- Introduction

- Introduction to Millennial Investors

- Importance of Technology and Digital Platforms in Investment Decisions

- Tech-Centric Investment Strategies

- Investing in Technology Stocks

- Risk Management and Financial Planning

- Future Trends in Tech-Driven Investing

- How Millennials Can Prepare for Future Tech Innovations in Investing

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

As a millennial, have you ever considered investing in stock but felt unsure where to start odir which strategies to use? Or do you wonder how to merge your digital-savvy nature with traditional investment methods? Investing in today’s market offers many opportunities, especially for tech-savvy millennials in a digital world. Let’s explore how you can use digital skills and tools at your fingertips to make informed investment decisions and navigate the stock market. Discover how investing for millennials in a tech-driven world works.

Introduction to Millennial Investors

Millennials refer to a generation of people born between 1981 and 1996. Millennial investors are becoming a driving force in the world of stock investing. They have a unique approach to investing by combining technology with traditional investment strategies. Their use of digital tools, knowledge of industry trends, and conventional investment plans position them as drivers in the financial market. They can be called the “tech-savvy newbies” of the stock market.

Characteristics of Millennial Investors

Millennials have preferences and characteristics that reflect in how they handle investments:

Technology knowledge: As a result of growing up in the digital age, an average millennial can handle basic technological tools. Millennials access online marketplaces, mobile apps, robo-advisors, etc., to make investment plans and decisions. Their reliance on technology influences them.

Flexibility: Millennials are attracted to flexible investment plans and easy access, hence their interest in ETFs, cryptocurrencies, fractional shares, and other flexible investment options.

Value-driven: Many millennials are interested in long-term investments, especially because of their long time horizon. They also prefer to invest in companies that align with their values, such as those that pay attention to environmental, social, and governance issues (ESG)

Risk takers: Millennials are usually more inclined to take calculated risks, especially in new sectors like tech start-ups and renewable energy, where they see a potential future. They typically go beyond the conventional investment plans.

Reasons why Stock Market Investing is essential for Millennials.

Investing in the stock market allows millennials to build wealth and achieve financial independence. Conventional jobs may be challenging because of the political and economic stability; nonetheless, millennials can succeed financially by making domestic and foreign investments. Africans living abroad can invest with ease both domestically and abroad. Their investment portfolio’s diversification would assist them in lowering the risks associated with investing.

Millennials worldwide can now invest in international financial markets because technology has facilitated better access to stock markets. Thanks to digital platforms and apps, investing with little money has never been easier. Technology use has promoted financial literacy because millennials may now access online stock market programs and instructors.

They can pick up on market trends and investment techniques. Millennials who invest can plan for the future and gain short-term returns. Millennials’ understanding of technology and inventions allows them to revolutionize the stock market. They can both contribute to and profit from economic expansion.

Importance of Technology and Digital Platforms in Investment Decisions

Technology has completely transformed the world we live in. No sector or business has succumbed to the easier and faster life of the digital age, including stock market investing. Technology is a modern tool that has given individual and institutional investors the tools needed to make informed market decisions quickly and efficiently. Technology can access and analyze real-time data, monitor market trends, make transactions, and analyze gathered information. Incorporating technology has also made the stock market more accessible by offering numerous benefits such as automated surveillance, greater security, faster transactions, and transparency.

Trends in the Stock Market Influenced by Technology

1. Algorithmic Trading: Using computer algorithms to execute transactions based on predetermined criteria. These algorithms conduct high-speed market analysis that promotes market efficiency. In some situations, they can increase market volatility.

2. Robo–Advisors and Automated Investing: Robo-advisors are digital platforms providing automated, algorithm-driven financial and investment services without human input or supervision. You can give answers to surveys from the platform. It then uses the received answers to advise and automatically invests in you.

3. Blockchain and Cryptocurrencies: Millennials can explore the new investing options and access classes introduced by blockchain technology and cryptocurrency. Blockchain technology creates secure and transparent peer-to-peer transactions without negotiators and at no extra cost. Its transparency can potentially replace traditional financial systems and increase efficient transactions. Cryptocurrencies like Bitcoin and Ethereum use blockchain for transactions, creating pathways for digital investments and management. Cryptocurrencies have become well-known as speculative investments and alternative stores of value.

Impact of Digitalization on Investment Strategies and Opportunities

Strengthened Cybersecurity: Technological advancements have enhanced cybersecurity by providing a secure platform for stock market investing. It has led to sophisticated encryption methods, multi-factor authentication, and monitoring systems that help safeguard financial information and stop illegal access and cyber threats. This feature allows investors to preserve market integrity and have a safe trading platform. Cybersecurity helps to relax the mind of investors when trading.

