- Introduction

- Understanding Short Selling

- Identifying Overvalued Stocks

- Techniques for Short Selling with Stock Analysis

- Strategies for Identifying Shorting Opportunities

- Risk Management in Short Selling

- Case Study

- High-profile Short Squeezes and Their Impact

- Future Trends in Short Selling

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

What is short selling? How can investors use it to spot overvalued stocks? One of these questions has most likely crossed your mind as an investor. Short selling is an investment strategy that can bring in significant profits, especially in a volatile market where stock price swings may be unpredictable. It is not just betting on the stock going down; instead, it is about understanding the market dynamics and identifying those stocks whose price, compared to their actual value, is high.

In this guide, we’ll delve into the intricacies of short selling with stock analysis. We will cover how to establish a company’s financial health, track market trends, and spot overvalued stocks using key indicators. Mastering these concepts can refine your investment strategy and give you new profit opportunities, whether you are a seasoned investor or a new investor. So, keep reading if you are curious about how to use short selling to your advantage and want to learn the art of identifying overvalued stocks.

Understanding Short Selling

Definition and mechanics of short-selling

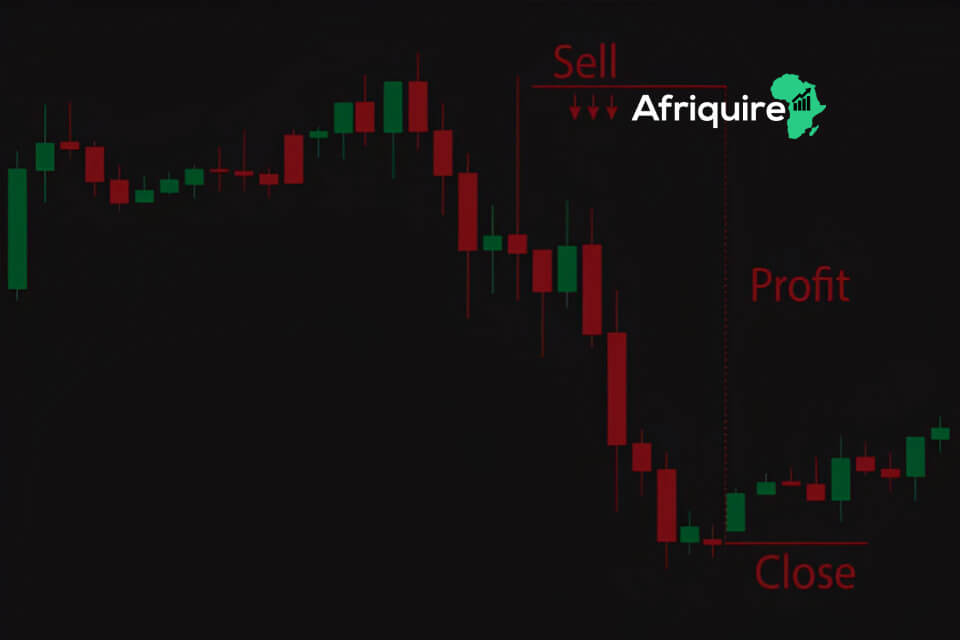

Short selling is one of the more sophisticated trading strategies available to investors. It is a concept that allows investors to profit from stocks in anticipation of a price drop, allowing them to repurchase them at a lower price and pocket the difference. Short selling is one of the trading strategies in which an investor bets that the stock price will drop. It is a worldwide market strategy. When you borrow stock shares and sell them in the hopes that the price will decline, this is known as short selling. You then repurchase the shares at the discounted price, give them back to the lender, and pocket the profit margin. Sell high, buy low – a lucrative strategy.

Mechanics of Short-selling

Here is how short-selling works:

Borrowing Shares: The short seller or investor borrows shares of a stock from a broker, paying a fee for the privilege.

Sell the Shares: The borrowed shares are sold on the open market at the current price.

Wait for Price Decline: The investor then waits, hoping that the price of the stock declines.

Buying back the shares: The short seller buys the shares back at a lower price if the stock price decreases as forecasted.

