Introduction

What makes African startups appealing to Venture Capitalists? As Africa’s entrepreneurial ecosystem grows, many startups are working hard to attract funding. However, having a groundbreaking innovation is not enough to stand out; success requires understanding how venture capitalists evaluate African startups. By studying how Venture Capitalists evaluate African Startups, entrepreneurs can better position themselves for success in securing capital.

Given the range of African startups competing for investment, VCs assess potential from multiple perspectives, from how extensive and unserved a market is to whether their business model stacks up in terms of cost structure. Understanding venture capital in Africa is crucial for entrepreneurs as it reveals how fund managers and investors evaluate startups.

Introduction to Venture Capital Landscape in Africa

Over time, the VC landscape in Africa has grown significantly as more investors recognize its enormous potential. The African startup ecosystem is now attracting attention from both local and global investors, with a particular focus on the continent’s growing tech sector. Venture capital investment is critical for providing seed funding to early-stage startups, allowing them to scale operations and create solutions tailored to the challenges in Africa.

The Venture Capital Landscape in Africa

With an expanding startup scene across the continent, more investors are drawn to the promising markets of Nigeria, Kenya, South Africa, and Egypt. These countries, with their large populations and rising internet penetration, offer significant investment opportunities, especially with the presence of thriving entrepreneurial hubs.

Additionally, regions like Ghana, Rwanda, and Tanzania are emerging as new destinations for venture capital transactions. There is a growing appetite for technology-driven businesses that address Africa’s unique socio-economic problems, particularly in finance, agriculture, and healthcare.

VC Investment Trends in African Startups

Venture capitalists are increasingly focusing on African tech investments in areas like fintech, health tech, and agritech. Fintech has garnered the most attention, as startups in this space are improving financial services and payment systems across the continent. Healthtech and agritech are also gaining momentum as investors see their potential to transform healthcare services and revolutionise agriculture, which is critical for Africa’s economic growth.

The African startup ecosystem is rapidly evolving, with increased collaboration among various stakeholders. When evaluating African startups, venture capitalists consider factors like market size, innovation, and the scalability of the business. These trends suggest a bright future for African startups and the broader venture capital landscape.

Key Criteria for Evaluating Startups

When venture capitalists assess African startups, they are searching for different signals that assure the startup will be successful. Due diligence helps investors understand whether the startup has a strong foundation and potential to scale. Grasping these parameters is vital for any startup looking to raise funds and scale their business. The top four key factors on every venture capitalist’s mind are: product-market fit, scalability, competitive advantage, and market traction.

- Product-Market Fit

Product-market fit is crucial when venture capitalists assess African startups. It refers to how well the startup’s product or service addresses a significant problem or need in the target market. A startup should solve a real problem and touch the lives of its target audience. A good product-market fit shows demand, with customers willing to pay for it. Startups must demonstrate thorough market research and an understanding of user needs. In Africa, this often means adapting products for sectors like agriculture, healthcare, or financial services, which are top priorities.

- Scalability

Scalability is another key criterion for judging African startups. It refers to the startup’s ability to expand into different regions or countries. A scalable startup is more attractive to investors because it offers the potential for greater returns. Venture capitalists assess whether the business model can handle increased demand without requiring disproportionate resources. Africa’s business environment presents challenges, such as infrastructure limitations and regulatory diversity, but startups that overcome these hurdles and demonstrate scalability are more likely to attract investment.

- Competitive Advantage

Competitive advantage is vital when venture capitalists evaluate African startups. A startup must have a unique selling proposition (USP) or edge that sets it apart from competitors. This could include intellectual property, proprietary technology, or exclusive partnerships. In Africa, competition can be intense, so having a strong competitive advantage is crucial for long-term success. Investors look for startups that can maintain their market position, even as new competitors emerge, by protecting intellectual property and securing patents or strong customer loyalty.

- Market Traction and Validation

Market traction and validation are key indicators of a startup’s potential success. Investors want tangible proof that the startup’s product is gaining customer adoption, feedback, or early sales. Startups that show market traction can display metrics like customer acquisition rates or partnerships. In Africa, gaining market validation may involve securing local partnerships, entering underserved markets, or showing a growing user base for digital platforms. Investors want proof that the startup is resonating with customers and has growth potential.

Importance of Market Potential and Business Model

- Market Size and Growth Potential

One of the first things venture capitalists evaluate is something called the total addressable market (TAM). Startups with large TAMs have more room to grow and scale their operations, which is highly attractive to investors. For example, in sectors like health and fintech, which are quickly growing on the continent, a startup has got high potential of capturing a big market share. When venture capitalists evaluate, they will focus on the fact that this startup can be targeted to which market segment, it identifies customer needs, and if these are unique solutions that make them competitive.