Use of Online Trading Apps: Online trading apps provide news updates, analytical tools, market data, and suggested market strategies. The information obtained from these apps can influence investor strategy. The days of having to pay brokers and deal with the headache of organizing paperwork are long gone for investors. Physical meetings during transactions can be minimized with online trading apps. Another advantage of online trading apps is their global access to a wide range of investors and the ability to build a broad portfolio. With the help of these apps, millennials can become more active traders, increasing market involvement and improving the investment decision-making process.

Faster Transactions: Technology makes transactions and communication faster, fostering seamless trading. With the use of algorithms, trades are made at fast speeds. Technology gives investors access to much information via mobile apps and opens them to investment opportunities. Social media platforms provide investment news, trends and analysis. Technological platforms provide fast transactions, communication, and information, increasing the rate of investor participation and decision-making.

Accessibility: Digitisation has made it easier for investors to participate and access financial markets from anywhere. Millennial investors can, therefore, trade securities and increase their portfolio sizes without needing a third party. Easy accessibility has expanded market involvement, encouraging people to invest.

Tech-Centric Investment Strategies

Robo-Advisors and Automated Investing

Tech-centric investment strategies use the results from robo-advisors and automated investing platforms to make portfolio management efficient.

Robo-advisors use algorithms to suggest investment decisions and financial planning strategies based on the client’s financial goals, preferences and risk tolerance. They are cheaper than employing the services of a conventional financial advisor. This platform analyses data and recommends investment strategies according to market trends.

Automated Investing is a technology-based investment strategy that uses algorithms and mathematical models to invest for clients. It is a cost-effective option investment strategy, especially for tech-savvy millennial investors. To use this tool, investors must know their investment goals and ensure it is in sync with them. This tool extends beyond robo-advisors, as it includes AI-driven investment models.

These tools use algorithms to monitor market trends and offer the best investment decisions outside human errors or emotional biases. Their recommendations lean towards data-based decisions rather than emotion-based or guesswork. Millennial investors can use this tool to access investment opportunities.

Explanation of Robo-Advisors and Their Role in Portfolio Management

A robo-advisor is like an intelligent robot that helps people to invest their money. Imagine you want to expand your investment portfolio without knowing how to use it. Instead of spending much money on getting a financial advisor, you communicate your financial goals and risk tolerance to the digital platform. Robo-advisors would use its algorithm-based data to suggest your best investment plan. It also monitors your money to ensure it yields a high return over time. Robo-advisors are digital platforms providing automated, algorithm-driven financial planning services with little human supervision.

Features of Robo-Advisors:

1. Portfolio Management: Robo-advisors create a diversified investment portfolio based on the investor’s financial goals and risk tolerance.

2. Low Charges: Robo-advisors charge less than conventional financial advisors because they can function without human input or supervision.

3. Accessibility: Unlike humans, they are easy to use, navigate, and access without extra investment requirements or charges.

4. Portfolio review and Rebalancing: Robo-advisors constantly review the portfolio and automatically rebalance it to keep it diversified while maintaining the desired level of asset goals.

Role in Portfolio Management:

1. Personalized Investment Strategy: Robo-advisors pattern the asset allocation and investment plans according to the investor’s goals, time horizon and risk tolerance.

2. Real-time Monitoring: They monitor the investments, making necessary modifications to align the portfolio with the investors’ goals.

3. Budget-friendly: Robo-advisors charge less than the conventional market experts while offering more efficient portfolio management. They require low starting balances.

4. Simplicity: They curate and streamline the investment process, making it easier for investors to understand and engage with their assets.

5. Education: Many robo-advisors provide resources to help investors understand their investment strategies and choices. This way, the investors can be educated on how each investment strategy operates.

Robo-advisors make it easier for a broader range of people to access investment opportunities and grow their wealth.

Benefits and Considerations for Millennial Investors

Robo-advisors are very beneficial for millennial investors. Their benefits include:

1. They are easy to use and understand. They make investment decisions on your behalf without much input from you.

2. They have lower fees when compared to employing human advisors. They also have pocket-friendly starting charges.

3. They make algorithm-based decisions rather than emotion-biased ones, preventing wrong investment decisions.

Before deciding to place your entire investment portion in the hands of robo-advisors, you should consider the following:

1. They have limited personalization compared to human financial advisors, so they may not be efficient in catering to complex financial situations or specific goals. For example, real estate investments.

2. Investors who prefer a more hands-on form of investing might find it challenging to put their entire portfolio in the hands of a robo-advisor.

3. A robo-advisor with a good reputation and enhanced cyber security should be employed.

Ultimately, millennials just setting foot into the stock market can choose robo-advisors as a cost-effective option.