Returning the Shares: Shares are returned to the broker, and the short seller gets to profit from the selling price minus the buying price—net of fees or interest.

The strategy could be very effective and profitable, but it comes with significant risk. If the stock rises instead of plummets in price, the short seller might have to buy back the shares at a more expensive price, resulting in a loss. Since stock prices can rise indefinitely, the potential losses in short selling are unlimited. This underlines the fact that short sellers should properly conduct their stock analysis and also manage their risk carefully

History and evolution of short-selling

Short selling is not a new concept. It is as old as the stock market, especially in the Dutch Republic during the 1600s. The concept of short selling dates back to the early 17th century when a very successful Dutch businessman, Isaac Le Maire, who made his fortune and was on the board of the Dutch East India Company, was forced out by the company; this meant he was subsequently barred from the spice trade, which was an enormously profitable business. He held considerable holdings in company stock. With the help of some confederates, he sold the company’s shares in enormous amounts to reduce the price.

The controversy caused by his speculative action against the Dutch East India Company led to the first ban on short selling issued by the Dutch government in 1610. Despite early resistance, short selling evolved over the centuries to become one of the staple strategies in modern financial markets.

In the 20th century, short selling gained popularity with notable figures like Jesse Livermore, who famously shorted stocks just before the 1929 market crash, amassing great wealth. Regulatory environments adapted, with measures like the uptick rule introduced in the U.S. to mitigate potential market manipulation.

Today, short selling is a sophisticated tool that hedge funds and individual investors use to hedge risks and capitalize on overvalued stocks. For investors, it is also an exciting aspect of the dynamics of financial markets, with a very rich history of strategic importance.

Risks and rewards of short-selling

Risks of Short Selling

The short-selling strategy can be very profitable but is associated with high risks. Therefore, understanding these risks is a must for investors to deal with the complexities of this trading strategy efficiently.

1. Unlimited Loss Potential: Unlike conventional investing, where losses are restricted to the initial investment, short selling can lead to infinite losses if the stock price rises indefinitely.

2. Margin Calls: Short sellers typically use margin accounts, which require maintaining a certain equity level. If the stock price increases, brokers may issue margin calls, demanding additional funds or shares, potentially forcing the investor to cover at a loss.

3. Market Risk: Market conditions can change rapidly, and unexpected positive news can cause stock prices to soar, leading to significant losses for short sellers.

Rewards of Short Selling

Short selling offers unique rewards, enabling investors to profit from declining stock prices. This strategy can hedge against market downturns and provide opportunities for significant financial gains.

1. Profit from Declines: Short selling allows investors to profit when they anticipate a stock’s decline, providing opportunities in bear markets.

2. Hedging: Investors can use short selling to hedge against potential losses in other investments, balancing their portfolio risk.

3. Market Efficiency: By betting against overvalued stocks, short sellers can help correct market inefficiencies, contributing to more accurate stock pricing.

Legal and ethical considerations

Short selling occurs within a framework of legal regulations that aim to maintain the market’s integrity. There is a substantial body of law on the requirement for short sellers to first borrow shares before selling, which guarantees the transaction’s validity. From this perspective, regulatory bodies, such as the SEC in the United States, monitor short-selling practices to prevent market manipulation, such as “naked short selling”—selling shares one does not borrow.

Ethically, there is a big question about how short selling could impact market sentiment and drive stock prices down unfairly. Critics label the practice as one that exacerbates market declines and hurts challenged companies, whereas advocates argue that short selling provides necessary liquidity and can sometimes help correct overvalued stocks.

Any investor involved in short selling should, therefore, understand these legal and ethical dimensions very well to position themselves within the law while at the same time taking into consideration any larger implications of their trading strategies.

Identifying Overvalued Stocks

Key indicators of overvaluation

High price-to-earnings (P/E) ratios: A high P/E ratio means that the investors are paying a significantly greater amount to the market average price per each dollar of earnings and can, therefore, indicate overvaluation, especially in a scenario in which the ratio is significantly high in comparison to the industry peers, meaning expectations from growth are unrealistic.

