Introduction

The impact of digital payments on African agribusinesses can be seen in how the face of farming and agriculture has been transformed across the continent. Farming is central to Africa’s economy, and digital payment solutions ease the transaction process of getting money for their products and services. This is because farmers need quick payments in order for them to continue their work.

With the agribusiness sector projected to reach $1 trillion by 2030, there is every reason why one needs to understand how digital payments will help farmers expand their businesses and improve financial inclusions. Let’s discuss the agribusiness sector, the importance of digital payments, how digital payments can be integrated, and how they relate to Africa’s future.

- Overview of The Agribusiness Sector in Africa

Agribusiness is one of the most critical sectors in the African economy. Agriculture contributes between 30% and 40% to Africa’s GDP, especially in Sub-Saharan Africa, and employs over two-thirds of Africa’s workforce. Africa has vast expanses of farmland—about 60% of the world’s unused arable land. This means that Africa can play a big role in food production worldwide.

However, this sector is faced with a lot of challenges. Generally, small-scale farmers have limited access to finance, use old farming methods, and have low productivity. Nevertheless, despite all those challenges, people are realising that agribusiness might help grow the economy and improve the lives of many Africans. This shows why it will be essential to see how digital payments can make this sector better and more efficient.

- Importance of Digital Payments in Transforming Traditional Agricultural Practices

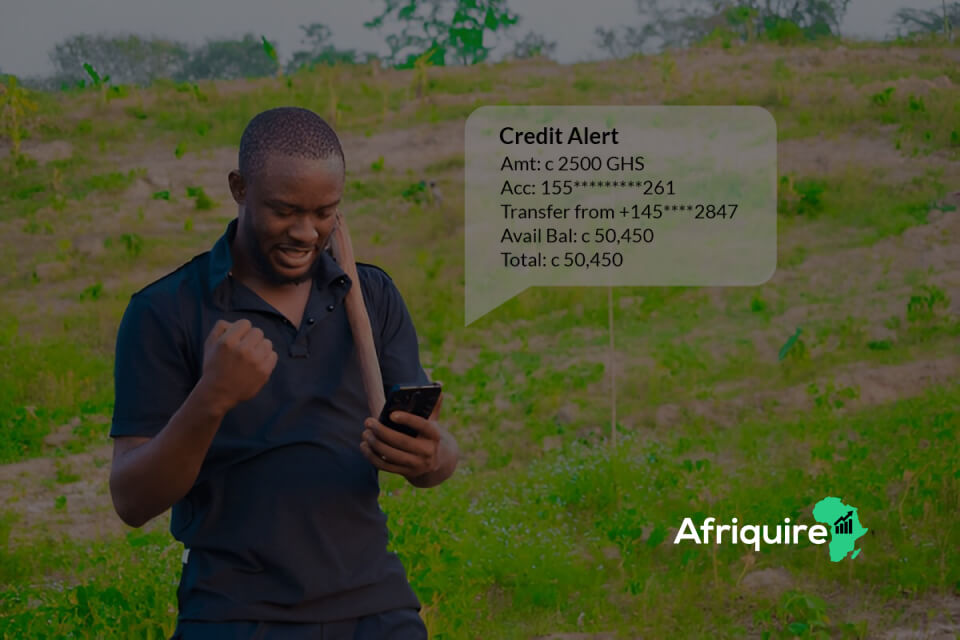

Digital payments make life easier for farmers and agribusinesses, as this kind of transaction is faster and safer. Through digital payments, the farmers would not have to wait for an unreasonably long period for the money from the buyers. This way, they will be able to purchase seeds, fertilizers, and equipment without wasting a single moment.

Operating on cash transactions can be highly risky due to problems such as theft and fraud. Digital payments reduce these risks and help farmers keep their money safe. In addition, digital payments allow farmers to expand their reach by selling to new customers or more significant markets that prefer cashless transactions. In this way, farming will become more organised and productive as more agribusinesses adopt digital payments.

- The Role of Financial Inclusion in Supporting Agribusiness Growth.

Financial inclusion plays a critical role in supporting agribusiness growth across Africa. Most farmers, especially smallholder farmers, lack access to banking services. Without a bank account, one cannot save or receive money, apply for loans, or invest in better farming techniques.

With digital payments, farmers have better access to financial services. Besides, they can receive money digitally, build credit history, and apply for loans to expand their farms. That is important because access to finance helps not only individual farmers but also the whole value chain of the agribusiness sector.

- Brief Introduction to The Scope of The Topic.

We will look into the impact of digital payments on African agribusinesses. We will also discuss how digital payments transform, discuss farming, look into case studies of agribusinesses that have employed digital payments, and examine the challenges and opportunities in integrating digital payments. We will explore how digital payments link with Africa’s economic growth and food security.