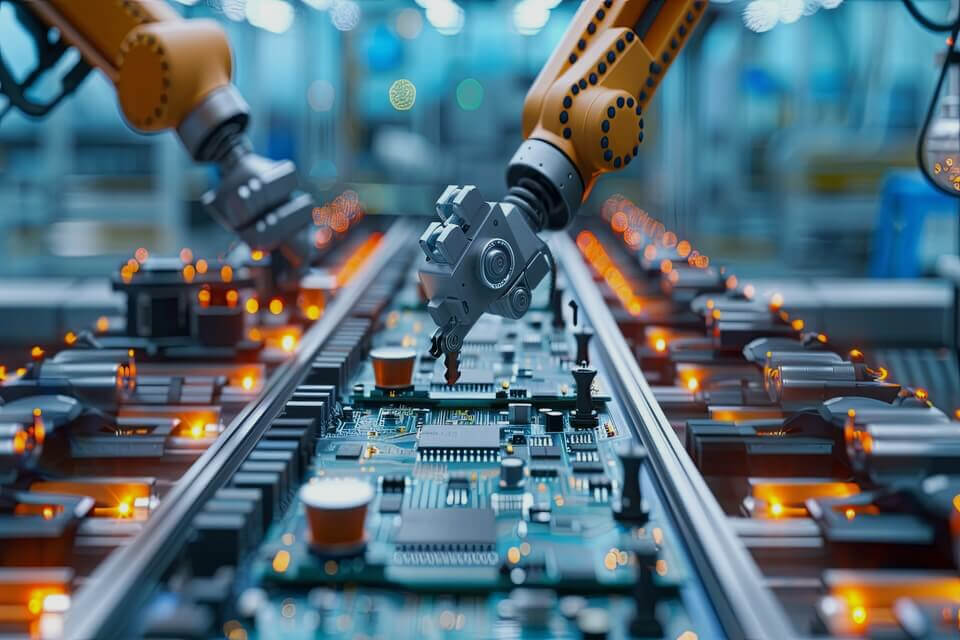

Investing in Technology Stocks

Technology is one of the fastest-growing sectors and a large investment opportunity for millennial investors. It is the largest and most rapidly evolving sector in the market. Investing in technology stocks can be highly rewarding, but it is best to understand the dynamics and strategies involved. Investors should expect to pump a lot of money into research, innovation, and development while gaining a steady income stream.

Understanding Tech Sector Dynamics

Investing in technology stocks focuses on key sectors like software, cloud computing, and artificial intelligence (AI).

Software: Businesses develop the systems and applications necessary for daily tasks and business operations on computers and mobile devices.

Cloud computing: Services that give enterprises scalability and cost-effectiveness via the Internet include software, data processing, and storage.

Artificial Intelligence (AI): is the technology that allows robots to mimic human intelligence. It is utilized for data analysis, automation, and process improvement.

Understanding these industries influences investment decisions in the tech sector by allowing investors to assess businesses based on their inventions, market demand, and competitive advantages.

Factors Driving Growth and Volatility

Innovation: New innovations drive growth as companies bring new products and services. When a tech firm has rapid technological advancement, it is bound to grow. However, rapid innovation can lead to market volatility as new products replace old ones faster.

Demand: Increasing demand for technology fuels the need for tech solutions. Increased demand would also improve companies’ stock prices.

Competition: While competition amongst tech companies can facilitate innovation and growth, unhealthy competition can lead to pricing issues and market volatility.

Diversification Strategies in Tech

This refers to balancing Risks Across Different Segments

Sector Diversification: Diversification of technical sectors (e.g., software, hardware) reduces the impact of fluctuations within specific industries by allowing investments to be spread across many sectors.

Company Size and Geography: It is essential to diversify risk further by including large-cap and small-cap tech stocks and global exposure to reduce the risk profile.

Geographic diversification: Invest in tech businesses across various geographies (such as North America, Africa, and Asia) to mitigate risks specific to those regions and capitalize on global innovation trends. Except in cases of a worldwide economic meltdown, Investing in multiple areas ensures that the strong economy will act as a buffer or hedge against weaker ones.

Importance of Sector Diversification within Tech-focused Portfolios

Risk Management: This limits the impact of a downturn affecting a particular sector by spreading investments across various tech sectors. This approach ensures that a decline in one area does not pull the entire portfolio down. Diversification helps investors cushion the blow of sector-specific downturns and maintain reasonable returns.

Opportunity Capture: Investors can capitalize on growth opportunities by investing in diverse segments. Spreading investments across various tech industries, like software, cloud computing, and AI, can help investors simultaneously benefit from market expansions in multiple areas.

These strategies are crucial in helping investors navigate the dynamic and volatile nature of the technology sector while benefiting from its growth prospects.