Low earnings growth relative to stock price: It could be considered overvalued if it substantially tallied up the price of a stock but not the earnings. A company can be fully valued for high growth because of high earnings growth; the stock price keeps up with it.

Elevated price-to-book (P/B) ratios: The P/B ratio is high, which suggests that, in comparison to what they value, investors are paying more for the assets of a company. If relative to the typical industry ratio, the P/B ratio is significantly higher, then this could be easy speculation and not any fundamental value to drive the valuation higher.

Poor return on equity (ROE): Return on equity measures the company’s profit generation efficacy against the equity. A very low ROE or a declining ROE, along with a higher stock price, may project overvaluation, as this may mean that the firm cannot utilise available resources to generate returns.

A closer look into these specific indicators will help investors decide which stocks are overpriced and will put them in a safe position to open short-selling positions as corrections happen.

Analysing financial statements

Income statement: It flows with the view of a firm’s profitability over time. From the short seller’s point of view, a declining revenue or rising expense could indicate possible financial distress and, therefore, make it a potential stock to short.

Balance sheet: A balance sheet shows the company’s financial position at any instant while laying down assets, liabilities, and equity. A high level of debt compared to the level of assets might show financial instability; this would attract short sellers because the stock is considered overvalued.

Cash Flow Statement: This outlines the cash generated or used in operating, investing, and financing activities. Negative cash flow, especially in operating activities, may indicate underlying problems, which would translate into a stock price decline, attracting short sellers.

Investors can go through all these financial statements and find out about overvalued stocks with probable price drops to work their strategies on short-selling accordingly.

Market sentiment and speculation

Market sentiment and speculation are two significant forces driving stock prices to overvalue. When investors get too optimistic, they bid up the price of stocks beyond their intrinsic value; this, in turn, creates bubbles. Further fuel in the form of positive news, high-profile endorsements, trending sectors, etc., could mean that their stock prices may not truly reflect their actual worth. This is further compounded by the fact that such speculative behaviour by investors, buying stocks in hopes of increasing prices in the future rather than on solid financial performance, has added to the problem.

Two significant means of identifying overvalued stocks are understanding market sentiment and distinguishing between authentic growth and hype-driven inflation. Analysing metrics such as the P/E ratio and price-book ratio—looking at historical averages and standards in that particular industry—provides insight into overvaluation. News stories, trending on social media, and investor forum monitoring provide a sense of sentiment behind stock prices.

For the short seller, recognizing overvalued stocks means he eventually profits from a price correction. The short seller capitalizes on this market return to rationality by agreeing on inflated stocks. Hence, one must understand market sentiment and speculation in recognizing overvalued stocks and make short-selling presentations to exploit profit opportunities.

Compared to industry benchmarks and peers

A comparison of the key financial metrics of a company against industry benchmarks and peers is a meaningful way to detect overvalued stocks. Comparative analysis will help the investor to determine whether the high value being paid by the market for the stock is primarily due to the company’s performance or is merely a reflection of inflationary market sentiment for that stock. In this context, some key financial ratios, particularly the Price-to-Earnings and Price-to-Book ratios, are particularly useful.

For example, if a company’s P/E far exceeds the industry average, this could be a sign of overvaluation. Similarly, if the P/B ratio is way higher compared to peers, such a situation reflects that the price that prevails in the market is more than its book value, which may indicate a case of overvaluation. When examined in terms of industry standards, metrics like ROE and profit margins might show discrepancies that may reflect overvaluation.

Benchmarking against peers provides a better view of the relative valuation of a company. If the valuation metrics of the stock are very high, it may indicate that it is holding an unrealistic price level without corresponding superior growth prospects or financial performance.

Comparisons such as these are relevant for short sellers. For them, this means identifying shares that are overvalued to industry benchmarks and peers and then targeting them as probable candidates for shorting—anticipating that the market, at some point, will do its due diligence in making these inflated valuations correct themselves into profitable opportunities.

Techniques for Short Selling with Stock Analysis

Succeeding in the stock market will involve deploying various tools and techniques for in-depth stock analysis. Among the significant techniques, these two methodologies stand out: fundamental and qualitative and technical analysis. Both provide different sets of information that, when added, will form a solid ground to make informed decisions on stocking.