The rate of market growth (penetration for those at scale) and your ability to meet cannibalising demand are critical. When the market is new, entrepreneurs may scale easily, making it easier for them to produce large incomes. For example, Africa’s continued internet penetration creates various chances for technology-driven enterprises. Companies that can benefit from trends such as mobile payments or e-commerce are significantly less trend-favoured than others.

- Business Model Viability

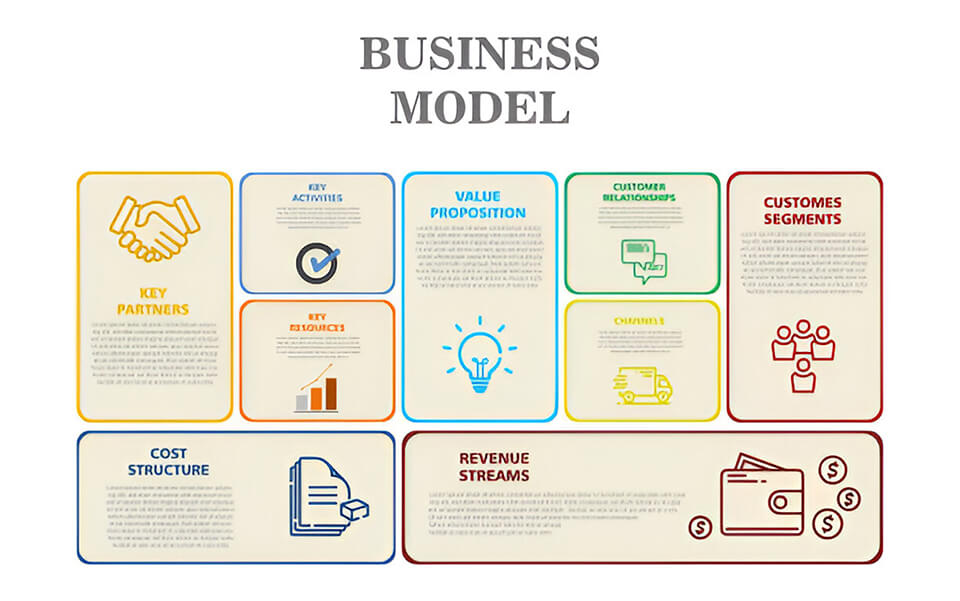

The soundness of a startup’s business model is critical to defining its revenue strategy and long-term profitability. How will a startup make money? When does it expect to be profitable? This is what an investor reads from their investment perspective. A business model that is transparent and indicates a way to generate ongoing revenue. African startups can earn revenue in several ways, such as subscription models, licensing fees, and direct sales. A good business model will show how the startup is going to get, keep and grow customers along with its approach toward pricing strategy and cost management.

Venture capitalists love companies that have a well-defined path to profitability. They estimate over what period the startup is expected to achieve profitability and start making money. In addition to this, the ability to scale a business model effectively is also important. A scalable business model is key to scaling a company, as it means the startup can grow operations and revenue without huge increases in costs, which is critical for long-term sustainability.

- Adaptability of the Business Model

The extent to which the startup can adjust its business model is also an important evaluation criterion by venture capitalists. In a flexible environment such as Africa, where trends and what customers want can pivot very quickly. A start-up that quickly pivots its business model based on the changing needs and macro-economic emerging trends stands a better chance to survive & scale up. For example, a fintech startup that originally focused on providing mobile banking services may transition to offer insurance or investment products as the market changes.

Being agile allows a company to make changes since it has more flexibility than its less adaptable competitors, particularly the giants. In certain circumstances, the market itself is changing as growth occurs; venture funders want to see founders who are not just aware of these developments but also willing and able to adapt their approach in response.

- Regulatory and Economic Context

The regulatory and economic environment is one of the main factors that investors look at when it comes to assessing African startups. Specifically, investors want to know whether prevailing political stability and economic/legal conditions would allow the start-up to smoothly carry out its operations. A supportive regulatory environment that aids innovation would put a startup in a better position to succeed versus some countries where, say, financial regulations are poor, which can lead to high risk.

Startups will also have to deal with macroeconomic elements such as inflation, forex swings, and uncertain access to capital, all of which can have a direct impact on businesses. This type of risk assessed by the startup is very valuable to VCs; they prefer firms that have examined these risks and implemented measures to mitigate them. For example, if you are a startup operating in multiple African countries and must conform to tax requirements, understanding the market is critical for commercial success.

The Role of Team and Management Assessment

- Founder and Team Experience

The skills and reputation of the founders are crucial for raising venture capital (VC) funding. Investors usually assess the founders based on their background, industry experience, and past ventures’ success or failure. A founder who has overcome startup challenges or possesses deep industry expertise can inspire more confidence in investors. Additionally, having a team with a strong technical background or domain knowledge is beneficial, especially when addressing the unique challenges of African markets.

