of the Impulse Waves Is Longer Than Usual.

Extended waves occur when one impulse wave extends beyond typical proportions, as Elliott’s Wave Theory describes. In this scenario, stock prices experience a more significant movement than usual, reflecting heightened market momentum and potentially leading to extended trends.

- Truncated Fifth Waves: When Wave 5 Fails to Exceed the End of Wave 3

Truncated fifth waves occur when Wave 5 does not surpass the end of Wave 3, resulting in an incomplete trend. This anomaly in Elliott Wave Theory indicates that the expected market movement falls short, signaling potential weaknesses or early reversals in the trend.

The Corrective Waves: Patterns and Structures

Understanding Corrective Waves

Corrective waves are counter-trend movements that follow a 3-wave structure, typically labeled A-B-C in Elliott Wave Theory. These waves adjust the previous impulse trend, with Wave A initiating the correction, Wave B retracing, and Wave C completing the correction.

- The 3-Wave Structure (A-B-C) and Its Variations

Since corrective waves typically follow an A-B-C structure with variations, where Wave A starts the correction, Wave B retraces part of Wave A, and Wave C completes the correction. Variations include zigzags, flats, and triangles, each with distinct patterns and characteristics.

Common Corrective Patterns

- Zigzag Corrections (5-3-5 Structure): Zigzag corrections consist of a 5-3-5 pattern, where Wave A has five sub-waves, Wave B has three sub-waves, and Wave C completes the correction with five sub-waves, forming a sharp, directional movement.

- Flat Corrections (3-3-5 Structure): Flat corrections follow a 3-3-5 pattern, with Wave A and Wave B each having three sub-waves, while Wave C has five sub-waves. This pattern typically forms a more horizontal, sideways correction.

- Triangles and Their Subtypes (Contracting, Expanding, Running): Triangles can be contracting, expanding, or running, each with unique characteristics. Contracting triangles have converging trendlines, expanding triangles feature diverging trendlines, and running triangles have a more dynamic structure with a consistent trend.

Complex Corrections and Combinations

- Double and Triple Corrections: Combining Basic Corrective Patterns

Complex corrections combine multiple basic patterns, such as zigzags and flats, to create double or triple corrections. These intricate wave formations involve two or three distinct corrective patterns, leading to more complex market adjustments.

- Identifying Complex Wave Formations in Real-World Charts

Traders use complex corrections to analyze advanced wave structures in real-world charts. They gain insights into intricate market movements and potential future trends by identifying patterns like double and triple corrections.

Applying Elliott Wave Theory in Market Analysis

Practical Steps for Elliott Wave Analysis

- Identifying the Starting Point of Wave Counts: Determining the starting point is essential for accurate wave analysis, as it sets the foundation for the entire wave count. Identifying this initial point correctly ensures that subsequent waves are counted and interpreted accurately, improving the reliability of market predictions.

- Labeling Waves and Validating Them Against EWT Rules: Proper labeling and validation against EWT rules are crucial for practical analysis. Accurate wave labeling ensures consistency with Elliott Wave Theory principles, while validation against established rules helps confirm wave patterns’ validity and improves market forecasts’ accuracy.

Using EWT to Forecast Market Movements

- Projecting Future Price Targets Based on Wave Counts: Elliott Wave Theory (EWT) helps forecast future price movements by analyzing wave counts. By examining the structure and patterns of waves, traders can project potential price targets and market trends.

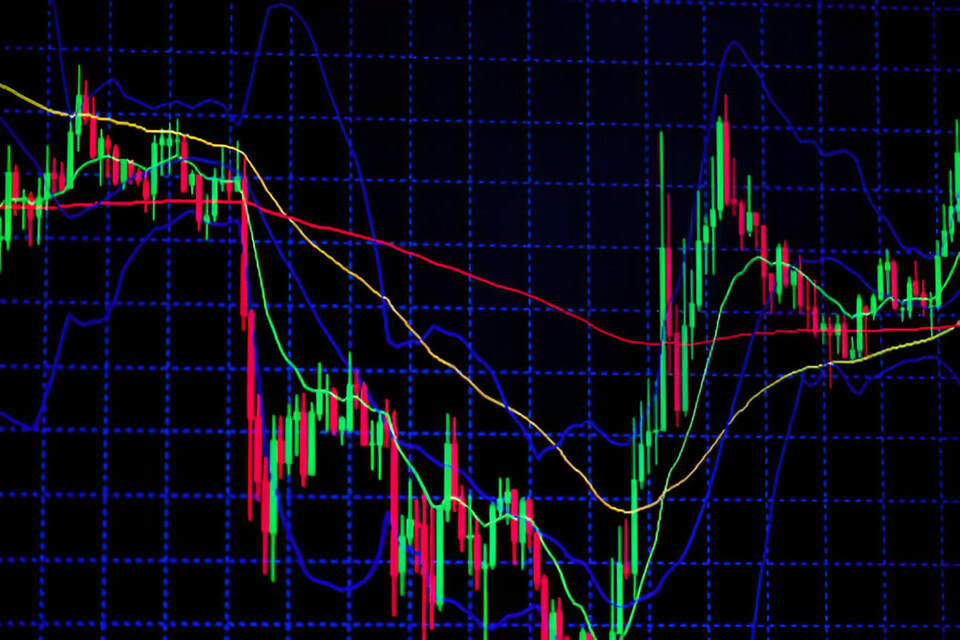

- Combining EWT with Other Technical Analysis Tools: Elliott Wave Theory (EWT) can be used alongside other tools, such as trendlines and oscillators, for enhanced analysis. Combining these methods provides a more comprehensive view and improves the accuracy of market predictions.