Fundamental and Qualitative analysis

Fundamental analysis and qualitative analysis examines a company’s intrinsic value by examining the various aspects of the business. This method examines the core drivers of performance and a firm’s long-term viability. The following are ways of conducting fundamental and qualitative analysis.

Assessing company fundamentals: The investor researches the company fundamentals by examining financial statements– income statements, balance sheets, and cash flow statements. To understand the company’s financial health and operations, one looks for growing revenues, high profit margins, debt levels, and healthy cash flow.

Financial ratios and metrics: Key financial ratios include Price-to-Earnings (P/E), Price-to-Book (P/B), Return on Equity (ROE), and Debt-to-Equity (D/E), and they provide insight into the valuation and performance of the company to its peers. The metrics are used to find potentially overvalued or undervalued stocks to help investors.

Management quality: A company’s management is the key driver of any strategy or implementation, making it essential to evaluate the competence and track record of the management team. Strong leadership and management help create value for all key internal and external stakeholders of the company—by driving the company’s strategic decisions, operations, and shareholder value.

Industry trends: The broader industry environment needs to be considered. Industry trends, growth prospects, regulatory impacts, and market dynamics must be measured to gauge a company’s future potential or downside risk.

Competitive landscape: Investors must understand the competitive environment when trying to position a company and determine if there are any possibilities for growth. It should include competitive analysis, market share, entry barriers, and unique value propositions.

Technical Analysis

Technical analysis is based on statistics gathered from trading activity, like the movement of price and volume. The method allows investors to foresee future price movements based on the patterns established earlier. The following are tools used in conducting technical analysis:

Chart patterns: From the chart, it is possible to identify common chart patterns, such as head and shoulders, double tops and bottoms, and support and resistance level lines that show up in triangles, showing potential market trends and price reversals.

Volume analysis: Volume analysis allows investors to confirm trends and potential breakouts. Besides, significant price movement is usually characterized by high volumes and provides some clues on market sentiments and the strength of a trend.

Moving averages: Moving averages, like 50-day, 200-day, etc., smoothen out price data to pick out some trends and potential reversals. The points of intersection of moving averages usually give buy and sell signals.

Finally, the investor may develop a well-rounded approach, using the positive aspects of fundamental, qualitative, and technical analysis to build a proper, balanced stock appraisal strategy. This will assist the investors in making solid decisions, reducing the risk level, and recognising undervalued or overvalued stocks in the market for investment purposes.

Strategies for Identifying Shorting Opportunities

To successfully engage in short selling, investors must employ effective strategies to identify overvalued stocks and capitalize on potential price declines. Here are key strategies to consider:

Screening for overvalued stocks: Utilizing financial ratios and metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Return on Equity (ROE) can help identify stocks that appear overvalued relative to their peers. Screening tools and stock screeners can automate this process, highlighting potential shorting candidates based on valuation discrepancies.

Analysing macroeconomic factors: Understanding the broader economic environment is crucial for short selling. Economic indicators such as interest rates, inflation, and GDP growth can impact market sentiment and stock prices. By analysing these factors, investors can anticipate sectors or companies that might be adversely affected, presenting potential shorting opportunities.

Monitoring market news and events: Staying informed about market news and events is vital. Corporate earnings reports, regulatory changes, and geopolitical events can influence stock prices. Keeping an eye on such developments helps investors identify situations where stocks might become overvalued or face significant downside risks, making them suitable for short selling.

Using professional research and analyst reports: Leveraging insights from professional research and analyst reports can provide valuable information about potential shorting opportunities. Analysts often provide in-depth assessments of a company’s financial health, industry position, and prospects. Adverse reports or downgrades can signal overvaluation, prompting short-selling considerations.

With these strategies, investors can systematically identify and capitalize on the shorting opportunity. Thorough screening, macroeconomic analysis, monitoring market-related news, and leveraging expert research build a solid short-selling strategy that increases the chance of identifying overvalued stocks and gaining from their expected declines.