When seeking investment, venture capitalists evaluate if the team knows its industry and market well. Founders with a track record of building, solving problems, and scaling businesses are more likely to receive funding. Even in cases where past ventures have failed, founders who show resilience and learning can attract investment.

- Team Cohesion and Vision Alignment

Beyond individual expertise, investors also assess how well the team works together and aligns on the company’s vision. Team members must share goals, trust, and collaboration. Key factors include how the founders met, the length of time they’ve worked together, and how they handle conflicts or disagreements.

When conducting due diligence on an African startup, VCs want to ensure that the team is well-aligned on vision and strategy. A team that communicates effectively makes decisions collectively, and shares common objectives is more likely to execute the business plan successfully. Investors want to see passion for the startup’s mission alongside the ability to adapt when necessary to achieve goals.

- Leadership and Decision-Making Skills

Leadership is another important factor that venture funders consider when evaluating African startups. The founders’ ability to inspire their staff, make smart decisions, and handle problems is critical to long-term success. Strong leadership abilities are required to overcome uncertainty, steer the organisation through difficult periods, and seize opportunities. Venture capitalists will evaluate the founders’ capacity to make quick yet intelligent judgments, as well as their readiness to listen to advice from mentors and investors.

A competent leader understands how to delegate responsibilities, trust their team, and maintain strong morale. When venture funders examine African firms, they frequently interview the founders to assess their leadership style and decision-making process. Investors are interested in the founders’ ability to balance risks and rewards, as well as how they encourage their teams.

- Hiring Potential and Talent Acquisition

Attracting and retaining top talent is another key consideration for venture capitalists. Startups, particularly in the technology sector, require skilled professionals in areas like development, marketing, operations, and customer service. Venture capitalists will evaluate whether the founding team can bring in experts in critical roles and build a strong workforce. This is particularly important in African markets, where finding specialised talent can sometimes be challenging.

Investors want to know if the startup has a solid recruitment strategy, how it plans to scale its workforce, and whether it can maintain a positive work culture. The ability to attract high-calibre talent not only helps the company grow but also increases investor confidence. A strong team, even beyond the founders, is a clear signal that the startup is well-positioned to succeed in the long term.

Financial Metrics and Growth Projections

As soon as a startup shows promise, they are usually evaluated by venture capitalists (VCs), who focus on financial metrics and growth projections to assess the potential return on investment. Understanding these details is crucial for making informed decisions. The following sections outline key financial metrics and growth projections VCs typically review.

- Revenue and Profit Margins

VCs evaluate current revenue streams and profit margins to see how efficiently a startup is operating. They seek diversification in revenue sources, like product sales, subscriptions, or service fees. Examining the cost structure is essential for identifying operational inefficiencies and areas for improvement. Profit margins indicate how much profit a startup retains after costs, with higher margins reflecting better financial health. Maintaining healthy margins is key for long-term sustainability and attracting investor interest.

- Cash Flow and Burn Rate

Another critical factor VCs examine is cash flow management. They analyze the burn rate—the rate at which a startup spends its cash—to gauge how long the company can operate before requiring more funding. Positive cash flow or a manageable burn rate is attractive to investors, as it shows the startup can sustain growth and minimize financial risk.

- Unit Economics

Unit economics helps determine whether a startup is profitable in acquiring customers. VCs assess the cost of acquiring customers (CAC) relative to the lifetime value (LTV) of a customer. Long-term profitability depends on LTV significantly exceeding CAC. A favourable ratio suggests the business is capable of generating strong returns on its customer acquisition investments, making it appealing to investors.

- Growth Trajectory and Projections

Projections for a startup’s growth in customers, revenue, and market expansion are critical when considering the role of venture capital in African startup growth. Venture capitalists prioritise realistic, data-driven projections that account for market trends, competition, and operational capacity. Startups with clear growth strategies and well-defined roadmaps for market expansion tend to attract more VC interest as they showcase strong scalability potential within the dynamic African market.

- Fundraising Strategy and Exit Plan

A solid fundraising strategy and exit plan are important factors for attracting VCs. Startups should clearly explain how much capital they plan to raise, how the funds will be used, and how these investments will fuel growth. Investors are also keen on the potential return on investment (ROI) and exit strategies, such as acquisition or going public. A well-thought-out exit plan shows a startup has considered its long-term goals and how it will deliver returns to investors.

Understanding how venture capitalists evaluate African startups requires a deep analysis of financial metrics and growth projections. By examining revenue, profit margins, cash flow, unit economics, growth trajectories, and fundraising strategies, VCs make informed investment decisions. Startups that effectively communicate their financial health and growth potential stand a better chance of securing venture capital in Africa’s competitive entrepreneurial landscape.