Case Studies and Real-World Examples

- Historical Examples of Accurate EWT Predictions

A notable example of Elliott Wave Theory (EWT) predicting market movements occurred during the 2008 financial crisis. Renowned analyst Robert Prechter accurately anticipated the market crash by analyzing wave patterns. He identified a major Elliott Wave cycle where the market was in a fifth wave of a larger downtrend. This analysis suggested a significant decline was imminent. As predicted, the market experienced a severe downturn, validating EWT’s effectiveness. Prechter’s insights, published in his book “Conquer the Crash,” showcased EWT’s ability to forecast major financial events, reinforcing its relevance in technical analysis and investment strategies.

- Analyzing Current Market Conditions Using EWT

Analyzing current market conditions using Elliott Wave Theory (EWT) involves identifying wave patterns to forecast future trends. For instance, in early 2020, EWT analysts examined the COVID-19 market reaction. They observed a sharp decline, interpreted as a fifth wave in a broader corrective pattern. Applying EWT, analysts predicted a potential rebound, forecasting a new uptrend following the initial wave. By mid-2020, markets indeed recovered, aligning with the predicted wave structure. This case demonstrates how EWT can effectively apply to current market conditions, helping traders anticipate and react to market movements based on wave patterns.

Challenges and Criticisms of Elliott Wave Theory

Common Criticisms of EWT

- Subjectivity in Wave Counting and Labelling: Subjectivity can affect the accuracy of wave counting and labeling in Elliott Wave Theory. Analysts may interpret wave patterns differently, leading to varied conclusions and potential inconsistencies in market predictions.

- The Complexity of Applying EWT Consistently: Applying Elliott Wave Theory (EWT) consistently can be challenging due to its complexity. Interpreting wave patterns requires a deep understanding of market psychology and precise analysis, which can lead to varied results among analysts.

Addressing the Limitations of EWT

- How to Mitigate the Subjectivity in Wave Interpretation: Mitigating subjectivity involves using additional analysis tools, and confirmation signals alongside Elliott Wave Theory. Incorporating trendlines, indicators, and volume analysis helps validate wave counts and reduce personal bias in interpretations.

- The Importance of Complementary Analysis and Confirmation Signals: Complementary analysis helps validate Elliott Wave Theory (EWT) predictions and improves accuracy by incorporating additional tools such as trendlines, indicators, and volume analysis. This multi-faceted approach enhances reliability and confirms wave patterns.

The Debate: EWT as Art vs. Science

- Understanding the Interpretive Nature of EWT: Elliott Wave Theory (EWT) involves a degree of interpretation, blending art and science. Analysts must balance objective rules with subjective judgment to identify and validate wave patterns. This approach requires a deep understanding of market psychology, where personal insights and adherence to established principles play crucial roles.

- Balancing Rigid Rules with Flexible Application: Finding a balance between rigid rules and flexible application is vital to effectively using Elliott Wave Theory (EWT). While adhering to established wave patterns and principles is essential, adapting to market nuances and variations is equally important. This balance enhances accuracy and helps analysts navigate complex market conditions effectively.

Advanced Concepts in Elliott Wave Theory

Fibonacci Extensions and Projections

- Advanced Techniques for Calculating Wave Targets: Using advanced Fibonacci techniques to project wave targets involves applying Fibonacci retracement and extension levels. These methods help identify potential support, resistance, and target levels, enhancing wave analysis and forecasting precision.

- Applying Fibonacci Time Zones for Time-Based Analysis: Fibonacci time zones can be used for time-based market analysis by identifying potential reversal points in stock prices. They help forecast significant dates for trend changes, enhancing the timing of entry and exit strategies. This approach is helpful for stock investments, improving overall investment decisions.

Elliott Wave Oscillator and Indicators

- Introduction to Indicators Designed to Support EWT Analysis: Indicators like the Elliott Wave Oscillator aid in analyzing wave patterns by measuring momentum and confirming wave counts. These tools provide additional insights into market trends, helping traders validate Elliott Wave Theory predictions and enhance their analysis with precise, actionable data.

- How to Use These Tools to Confirm Wave Counts: Using indicators to confirm wave counts and enhance analysis involves applying tools like the Elliott Wave Oscillator and Relative Strength Index (RSI). These indicators confirm wave patterns, validate wave counts, and offer additional insights into market trends and momentum.

