- Introduction

- Different Types of News Events That Affect the Stock Market

- Understanding Market Psychology and Potential Overreactions to News

- Techniques for Analyzing News Impact and Predicting Market Reactions

- Identifying Investment Opportunities Arising from News-Driven Market Fluctuations

- Avoiding Emotional Decision-Making Based on Sensational News Headlines

- Diversification

- Case Studies

- Frequency Asked Questions (FAQs)

- Conclusion

Introduction

Understanding the role of news and events in stock analysis is crucial for investors. News and events can significantly impact stock prices, providing risks and opportunities. This article will delve into the various news events that affect the market in stock investing, the psychology behind market reactions, techniques for analyzing news impacts, identifying investment opportunities, and avoiding emotional decision-making based on sensational headlines.

Different Types of News Events That Affect the Stock Market

Economic Data

Economic data releases, such as GDP growth rates, unemployment figures, inflation rates, and interest rate changes, play a pivotal role in stock market movements. For instance, in African and developing countries where economies are often volatile, positive GDP growth reports can lead to a surge in stock prices. At the same time, negative data can trigger a decline. Investors closely monitor these reports to make informed decisions.

Company Announcements

Company-specific news, including earnings reports, mergers and acquisitions, product launches, and management changes, can directly impact a company’s stock price. For example, if a leading tech company announces a groundbreaking innovation, its stock price may soar. Conversely, news of poor quarterly earnings can lead to a sharp decline.

Geopolitical Events

Geopolitical events such as elections, conflicts, and international trade agreements can create uncertainty in the stock market. Political instability in Africa and developing countries can cause significant market volatility. Investors need to stay informed about geopolitical developments to navigate potential risks.

Understanding Market Psychology and Potential Overreactions to News

Market psychology plays a crucial role in how news events affect stock prices. Investors often react emotionally to the news, leading to potential overreactions. Understanding these psychological factors can help investors make more rational decisions. Market psychology includes the following;

Fear and Greed

Fear and greed are powerful emotions that drive market behaviour. In African markets, where investor sentiment can be particularly volatile, fear of economic instability can lead to panic selling, while greed during bull markets can result in irrational exuberance.

Herd Behavior

Herd behavior refers to the tendency of investors to follow the crowd. This can amplify market reactions to news events. For instance, if a major African company experiences a sudden drop in stock price due to negative news, other investors might also sell their shares, exacerbating the decline.

Overreaction

Overreaction occurs when investors respond disproportionately to news, causing stock prices to move excessively in either direction. Recognizing overreaction can allow savvy investors to buy undervalued stocks or sell overvalued stocks.

Techniques for Analyzing News Impact and Predicting Market Reactions

The role of news and events in stock analysis is pivotal, as it enables investors to utilize various techniques to assess the impact of news on the market and predict subsequent reactions. By understanding and analyzing these events, investors can make more informed decisions and identify potential investment opportunities.

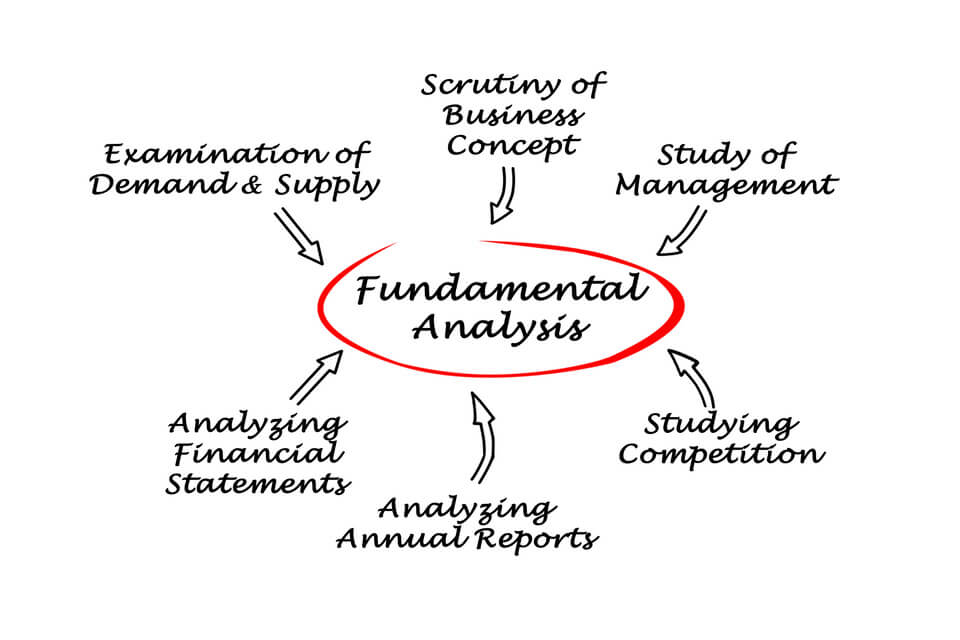

One of the primary techniques is fundamental analysis, where investors evaluate a company’s financial health, including earnings, revenue, and debt levels, in light of recent news. For instance, if a company announces a significant merger, fundamental analysts will scrutinize how this merger might affect the company’s future earnings and market position.