Common Pitfalls and Red Flags

In scrutinising Africa’s startups, venture capitalists (VCs) have questions about potential pitfalls and red flags to allay concerns before investing. This understanding is key for entrepreneurs when seeking to raise venture capital. Here are some of the red flags VCs look out for, and aim to give companies a little awareness before headhunting capital.

- Lack of Focus and Vision Drift

A startup has a very high connection and linkage to vision clarity. When a startup is lacking direction or sees strategic shifts seemingly every month, that’s usually when venture capitalists spot the red flags. If your company is pivoting too much without a solid strategic cause, you are at risk of losing everything and confusing the world. Startups need to focus — forget chasing multiple ideas; startups must remain focused on what they set out to launch with and pivot only when warranted by results.

VCs perceive a lack of focus in a startup as exceeding the tolerance for risk, primarily because it is unlikely that the company would be able to establish itself in any market. By going broad, startups run the risk of capturing none (or very little) or being an expert in one area neither helping your customers nor investors to understand where you really excel.

- Overestimating Market Size

An error that is usually made by many African startup businesses is called “overestimating market size.” Although founders often describe a huge market that has yet to be tapped, these projections may not always be true. Instead of dreaming up over-inflated projections, startups must do realistic market sizing and actually find real data to measure against.

Clear and achievable targets should be set and be based on market research or customer insights. This shows the startup has a vision for your startup, and it would earn points with VCs as they like an entrepreneur who actually understands his potential to grow. If startups overestimate the market, it may generate unrealistic business models which eventually can put you in a very risky position of scaling too early.

- Poor Financial Management

Prudent financial management is one of the most essential parts where startups are being evaluated besides excellent business concepts by venture capitalists. Unfortunately, that is when red flags come up: those startups with no financial sense or unrealistic financial projections. Signs of trouble could be unclear cash flow management, a burn rate which has gone out the window or an inability to account for process costs.

Many startups have gone under due to lack of financial accountability.

To prevent poor financial management, record keeping must be extremely transparent and detailed, growth expectations must remain realistic, and expenditures need to closely align with revenue streams, or the whole enterprise could come crashing down. Solid financial management, therefore, tells VCs that the company is well-run and has an eye on long-term economic viability.

- Founder Conflicts and Team Dysfunction

Individuals or groups of entrepreneurs form startups to develop and market products or services for which they believe there is a need. One of the most significant aspects of a startup is the founding team’s strengths/dialogue. The investor would look for red flags in team dynamics that indicate potential future concerns, such as internal disagreements, a lack of leadership, or a high turnover rate. Even worse than the aforementioned are founder disputes, which can hinder a company’s development by disagreeing on strategy or roles, for example.

This might create confusion and impede the smooth operation of the business. To lessen this risk, firms with strong teams, clear duties, and skilled leadership are more likely to acquire investor trust. Given the numerous distractions and dangers associated with a fledgling company, VCs place a high value on good team chemistry when evaluating early-stage investments — in general, people who are reliable to work with in less-than-ideal settings manage chaos well.

- Regulatory and Compliance Issues

Many verticals in Africa (particularly health, agriculture, and fintech) are heavily regulated. However, entrepreneurs in these areas may face legal and regulatory difficulties that limit their growth and scalability. Venture capitalists are wary of investing in a firm that has neglected to disclose its compliance concerns or is otherwise unfamiliar with the regulatory environment in which it operates.

Failing to adhere can lead to fines, penalties and closure of operations—all very bad signs for investors. Startups need to be aware of the compliance landscape in their respective industry and now, more than ever, have a proactive game plan for actually dealing with potential land mines from day one. Showing a serious dedication to adhering to regulations suggests to VCs that the business will not run into unread legal impediments.

Frequently Asked Questions (FAQs)

1. What do VCs (Venture Capitalists) look for in African Startups?

VCs focus on the potential for high returns, innovative ideas, and scalable business models.

2. How Relevant is the Founding Team for a VC Evaluation?

The team is the most important factor; VCs prioritize seasoned founders with experience, vision, and leadership.

3. How do VCs Evaluate the Financials of a Startup?

VCs quickly review financials, revenue streams, and projected profitability to gauge the startup’s financial health.

4. Is Product or Service Innovation a Key Factor?

Yes, startups with unique products or services solving real problems attract venture capitalists.

5. Is Scalability a Factor in VC Evaluations?

Scalability is crucial. VCs prefer startups that can achieve rapid growth and expand into other regions or markets.

Conclusion

Venture capitalists play a key role in the growth of African startups by providing not just capital but also mentorship and strategic guidance. They evaluate startups based on factors like the founding team, market size, innovation, financial health, and scalability to gauge their potential for success.

For African entrepreneurs, understanding how venture capitalists evaluate startups is essential to securing investment. By focusing on building a solid team, refining their business model, and demonstrating market traction, startups can increase their chances of attracting VC support and achieving long-term success.