Sector-focused ETFs: How to Diversify Smarter and Faster

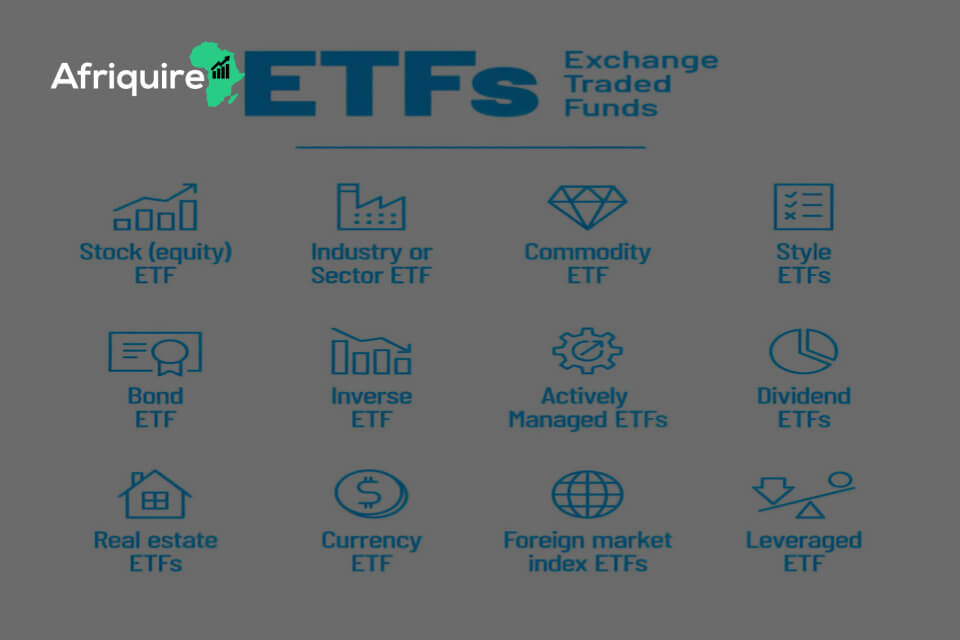

Introduction Do you wish to diversify investments such that you also get increased exposure to a certain industry or sector? The sector-focused ETFs will provide the solution. You will be able to diversify your portfolio by focusing on a particular sector. This could be technology, health, or energy. How do these ETFs work? Do they […]

Sector-focused ETFs: How to Diversify Smarter and Faster Read More »