Another technique is technical analysis, which involves examining historical price movements and trading volumes to forecast future stock trends. Investors use charts and patterns to identify potential entry and exit points based on how similar news events have impacted the market in the past.

Sentiment analysis is also crucial, especially with the advent of advanced technologies. This method involves gauging the market’s overall sentiment by analyzing news articles, social media posts, and other sources to predict how news might influence stock prices. Positive sentiment can indicate a potential rise in stock prices, while negative sentiment might suggest a decline.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, including earnings, revenue, and debt levels, in light of news events. This method helps investors understand the intrinsic value of a stock by examining various financial metrics and how current events influence them.

For instance, when a company announces a new product, fundamental analysts assess the potential impact on future earnings and stock value. They consider market size, competitive positioning, and revenue growth potential. Additionally, they evaluate costs associated with the new product, such as R&D expenses, marketing costs, and operational efficiency changes.

News events play a significant role in fundamental analysis. Economic indicators like inflation rates, interest rate changes, and GDP growth provide a company’s operations context. Economic news is particularly impactful due to the region’s often volatile financial conditions. A favourable economic outlook can boost consumer spending and business investments, enhancing earnings and stock prices. Conversely, negative economic news can signal challenges, prompting analysts to adjust earnings forecasts and valuations.

Company-specific news, such as mergers, leadership changes, and strategic partnerships, also heavily influences fundamental analysis. For example, if a telecom company announces a merger, analysts assess potential synergies, cost savings, market share, and revenue growth prospects. This news can significantly alter the company’s financial outlook and stock value.

Geopolitical events, including elections, policy changes, and trade agreements, further complicate the analysis. These events can introduce new risks or opportunities. For instance, a new trade agreement between African nations might open additional markets for a company, boosting growth potential.

Fundamental analysis uses news events to evaluate financial health, helping investors make informed decisions.

Technical Analysis

Technical analysis focuses on historical price movements and trading volumes to predict future stock price trends. Investors use charts and patterns to identify potential entry and exit points based on news events. This method benefits markets with high volatility, like those in Africa and developing countries.

Sentiment analysis uses natural language processing and machine learning to gauge market sentiment from news articles, social media, and other sources. Investors can predict how news might impact stock prices by understanding the overall sentiment. For example, positive sentiment around a new government policy in a third-world country can boost investor confidence and stock prices.

Identifying Investment Opportunities Arising from News-Driven Market Fluctuations

News-driven market fluctuations can create lucrative investment opportunities. By staying informed and analyzing news impacts, investors can identify stocks poised for growth.

Buying on Dips

Investors often look for opportunities to buy stocks on dips caused by temporary negative news. This strategy is especially effective in stock analysis. For example, suppose a leading telecom company experiences a short-term decline due to regulatory concerns. In that case, savvy investors might buy shares at a lower price, anticipating a rebound once the issues are resolved.

Diversifying a portfolio with emerging market stocks, such as those from African and developing countries, can enhance returns and spread risk. Despite being more volatile, emerging markets often show higher growth potential than developed markets. By staying informed about local news and regulatory changes, investors can identify undervalued stocks that may benefit from future economic developments.

For instance, regulatory concerns impacting an African telecom company might create a buying opportunity for those who understand market dynamics. These investors leverage the temporary decline to acquire shares at a discount, banking on the company’s recovery and long-term growth potential.

The role of news and events in stock analysis helps investors discern between temporary setbacks and fundamental issues. By incorporating emerging market stocks and staying attuned to relevant news, investors can diversify their portfolios effectively, mitigating risk and capitalizing on growth opportunities.

Capitalizing on Positive News

Positive news can create momentum in stock prices. Investors can capitalize on this by investing in companies likely to benefit from favourable developments. For example, a new trade agreement between African nations can boost the prospects of export-oriented companies, presenting investment opportunities.

Long-Term Trends

Investors can also focus on long-term trends driven by news events. For example, increasing digitalization and mobile penetration in Africa are long-term trends that can create investment opportunities in the tech and telecom sectors.

Avoiding Emotional Decision-Making Based on Sensational News Headlines

Sensational news headlines can lead to emotional decision-making, which is detrimental to investment success. These headlines often evoke strong reactions, clouding an investor’s judgment. While the role of news and events in stock analysis is crucial, it’s essential to approach it with a disciplined mindset to avoid sensationalism.

Impulsive reactions to sensational news can result in hasty decisions based on incomplete information, leading to common mistakes like buying high out of FOMO or selling low in panic. Instead, investors should methodically analyze news and its impact on stock fundamentals.

To avoid emotional decision-making, investors should develop a clear strategy with predefined criteria for buying and selling stocks, such as target price levels and risk tolerance. By focusing on data-driven analysis and adhering to a well-defined strategy, investors can navigate market fluctuations more effectively and achieve long-term success. The role of news and events in stock analysis is vital, but maintaining discipline is key to avoiding the pitfalls of sensationalism.

Relying on Data

Investors should base their decisions on data and analysis rather than emotions. Investors can make more rational decisions by focusing on fundamental and technical indicators.