For those interested in learning more, check out our articles on choosing the right digital payment solution and integrating digital payments with African banking systems. These topics will show how digital payments enable a better future for African agribusinesses.

Benefits of Digital Payments for Agribusinesses

For Farmers and Producers:

- Direct Access to Markets and Buyers: Digital payments allow farmers and producers to sell their produce directly to consumers. This eliminates the need for intermediaries, a significant part of the most important improve their income and proportion of the farmers’ profits. With digital payment platforms, farmers can understand the market’s requirements and become more successful.

- Quick and Secure Payments: One of the most significant advantages of digital payments is that they are fast and safe. Farmers can get their money immediately after selling their products. This helps them manage their money better and avoid problems like theft or fraud with cash payments. With quick and secure payments, farmers can focus more on growing their business rather than stressing about delays or losses of money.

- Elimination of Middlemen and Associated Costs: Digital payment solutions help farmers eliminate intermediaries in selling. Intermediaries, on their end, generally take advantage of high commissions, thereby reducing farmers’ profits. By directly receiving the payments, farmers can retain more money. They will, therefore, be in a better position to invest in their farms, higher quality seeds, and better tools or even put something aside for the future. This benefits not only the farm owner himself but also aids in the growth of rural communities.

For Agribusiness Companies:

- Streamlined Financial Transactions: Digital payments help agribusiness companies process transactions faster. With an automated payment system, it is possible for companies to send and receive money quickly and accurately. This reduces paperwork and allows businesses to focus on more important things like improving their products and expanding their markets.

- Improved Supply Chain Efficiency: Digital payments reinforce the supply chain. This can enable agribusinesses to monitor costs and deliveries more closely, ensuring goods are moved. Transparency in transactions decreases delays and errors, making business operations effective.

- Enhanced Record-Keeping and Financial Management: Digital payments facilitate the proper recording of financial books for agribusinesses. Accurate record-keeping is vital for financial management and compliance with regulations. In digital systems, the company knows better about its profit, loss, and cost of operations. This way, companies can do business without much pressure.

For Rural Economies:

- Boosting Economic Activity Through Secure Payment Flows: Digital payments foster the growth of rural economies through safer and speedier money transactions. When farmers get paid more quickly, they can spend more in their communities. This helps local businesses thrive and creates additional jobs, increasing the economy’s growth.

- Encouraging Investment in Agricultural Innovations: With the new digital payments, farmers will be able to invest in new farming techniques and technology. When they can access their money with ease, they can buy better seeds, equipment, or even training that helps them increase their production. This is important in making farming more modern and sustainable in Africa.

The impact of digital payments on African agribusinesses is enormous. They are changing the way farmers and companies do business, and the changes that digital payments create are definitely contributing to growing a stronger agricultural sector in Africa.

Case Studies of Agribusinesses Using Digital Payments

Examples of Successful Integration

- Smallholder Farmers Using Mobile Money Services

In Kenya, small farmers have significantly benefited from the use of mobile money services such as M-Pesa. This system allows farmers to receive payments directly on their phones and conduct fast and easy transactions. For instance, farmers may sell the crops to any market and be paid through the M-Pesa cash directly into their hand without being at risk with all that cash money.

In addition, directly accessing such funds allows the farmers to quickly get the required improved seeds, fertilizers, and farm equipment in preparation for increased yields. The impact is that through digital payments, African agribusinesses have better financial security and can quickly expand their businesses.

- Partnerships Between Agritech Startups and Financial Service Providers.

Many of the agritech startups have partnered with various financial service providers in a bid to help farmers in Africa.

For example, VeryPay partners with mobile money providers to offer farmers digital wallets. These wallets also enable farmers to pay for seeds, fertilizers, and other farm inputs without using cash. Transactions go faster with digital means, which teaches farmers how to handle their money more properly. The impact brought by digital payment systems on African agribusinesses is enormous in creating a stronger and more inclusive financial system for farmers.

- Digital Marketplaces for Agricultural Products Leveraging Payment Systems.

Digital marketplaces are emerging as vital platforms for agricultural products in Africa. These platforms connect farmers directly with consumers and businesses, allowing them to sell their products online.

A good example is Twiga Foods in Kenya, where farmers list their produce and get paid digitally. This increases their sales and reduces the chances of not being paid on time. These platforms use a digital payment system to make transactions more transparent and efficient. The impact of digital payments on African agribusinesses is evident as it empowers farmers to reach broader markets and improve their incomes.

Impact stories: Increased Productivity, Profitability, and Financial Inclusion

Many farmers have increased their productivity and profits by using digital payments. With fast and convenient access to cash, they can purchase high-quality seeds and fertilizers that better their yields. With mobile payments, farmers can invest more in their farms, thus reaping more. Since they are paid on time, they can reinvest the profits sooner.