Risk Management and Financial Planning

Setting Investment Goals and Risk Tolerance

Making informed investing decisions that align with your long-term financial goals requires a clear understanding of your objectives and risk tolerance. Setting clear objectives for your investing helps you stay focused. It’s essential to evaluate your willingness to take on risk as well as the amount of time your investment portfolio can withstand market volatility. Creating these plans assists you in selecting the finest investment option and upholding a disciplined strategy to reach your financial objectives.

Importance of Defining Investment Objectives and Time Horizon

Defining investment objectives and time horizons is crucial because it gives direction and clarity to your financial plans. Objectives specify what you want to achieve through investing, such as planning for retirement, future projects, or wealth accumulation. This helps you decide where to allocate your money.

Your time horizon, whether short-term (less than 5 years), medium-term (5-10 years), or long-term (more than 10 years), determines your investment diversification, strategy, and risk tolerance. While shorter time horizons necessitate more cautious techniques to guard against transient market changes, longer time horizons provide more aggressive investing strategies. Combining both short-term and long-term investment is one of the ways of mitigating the risks that come with tech stocks.

Strategies for Managing Risk in Volatile Tech Sectors

Diversification: This is one of the most common strategies to reduce investment risks. Spreading investments across different tech sectors and asset classes to mitigate risks. It is like saying not to put all your eggs in one basket.

Asset Allocation: Investing in high-risk, high-reward assets (like equities) and lower-risk investments (like bonds) helps to reduce risks.

Stop–loss Orders: Setting sell points ahead to avoid losses resulting from a significant price decline.

Integrating these strategies will help millennial investors mitigate risks in volatile tech sectors.

Future Trends in Tech-Driven Investing

Emerging Technologies and Investment Opportunities

In this digital world that we live in, emerging technologies like Artificial Intelligence, Virtual Reality/Augmented Reliable, and the Internet of Things have taken over how investments work globally. These new innovations have transformed several industries and sectors, presenting opportunities for millennials to invest in the potential of these industries. Understanding these innovations’ functions and potential helps investors analyze and exploit industry trends. The earlier an investor adopts technology into his everyday business, the faster his participation in the world economy. These emerging technologies can potentially reconstruct several sectors and maximize investment opportunities.

Potential Impact of AI, VR/AR, and IoT on Investment Landscapes

Artificial Intelligence (AI): AI speeds up data analysis and reduces human and emotional trade biases. Its predictive features can impact sectors like healthcare, finance, and transportation. AI can also be used to predict market trends, give customized investment ideas, and enhance decision-making in the stock market.

Virtual Reality (VR) and Augmented Reality (AR): VR involves creating an interactive artificial world or experience, while AR displays digital information in reality, creating another version of the real world. These innovations have influenced the gaming, entertainment, and education industries while creating virtual experiences and collaboration. VR/AR offers ways for corporations to interact with their target audience.

Internet of Things (IoT): This refers to creating a network of physical objects embedded with sensors and connectivity to exchange data autonomously and in real time. The information obtained from these connected devices can influence decisions in healthcare, manufacturing, and investing.

How Millennials Can Prepare for Future Tech Innovations in Investing

Stay up-to-date: Staying informed with innovations would help investors know industry trends. It would also open up millennials to potential investment opportunities.

Education and Training: Millennials can go for formal and informal education on how technologies like AI, VR/AR, and IoT work. Investing in learning these skills would help millennials know how to apply them to their businesses.

Early Integration: In the fast-paced world we are in now, millennials should focus on how to take advantage of these technologies. This way, they can participate in investments early.

By embracing these technological advancements, millennials can capitalize on emerging investment opportunities.

Frequently Asked Questions (FAQs)

1. What are the best investment strategies for millennials in the tech-driven market?

Millennial investors can use strategies like diversification, using robo-advisors, and staying informed about emerging technologies like AI, and market trends

2. How can millennial investors manage risks in the volatile tech sector?

Risk management involves diversification, balancing high-risk and lower-risk investments, and using stop-loss orders.

3. What role do robo-advisors play in millennial investment strategies?

Robo-advisors offer automated, algorithm-driven, cost-effective investment strategies and portfolio management.

4. Which tech sectors should millennials consider for diversification?

Millennial investors can consider tech sectors such as software development, cloud computing services, and artificial intelligence (AI) for diversification

5. How can African millennials leverage technology for better investment decisions?

African millennials can leverage technology through online trading apps and robo-advisors. They also have to stay updated.

Conclusion

In conclusion, navigating the stock market in today’s tech-driven society opens millennials to new prospects for advancement and financial independence. Millennials can utilize the IT sector’s dynamic character by utilizing digital tools, being up-to-date on emerging innovations, and implementing prudent investment methods. Millennials have the advantage of time and technology to make wise investment decisions. As a millennial investor, learning about integrating technology into your investment plans can help widen your portfolio and grow long-term profit.