Executing Short Trades

Selecting the right brokerage and platform: First, you must choose a brokerage that allows short selling. Look for investment platforms charging low prices for lending, ensuring reliable execution of trades, plus enabling tools rich in analytics. A good brokerage will also provide educational resources to perfect your strategy.

Timing the market entry and exit: Timing is crucial in short selling. Therefore, technical analysis should be used to decide whether to buy or sell. Chart patterns, moving averages, and volume indicators will alert one to overbought positions likely to decline. Timing an exit is equally crucial in locking in a profit and cutting losses.

Setting stop-loss and take-profit orders: Setting stop-loss and take-profit orders protects your capital when selling short. A stop loss automatically buys back the shares at a certain price level that you set, thereby limiting possible losses. Take-profit orders lock in gains by buying back the shares once they have fallen to your target price. These orders help in risk management and ensure disciplined trading.

Managing margin requirements and leverage: Short selling typically involves borrowing shares requiring a margin account. Ensure you properly manage your margin requirements and leverage to avoid margin calls and potential excessive risks. Leverage will raise potential gains and losses, so it is very important to use it judiciously. Periodically monitor the balance of your account under the required margins and adjust your positions accordingly.

The proper selection of a brokerage house, timing the market, placement of protective orders, and margin and leverage control are the ways to execute short trades. These strategies help mitigate risks and enhance the potential for profit in short selling, making it a viable approach for seasoned traders.

Risk Management in Short Selling

Good risk management techniques are very vital in the process of short selling so that one can find a way of avoiding significant potential losses and hence allow for an increase in overall trading success. Since short selling is inherently risky, it is essential to implement robust strategies to protect your investment.

Diversifying Short Positions

This forms a very important way of risk control. By diversifying your short positions across sectors and stocks, one lessens the potential impact a single stock can have on the portfolio due to an unexpected rise. Through diversification, one manages risks so that the portfolio does not get overexposed from any individual stock or industry.

Hedging Strategies

If smartly used within one’s scheme, some hedging strategies add an extra layer of protection from losses.

- Options and derivatives: You could bet on a stock’s fall by buying put options, for instance, without having to short the stock. This will help you restrict your risk to only the premium you have paid for buying such options. Other popular financial contracts are futures and swaps. These also offer a leveraging opportunity and aid in efficiently handling the risk factors.

- Pair trading: Pair trading entails taking a long position in one equity and a short position in another of the same sector. The strategy, hence, leverages relative performance differentiation between the two instruments, providing an innate hedge against market-wide movements.

Regularly Reviewing and Adjusting Positions

One must keep on monitoring one’s short positions. The conditions in the market or the stock fundamentals can turn around in a flash. It is, therefore, very important to review and re-balance them repeatedly. It will help make timely adjustments if one stays current with the market trend and stock-specific news.

Understanding and Planning for Potential Short Squeezes

A short squeeze is a sudden increase in the price of a heavily shorted stock that forces short sellers to buy back the stock at higher prices, resulting in tremendous losses. Knowing stocks with high short interest and planning around the potential short squeeze can help minimize this risk. Setting stop-loss orders and continuous monitoring of market movements are efficient ways to address the possibility of risk.

Proper diversification of short positions, hedging, regular review of positions, and being ready for squeezes would make it easier for an investor to offset the risks in short selling, protecting investments and enhancing potential returns.

Case Study

Successful Short-selling Examples

The 2008 Financial Crisis:

Hedge fund manager Michael Burry famously shorted the housing market during the financial crisis 2008. He took a contrary position in the booming housing market because he found overvaluation in subprime mortgage-backed securities. When the bubble finally burst, he came out with massive gains in profit, thus making the point of learning the thorough market analysis and being skeptical of rampage optimism.

African Success: The Case of the Nigerian Banking Sector, 2011

The banking industry in Nigeria was in deep waters in 2011 due to reckless lending and bad corporate governance. Some astute investors began selling short stocks of key Nigerian banks, wagering on their decline. As the regulators scrambled to improve regulatory oversight amid revelations about the financial condition of the banks, these stocks nosedived, enabling short sellers to reap sizeable returns. This case illustrates very well how critical it is to understand emergent sector risks and to exploit regulatory changes.