This not only benefits the individual farmer but also boosts the local economies. The impact of digital payments on African agribusinesses is strong, as more farmers start to see financial security to grow their businesses. Farmers should research the right digital payment solution and ways to integrate digital payments with African banking systems.

Challenges in Implementing Digital Payments

Digital payments can help farmers in Africa to grow their businesses, yet there are so many issues that make it difficult for them to use the systems. Let’s go into details of some of the biggest challenges and how they would relate to the impact of digital payments on African agribusinesses.

Infrastructure Issues:

- Limited Access to Reliable Internet and Mobile Networks in Rural Areas: Infrastructure is one major problem. Most rural areas in Africa do not have a good internet or mobile network, leading to failed transactions or delays. This may be unpleasant for farmers who want their money on time.

- Lack of Banking Infrastructure to Support Digital Payments: Another problem is that banking services are not widely accessible in rural areas. Some farmers may not even have bank accounts; therefore, using a digital payment platform is out of the question. Seriously, without proper infrastructure, the impact of digital payments on African agribusinesses is limited, and many farmers would not be able to benefit from these modern solutions.

Financial Literacy:

- Farmers’ Unfamiliarity with Digital Payment Systems: Farmers also do not understand how the digital payment system works. Therefore, this incomplete financial knowledge makes farmers suspicious of all digital payment means. However, it’s important to note that digital payment systems offer benefits such as security, convenience, and transparency, which can significantly improve their financial management. Some prefer cash over other means due to familiarity with it. They would be unwilling to go into digital systems if they did not understand.

- Resistance to Change From Traditional Cash-Based Transactions: Farmers may resist changing from traditional cash-based transactions because they feel more comfortable with their knowledge. This resistance can slow the adoption of digital payments, limiting their potential benefits. To improve this situation, it’s essential to provide training and resources that help farmers understand how to use digital payment solutions effectively.

Regulatory and Policy Barriers:

- Inconsistent Regulations Across Countries: Different countries have varied rules and regulations concerning digital payments in different African countries. This may inconvenience farmers and businesspeople who try to use these systems across borders. For example, a payment method in one country may not work in another. This creates confusion and slows down the adoption of digital payments.

- High Transaction Fees for Digital Payment Platforms: Another challenge is high transaction fees. Some digital payment platforms have high charges, making it expensive for farmers to use their services. If the cost of using digital payments is too high, many farmers will prefer using cash. To enhance the impact of digital payments on African agribusinesses, governments and financial institutions need to create better policies that support farmers.

Trust Issues

Concerns over Data Security and Fraud: Many farmers are seriously concerned with the probability of fraud and data security with digital payments. They fear that their personal information may be stolen or that they could lose money because of fraud. Will not use them.

Digital payment companies have to ensure that the platforms they provide are secure and user-friendly to curb this problem. They are also responsible for educating farmers on safeguarding themselves from fraudsters. Once farmers trust the digital payment system, the impacts of digital payments on African agribusinesses will be considered high.

While digital payments could help African farmers, infrastructure problems, financial literacy, regulatory barriers, and trust issues must be resolved. Till then, the benefits will reach a few farmers.

Opportunities for Growth and Development

- Expansion of Mobile Money Platforms in Underserved Regions

The rise of mobile money platforms in previously underserved regions is a transformative development for Africa. Many rural areas, once considered isolated, are now connected. People can send, receive, and save money using their phones, facilitated by platforms like M-Pesa. This has significantly improved the financial inclusion of farmers and small businesses, marking a significant shift in the financial landscape. As mobile money services continue to expand, they will further enhance financial inclusion and the impact of digital payments on African agribusinesses, enlightening us about the potential for growth and development in rural areas.

- Collaboration Between Governments, Banks, and Agritech Companies.

There are many reasons why collaboration between governments, banks, and agritech companies is necessary. One of the most promising reasons is the technology the agritech companies use for digital transactions. This technology has the potential to transform the agricultural landscape, making stakeholders in agriculture feel hopeful and optimistic about the future.

Such collaborations will guarantee increasing usage of the digital payment, intensification of digital payment impact on African agribusinesses, and modernizing of farming.

- Integration of Digital Payments into Broader Agricultural Value Chains

Another good opportunity is adding digital payments to every stage of agribusiness in cases where farmers, suppliers, and buyers can work faster and more efficiently when they use digital transactions. For example, suppliers will be able to get money instantly, which will help them to reinvest in their business as soon as possible. Besides, using digital payment methods makes transactions more transparent and builds trust. The more agribusinesses use these systems, the more potent they become.