Diversification

Diversifying investments across different sectors and regions can help mitigate risks associated with news-driven volatility. For example, an investor in Africa might spread their investments across multiple countries and industries to reduce exposure to any news event.

Staying Informed

Regularly monitoring news sources and staying informed about global and local developments is crucial. Investors should use reliable sources and avoid making decisions based on unverified information.

Case Studies

1. The Volkswagen emissions scandal:

In 2015, Volkswagen found itself at the centre of a massive scandal when it was discovered that the company had installed software in its diesel engines to cheat emissions tests. This event, known as “Dieselgate,” swiftly and severely impacted Volkswagen’s stock. The news of the scandal caused the company’s stock to plummet by nearly 40% within just a few days.

This case highlights how regulatory news can drastically affect stock prices. The initial revelation led to a widespread sell-off as investors reacted to the potential legal, financial, and reputational damage to Volkswagen. Those who could quickly analyze the news and understand its long-term implications—such as potential fines, recalls, and loss of consumer trust—were better positioned to make informed decisions.

Some investors saw the sharp decline as an opportunity to buy shares at a lower price, anticipating a rebound once the company addressed the regulatory issues and rebuilt its reputation. Others chose to avoid the stock altogether, wary of the prolonged legal battles and potential for further declines. The Volkswagen emissions scandal is a stark reminder of the importance of staying informed and carefully analyzing news events to navigate the stock market effectively.

2. The Brexit Referendum and Its Market Impact

The 2016 Brexit referendum is a notable example of how geopolitical events can influence stock markets worldwide. When the United Kingdom voted to leave the European Union, the decision sent shockwaves through global financial markets. The immediate aftermath saw the British pound plummet to its lowest level in decades, highlighting Brexit’s profound uncertainty and economic implications.

Stock markets experienced significant volatility following the vote. UK-based companies, in particular, saw dramatic fluctuations in their stock prices as investors tried to gauge the long-term effects of Brexit on the British economy. Some sectors, such as banking and real estate, were hit particularly hard due to concerns over market stability and future regulatory changes.

For investors, the Brexit referendum underscored the importance of staying informed about geopolitical events and their potential impact on the market. Those who closely followed the developments and understood the broader economic implications were better positioned to navigate the volatility. Some investors saw opportunities to buy undervalued stocks amid the uncertainty, while others took a more cautious approach, waiting for more clarity on the post-Brexit economic landscape.

The Brexit case study highlights how significant geopolitical events can create risks and opportunities in the stock market, emphasizing the need for thorough analysis and strategic decision-making in response to such news.

3. Apple’s Market Reaction to Product Announcements

Apple Inc. offers a prime example of how company announcements can significantly influence stock prices. Each year, the anticipation and subsequent unveiling of new products, such as the iPhone, have a noticeable impact on Apple’s stock performance.

Take the announcement of the iPhone 11 in September 2019, for instance. The new features, including an improved camera system and a more attractive price point compared to previous models, were met with widespread approval. This positive reception led to a substantial increase in Apple’s stock price. Investors, buoyed by the strong sales forecasts and enthusiastic market response, drove the stock upwards.

Conversely, any hint of production issues or underwhelming product features can result in a decline in stock prices. Investors closely monitor these announcements and often react swiftly based on the perceived success or failure of the new products. This dynamic illustrates how critical it is for investors to stay informed about company news and understand its potential market impact.

Investors can make more informed decisions by analyzing such announcements and predicting the market’s reaction. Apple’s product launches demonstrate the significant role that company news plays in stock analysis, highlighting the importance of staying attuned to developments within major corporations.

Frequency Asked Questions (FAQs)

1. What types of news events have the most impact on the stock market?

Economic data, company announcements, and geopolitical events are among the most impactful news events that affect stock markets.

2. How can I avoid emotional decision-making based on news headlines?

To avoid emotional decision-making, rely on data and analysis, diversify your investments, and stay informed through reliable news sources.

3. What techniques can I use to analyze the impact of news on stock prices?

Techniques include fundamental, technical, and sentiment analysis to understand how news events might impact stock prices.

4. How do geopolitical events affect stock markets in Africa?

Geopolitical events can create uncertainty and volatility in African stock markets. Investors need to stay informed about political developments to navigate potential risks.

5. What are some investment opportunities arising from news-driven market fluctuations?

Opportunities include buying on dips caused by temporary negative news, capitalizing on positive news, and focusing on long-term trends driven by news events.

Conclusion

Understanding the role of news and events in stock analysis is crucial for making informed investment decisions, particularly in African markets and third-world countries where volatility can be high. Investors can better predict market reactions and identify lucrative opportunities by analyzing economic data, company announcements, and geopolitical events. Techniques such as fundamental analysis, technical analysis, and sentiment analysis help gauge the impact of news on stock prices. Moreover, avoiding emotional decision-making and sensational headlines ensures a more disciplined and rational approach to investing. Staying informed and adopting these strategies can significantly enhance investment outcomes, providing a roadmap for navigating the complexities of news-driven market fluctuations.