Elliott Wave and Market Cycles

- Integrating EWT with Broader Market Cycle Theories: Combining Elliott Wave Theory (EWT) with broader market cycle theories, such as Kondratiev waves, provides a comprehensive market analysis. Integrating these approaches helps to understand long-term economic cycles and enhances predictions by aligning EWT patterns with broader economic trends.

- Understanding the Interplay Between Long-Term Cycles and Shorter Wave Patterns: Analyzing how long-term cycles interact with shorter wave patterns in Elliott Wave Theory (EWT) involves understanding the relationship between extended economic cycles and shorter-term market fluctuations. This interplay provides a holistic view, enhancing predictions and refining wave pattern analysis for better market insights.

The Future of Elliott Wave Theory

The Evolution of EWT in Modern Markets

- How AI and Machine Learning Are Integrated with EWT: AI and machine learning are increasingly integrated with Elliott Wave Theory (EWT) to enhance advanced market analysis. These technologies automate wave identification, improve pattern recognition, and refine predictions by analyzing vast market data. By combining EWT with AI-driven tools, traders and analysts can achieve more accurate and efficient forecasting of market trends.

- The Impact of Algorithmic Trading on Wave Patterns: Algorithmic trading significantly impacts wave patterns and their analysis in Elliott Wave Theory (EWT). As algorithms execute trades at high speeds based on pre-set criteria, they can alter traditional wave formations, creating more complex and less predictable patterns. This shift challenges analysts to adapt their strategies, accounting for the influence of algorithmic activity on market behavior and wave structure.

EWT in Different Market Conditions

- Application of EWT in Various Asset Classes: Elliott Wave Theory (EWT) can be applied across various asset classes, including stocks, forex, and cryptocurrencies. By analyzing wave patterns, traders gain insights into market trends and potential reversals. This versatile tool helps forecast price movements and make informed decisions, regardless of the asset class traded.

- Adapting EWT for Volatile and Less Liquid Markets: Adapting Elliott Wave Theory (EWT) for volatile or less liquid markets requires adjustments in technique. In high-volatility markets, traders may use shorter timeframes to refine wave counts. In contrast, broader wave patterns can help accommodate irregular price movements in low-liquidity markets and provide more reliable trend insights.

The Continuing Relevance of EWT

- Why EWT Remains a Valuable Tool for Technical Analysts and Traders: EWT continues to be a valuable tool due to its ability to capture market psychology and predict price movements. By analyzing wave patterns that reflect investor sentiment, technical analysts and traders can make informed decisions, improving their chances of success in various markets.

- Future Trends and Potential Developments in Wave Theory Analysis: Exploring potential developments in wave theory and its applications involves integrating advanced technology and data analytics. As markets evolve, artificial intelligence and machine learning could enhance wave theory analysis, making predictions more accurate and adaptive. This evolution may lead to new strategies and insights for traders and investors.

Frequently Asked Questions (FAQs)

1. What is Elliott Wave Theory?

Elliott Wave Theory analyzes market price movements based on patterns driven by investor psychology.

2. How can Fibonacci ratios be applied in Elliott Wave Theory?

Fibonacci ratios help identify potential support and resistance levels within wave patterns.

3. What are the main characteristics of impulse waves?

Impulse waves are five moving toward the trend, each exhibiting specific characteristics and rules.

4. What are some common criticisms of Elliott Wave Theory?

Common criticisms include the subjectivity in wave counting and the complexity of applying EWT consistently.

5. How can Elliott Wave Theory be integrated with other technical analysis tools?

EWT can be combined with tools like trendlines, oscillators, and Fibonacci levels to enhance market analysis and forecasting.

Conclusion

Elliott Wave Theory (EWT) offers a profound understanding of market psychology and price patterns, empowering traders and analysts to forecast market movements more accurately. By recognizing waves’ repetitive and predictable nature, EWT provides a valuable tool for navigating complex financial markets.

As explored in this article, EWT’s principles and applications continue to evolve, incorporating advanced technologies and data analytics. Embracing EWT’s insights can significantly enhance trading strategies and investment decisions. Whether you’re a seasoned analyst or an aspiring trader, Elliott Wave Theory’s timeless wisdom and adaptability ensure its relevance in today’s fast-paced markets. By mastering EWT, you’ll unlock a deeper understanding of market dynamics, positioning yourself for success in the ever-changing world of finance.

2 thoughts on “Elliott Wave Theory: A Deep Dive into Market Psychology and Powerful Price Patterns”

Fantastic goods from you, man. I have keep in mind your stuff previous to and you are just extremely wonderful. I actually like what you’ve obtained here, certainly like what you are stating and the best way by which you say it. You’re making it entertaining and you continue to care for to keep it smart. I can’t wait to learn far more from you. That is actually a great site.

Lovely just what I was looking for.Thanks to the author for taking his time on this one.