High-profile Short Squeezes and Their Impact

GameStop, (USA, 2021)

One of the most famous and recent short squeezes is the GameStop saga in 2021. The retail investors behind platforms such as Reddit’s WallStreetBets drastically dropped the stock price of GameStop to the floor, thereby inflicting huge losses on institutional investors who had heavy short positions against the stock. This event brought much attention to the force of collective retail trading and the risk of highly shorted stocks.

Volkswagen (2008, Germany)

In 2008, Volkswagen became the target of a dramatic short squeeze after Porsche disclosed it had acquired a sizable stake in VW shares. The stock price went through the roof, briefly becoming the world’s most highly valued company. This incident underlined the need to be aware of shareholder structures and the risks of concentrated short positions.

Herbalife

In 2012, Bill Ackman of Pershing Square Capital Management ran a highly publicized campaign to short Herbalife, calling it a pyramid scheme. How wrong this bet proved to be. After intensive research and public presentations, Herbalife’s stock rebounded and performed well. This shows that adequately researched short positions can sometimes prove reasonably dangerous, and market sentiment and corporate resilience can completely overhaul bearish bets.

These examples and the lessons learned from them further underline the complexities and risks involved in short selling and, therefore, emphasize careful analysis, cautious positioning, and adaptability in dynamic markets.

Future Trends in Short Selling

Impact of Technological Advancements

Technological advancement is gradually changing the landscape of short selling. Next-generation Artificial Intelligence (AI) and Machine Learning (ML) facilitate more complex data analysis, thus helping investors zero in on shorting opportunities more effectively. Now, algorithms can comb through terabytes of data, disseminating social media sentiment, news feeds, and financial reports to predict where the stock is headed. Moreover, trading platform improvements offer real-time analytics and execution capabilities that help investors establish and manage short positions with much more ease.

Changing Market Conditions and Their Effects

Continuous changes in market conditions were due to economic cycles, geopolitical events, and investor behavior. The increased market volatility and sudden market sentiment shifts increase the risk and opportunities for short sellers. The increasing power of retail investors, as illustrated by the GameStop squeeze, underlines the necessity to understand the formation of new market dynamics better. A more flexible and responsive strategy will be critical to navigating those uncertainties and spotting their opportunities in an ever-changing environment.

Evolving Regulations and Their Implications

Regulatory environments are becoming more stringent, affecting how short selling is conducted. In the process, regulatory authorities monitor various short-selling activities to deter market manipulation and ensure transparency. For instance, in some cases, regulations requiring positions that are short to be disclosed may influence market sentiment and alter trading strategies. Regulation changes will also impact the availability of shares to be shorted or the cost of borrowing. With regulations unlikely to stop evolving any time soon, the short seller must keep themselves informed and compliant, adjusting their strategies to help mitigate regulatory risks while gaining leverage from any new opportunities that may present themselves.

In summary, the future of short selling will be shaped by technological advances, shifting market conditions, and evolving regulations. In keeping pace with these trends, short sellers can improve their strategies, control risks more effectively, and realize budding opportunities within these dynamic financial markets.

Frequently Asked Questions (FAQs)

1. What is short selling?

Short selling involves borrowing and selling shares, hoping to repurchase them at a lower price.

2. How do I identify overvalued stocks?

Use financial ratios, compare with industry benchmarks, and analyze market sentiment.

3. What are the risks of short selling?

Unlimited losses, margin requirements, and potential short squeezes.

4. What is a short squeeze?

A short squeeze occurs when a stock’s price rises rapidly, forcing short sellers to cover their positions at a loss.

5. How can I manage risks in short selling?

Diversify positions, use hedging strategies, and set stop-loss orders.

Conclusion

Short selling with stock analysis is a powerful strategy for identifying and profiting from overvalued stocks. Investors can spot opportunities and manage risks by combining fundamental, technical, and qualitative analysis. However, understanding the complexities and potential pitfalls is crucial for successful short selling.