- Leveraging Data from Digital Payment Systems for Better Market Insights

Digital payment systems generate valuable data that can provide insights into market trends and consumer behaviour. This would help to yield maximum profit. Using data analytics tools, agribusinesses can enhance their competitiveness and adapt quickly to changing market conditions. This ability to leverage data is essential for maximising the impact of digital payments on African agribusinesses.

- Potential for Cross-Border Trade Facilitated by Digital Payment Solutions

Digital payments will facilitate farmers and agribusinesses in cross-border trade. Instead of selling their products in their local market, they can now easily reach international markets. This might help African farmers expand their businesses and improve their incomes. Digital payment systems eliminating trade barriers will significantly enhance the impact of digital payments on African agribusinesses and spur economic growth within the continent.

The future of African agribusinesses is bright as they seize these growth opportunities. More farmers and business owners will benefit from the advantages of digital transactions by learning how to choose the right digital payment solution and finding ways to integrate digital payments with African banking systems.

Strategies for Effective Integration

- Building Digital Literacy Programs for Farmers and Agribusiness Stakeholders

Building digital literacy programs is critical for successfully educating farmers and agribusiness stakeholders on using digital payment systems. These programs can teach fundamental skills like using mobile payment platforms and handling online transactions. For example, the Women Farmers Programme in South Africa has effectively taught many female farmers digital skills, allowing them to access markets and enhance their companies. By investing in digital literacy, we can increase the impact of digital payments on African agribusinesses and enable farmers to utilise these technologies fully.

- Investing in Rural Infrastructure

Good Internet and mobile network access are prerequisites for using digital payments. Most farmers in Africa live in areas with inferior network coverage, which makes it hard to use mobile money and other digital payment systems. If more governments and private companies invest in better internet and mobile connectivity, more farmers will be able to connect with buyers and markets. Improving rural infrastructure will further enhance the impact of digital payments on African agribusinesses, enabling farmers to grow their businesses faster.

- Offering Incentives for Agribusinesses to Adopt Digital Payment Systems

Most agribusinesses would not like to shift to digital payments owing to the costs involved. To encourage them, governments and organisations can offer incentives, such as tax breaks, subsidies for technology purchases, or grants for training programmes. This will make the shift to using digital payments much easier and more affordable for agribusinesses. The more businesses that adopt the digital payment system, the more impact digital payments will have on African agribusinesses, making transactions faster and safer.

- Developing Partnerships Between Banks, Fintech Companies, and Agritech Startups

Better financial solutions can be developed for farmers when banks, fintech companies, and agritech startups come together. These partnerships could grant loans to farmers or make it easier for them to save and make digital payments. For instance, banks may create financial products on the basis of fintech platforms to make the handling of digital money easy for farmers. Strengthening these partnerships will enhance the impact of digital payments on African agri-businesses and ensure that farmers and agri-businesses receive the best possible financial inclusion.

- Advocating for Supportive Policies and Regulatory Frameworks to Reduce Barriers.

Most farmers and agribusinesses avoid digital payments due to high charges and/or unclear regulations. Governments should develop policies that make digital payments more affordable, secure, and convenient. This includes easing transaction costs, increasing the security of data, and providing assurances on the safety of farmers. When the enabling regulatory environment is fair, more farmers will be confident in trusting digital payments.

Frequently Asked Questions (FAQs)

1. What are digital payments?

Digital payments refer to transactions made electronically that allow users to send and receive money utilizing a device such as a mobile phone or computer.

2. How do digital payments benefit farmers?

Digital payments provide farmers with faster access to funds, help to prevent fraudulent activities, and cut out middlemen so that farmers can retain a larger share of their profits.

3. Are there challenges in adopting digital payments?

Yes, among them are limited internet access in rural areas, financial illiteracy of farmers, and concerns over the security of data. Overcoming these challenges would ensure tapping into the full benefits of digital payments.

4. How do digital payments enable financial inclusion?

Mobile phone banking makes it possible for the unbanked to access the financial mainstream. By doing this, farmers can save money and take out loans.

5. What should I consider when choosing a digital payment solution?

Besides convenience, consider factors such as usability, transaction fee, security measures available, and integration with existing bank systems when selecting a digital payment method. Making the right choice will depend on these factors

Conclusion

In conclusion, the impact of digital payments on African agribusinesses is profound and transformative. Digital payments enable farmers and agribusinesses to thrive in a competitive landscape by improving financial inclusion, increasing market access, and streamlining transactions. As mobile money and digital payment solutions continue to grow, they create opportunities for agricultural productivity and profitability.

With the right strategies in place, digital payments can drive sustainable growth and development for African agriculture, ensuring a brighter future. However, addressing challenges such as infrastructure gaps and financial literacy is crucial for maximizing these benefits.